DeFi Risk Assessment

Must-have gauge to manage risks tailored to provide the latest info and insights over your investments.

All Investment Risks Are Measured

Notum's Risk Assessment Framework (RAF) carefully evaluates the most crucial risks associated with DeFi investments.

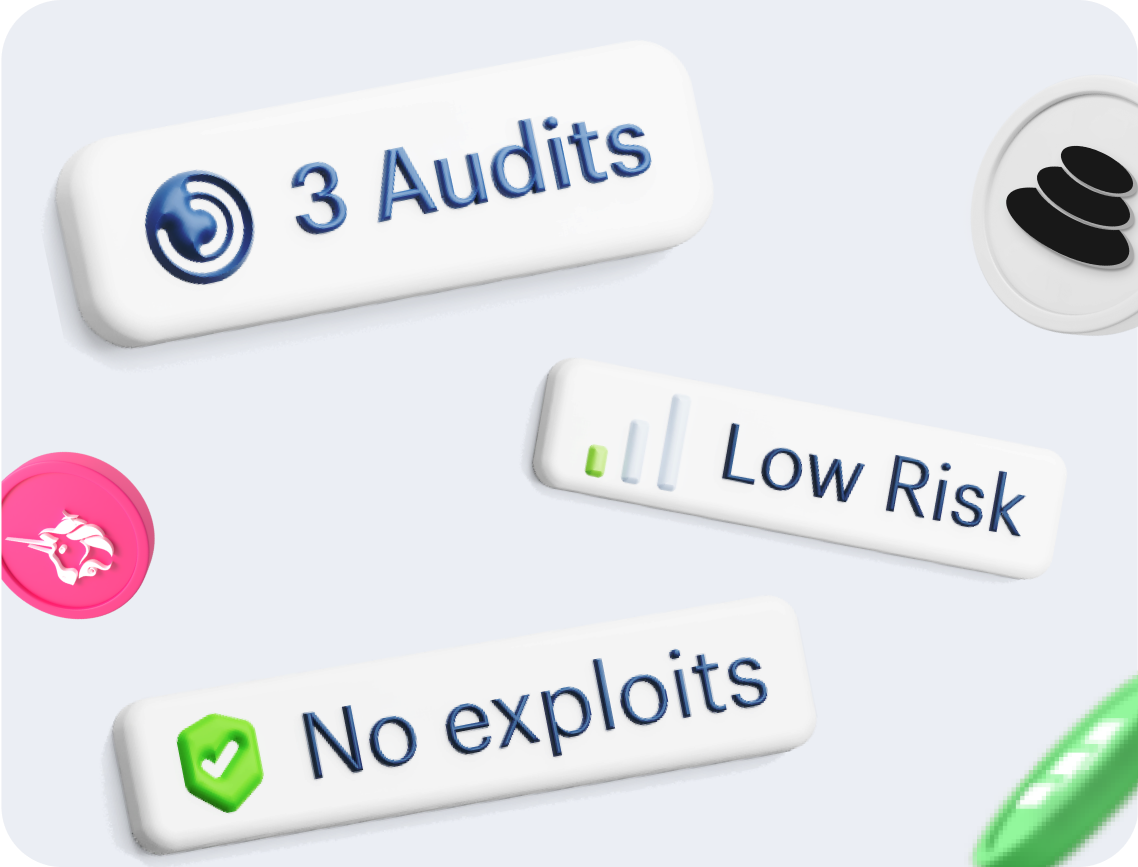

Protocol Risks

We focuses on the security and historical performance of protocols. We consider essential factors like audits and exploits, crucial in understanding the crypto market risk.

Asset Risks

We assess the market capitalization, volatility, intrinsic value, and code quality of assets. This comprehensive evaluation helps in determining the overall crypto risk index for each asset.

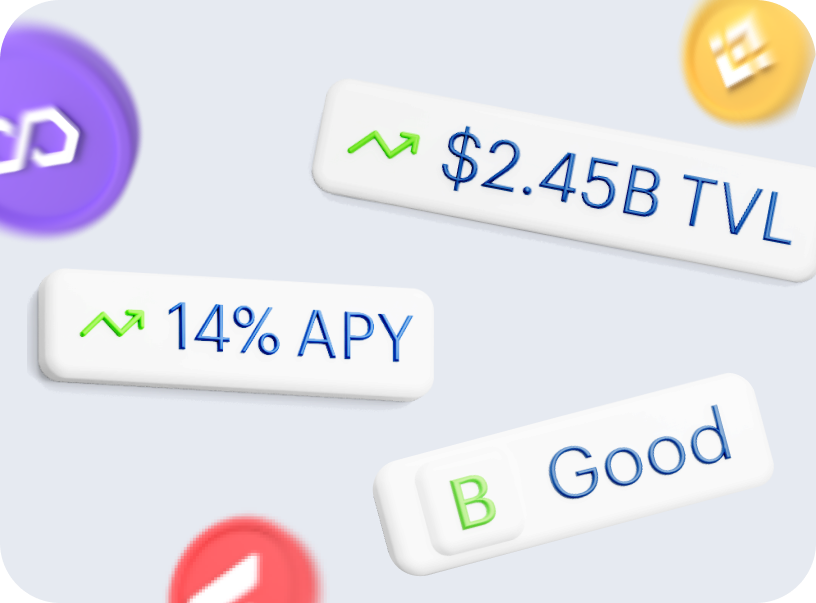

Pool Risks

Our framework analyzes pool-specific factors such as Total Value Locked (TVL), impermanent loss potential, and blockchain maturity, integral to the crypto risk index.

Risk Assessment Framework

Notum's risk system scaled from the lowest to the highest grade helps you to make smarter investment decisions.

DeFi Market Risks Under Your Control

The DeFi market is volatile and affected by various factors but a strong risk management strategy can drastically reduce risks. Notum's RAF helps you to measure possible risks. Our methodology includes:

Protocol Analysis

We break down each protocol's audits, maturity, and track record — key indicators proving its stability and reliability.

Asset Evaluation

Our assessment of assets' market presence, stability, and underlying code quality helps in accurately determining their risk profile in the cryptocurrency landscape.

Pool Dynamics

Asset's market presence, stability, and underlying code quality insights help in effectively determining its risk profile in the DeFi landscape.

Watch Out & Reduce Crypto Risks

Notum arms you with powerful risk management tools to handle sensitive risk issues and protect your investments.

Explore

FAQ

1.

What are the risks of cryptocurrency?

The risks involved in cryptocurrency include market volatility, regulatory changes, technological vulnerabilities, and security issues. These risks can affect the value and stability of cryptocurrencies, making them a potentially high-risk investment.

2.

What is the risk of investing in cryptocurrency?

Investing in cryptocurrency carries several risks, such as extreme price fluctuations, potential loss of investment due to security breaches, lack of regulatory oversight, and the possibility of fraudulent activities. Investors should be aware of these risks and invest cautiously.

3.

What are risks and threats of cryptocurrency?

Risks and threats of cryptocurrency include hacking and cyber theft, risks of staking crypto (like liquidity issues and smart contract vulnerabilities), market manipulation, and exposure to unregulated financial systems. Additionally, the anonymity of transactions can sometimes lead to illicit activities.

4.

What is cryptocurrency systemic risk?

Cryptocurrency systemic risk refers to the potential for disruptions in the cryptocurrency market to affect the broader financial system. This includes risks associated with interconnectedness of various cryptocurrencies, reliance on technology, and the impact of large-scale market events.

5.

What is the best risk to reward ratio in crypto?

The best risk to reward ratio in crypto varies depending on individual investment goals and market conditions. Generally, a favorable risk to reward ratio is one where the potential rewards of an investment justify the risks taken. This ratio can be improved by thorough research, diversification, and using tools like Notum's risk assessment framework.