Crypto Investment Strategies

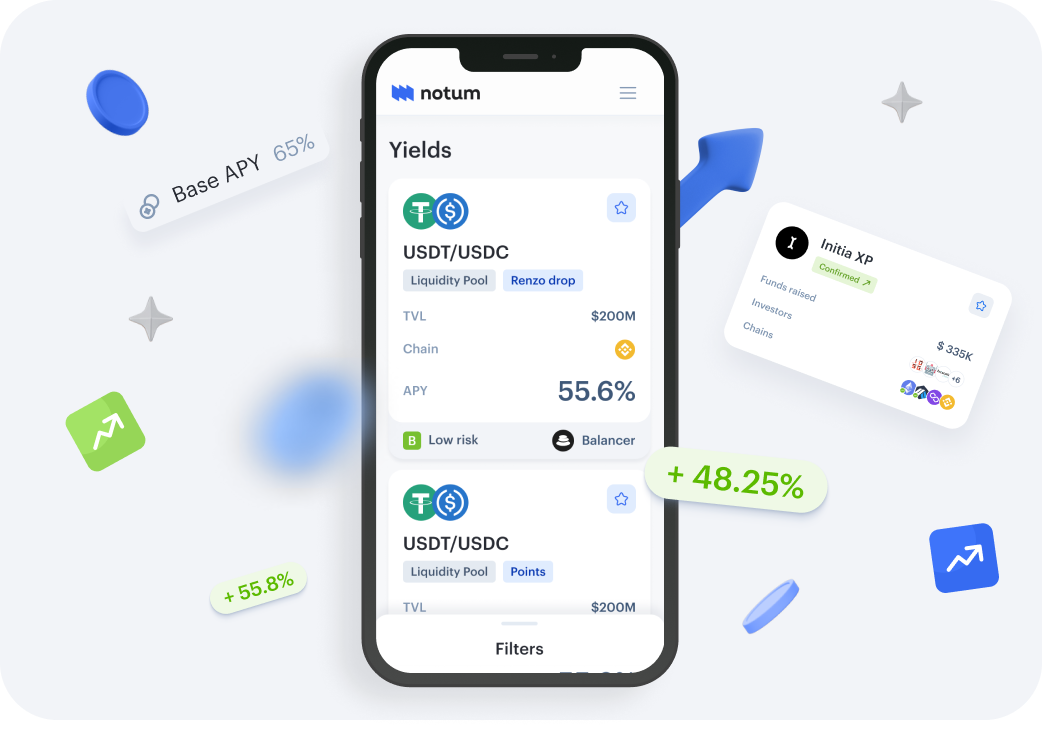

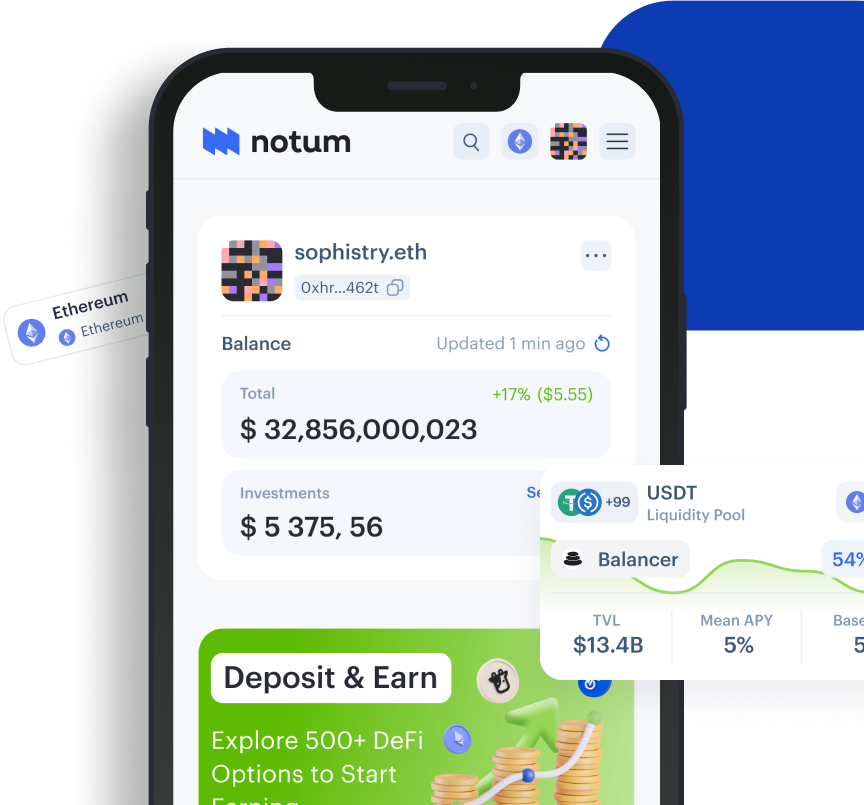

Explore the whole range of crypto investments: from yield farming to liquidity provision. Maximize your crypto returns with Notum.

Notum tracks 19 protocols and 19 networks to keep you always updated.

Working with the best in industry

AAVE

Velodrome

Trader Joe

Venus

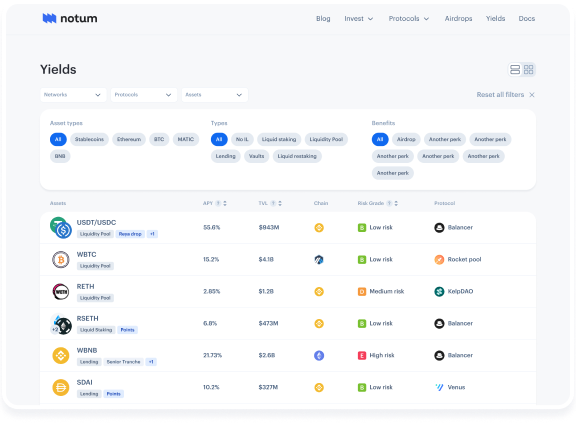

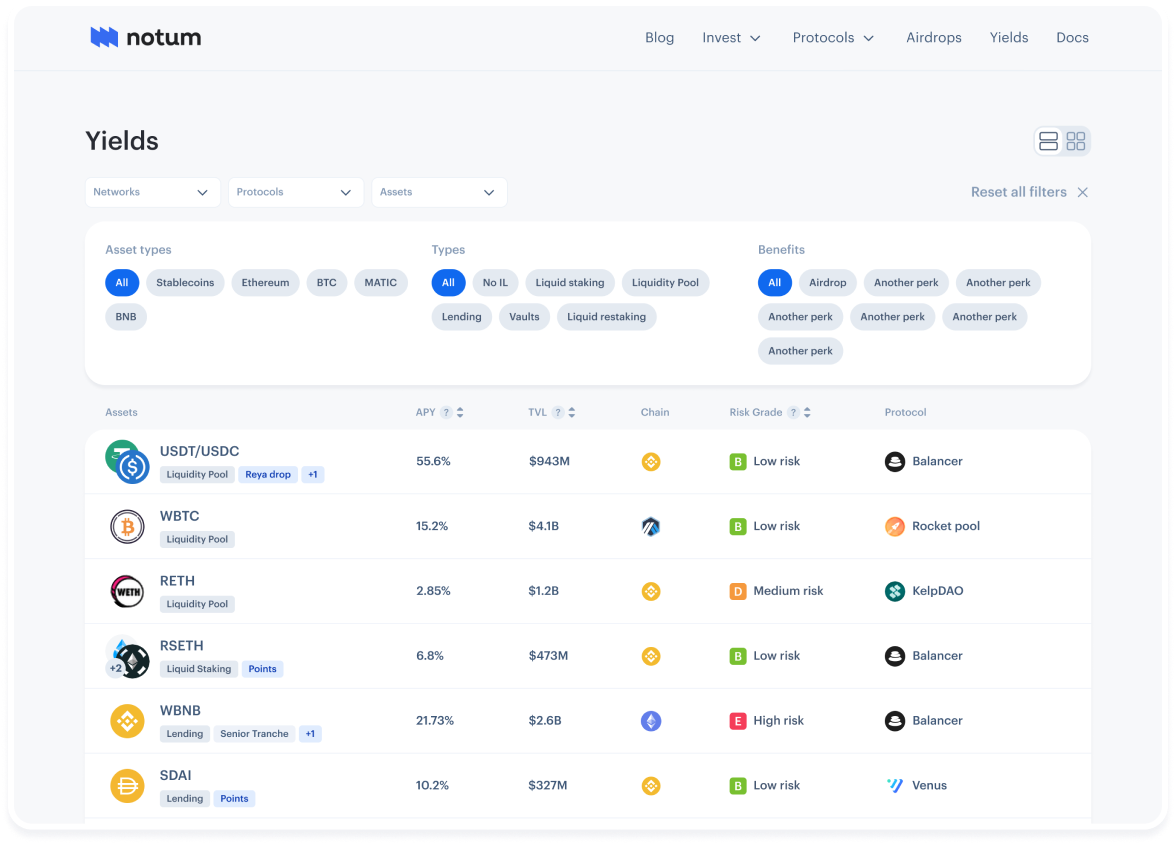

Measurable Success With Notum

100

Investment strategies featured on the platform

10

Supported networks, and more to come soon

10

Supported protocols, and more to come soon

+24.9%

Average increase in APY while using Notum

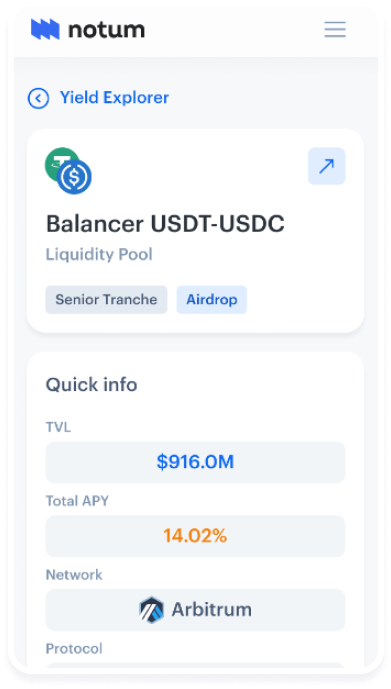

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

What are the risks of cryptocurrency?

The risks involved in cryptocurrency include market volatility, regulatory changes, technological vulnerabilities, and security issues. These risks can affect the value and stability of cryptocurrencies, making them a potentially high-risk investment.

2.

What is the risk of investing in cryptocurrency?

Investing in cryptocurrency carries several risks, such as extreme price fluctuations, potential loss of investment due to security breaches, lack of regulatory oversight, and the possibility of fraudulent activities. Investors should be aware of these risks and invest cautiously.

3.

What are risks and threats of cryptocurrency?

Risks and threats of cryptocurrency include hacking and cyber theft, risks of staking crypto (like liquidity issues and smart contract vulnerabilities), market manipulation, and exposure to unregulated financial systems. Additionally, the anonymity of transactions can sometimes lead to illicit activities.

4.

What is cryptocurrency systemic risk?

Cryptocurrency systemic risk refers to the potential for disruptions in the cryptocurrency market to affect the broader financial system. This includes risks associated with interconnectedness of various cryptocurrencies, reliance on technology, and the impact of large-scale market events.

5.

What is the best risk to reward ratio in crypto?

The best risk to reward ratio in crypto varies depending on individual investment goals and market conditions. Generally, a favorable risk to reward ratio is one where the potential rewards of an investment justify the risks taken. This ratio can be improved by thorough research, diversification, and using tools like Notum's risk assessment framework.