Aerodrome Finance Investments

Delve into liquidity pool provision with Aerodrome and Notum.

Working with the best in industry

Aerodrome

Aerodrome Finance in Numbers

$172M

Total TVL Across All Supported Networks

Medium Risk

Generally considered as balanced risk-reward investment

Passive

Control-free. Hold & Earn.

60.52%

Average APY you can expect on Notum

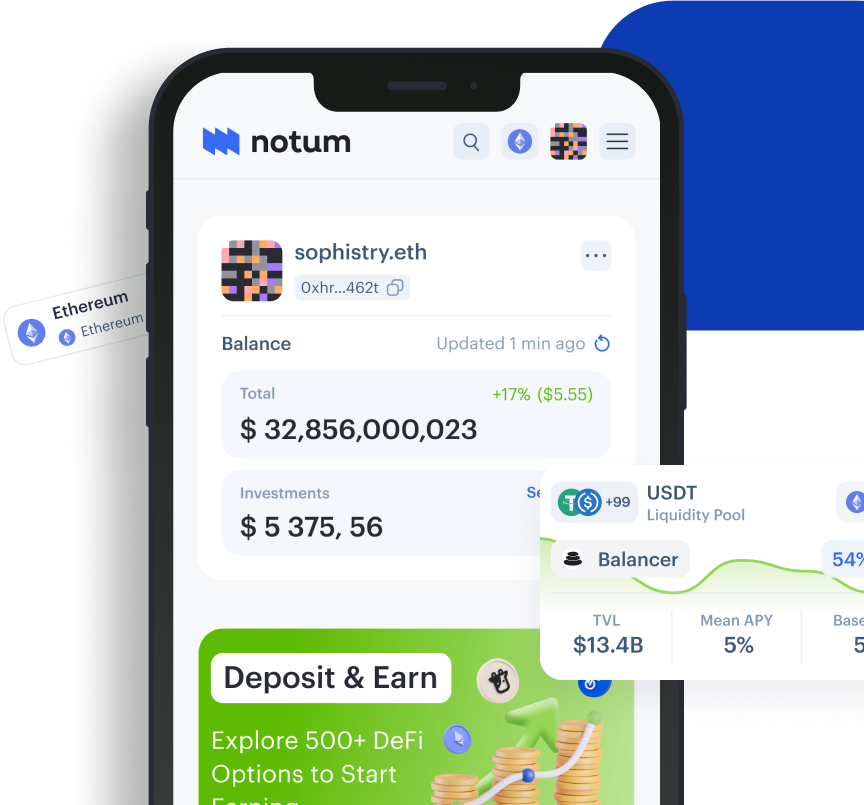

How to Invest in Aerodrome Finance on Notum

The cryptocurrency space is growing and developing, and every year it offers more and more opportunities for users and investors. In 2024, there are a huge number of investment types, allowing users to earn large rewards for providing their assets. One of the most popular investment options is liquidity pool provision.

Liquidity pool provision is an investment strategy that allows users to deposit their crypto assets on various platforms and protocols in order to receive rewards. Funds invested in smart contracts are used for various financial transactions such as decentralized trading, lending, financing, etc and help provide liquidity for various DEX exchanges.

It is important to note that DeFi platforms and DEXs use automated market makers (AMMs). These algorithms use liquidity pools instead of actual market makers, eliminating investors from centralized intermediaries.

Today we will talk about next-generation AMM, which also allows users to deposit funds and receive rewards through the liquidity pool provision - Aerodrome Finance. We will talk about how the platform works and introduce you to profitable strategies for investing through Notum in 2024.

Aerodrome Finance: The Essentials

- TVL: $172M

- Average APY: 233.99%

- Risk Level: Medium

- Blockchains: Base

- Foundation Date: 2023

Aerodrome Finance describes itself as a next generation AMM designed to serve as Base's central liquidity hub. According to the official website of the platform, Aerodrome not only has a powerful mechanism for stimulating liquidity, but also a vote-lock governance model. AMM (or automated market maker) is an algorithm that replaces actual market makers with liquidity pools so that users can trade cryptocurrency freely and safely.

The platform has a clear and user-friendly user interface and offers the latest features of the Velodrome V2. «Aerodrome is a DEX that combines the best of Curve, Convex, and Uniswap V2 into a cohesive AMM designed to serve as BASE network's liquidity layer» - Aerodrome.

Despite the short history of Aerodrome Finance, the platform already has more than 29,000 users, and its total value locked exceeds $172 million. At the moment, it offers users two main functions - making swaps and providing liquidity.

Aerodrome Swaps

If you want to exchange one token for another, the platform offers you to use Aerodrome Swaps with minimal slippage.

- First, you will need to connect your crypto wallet with the platform. Aerodrome offers one of four options to choose from - Browser Wallet, WalletConnect, CoinbaseWallet and Safe.

- Next, you need to select the token to swap from the 71 assets presented on the platform, as well as the amount you want to exchange.

- After selecting the cryptocurrency you want to exchange for, you will get and exchange rate, percentage of slippage applied, and estimated price impact, after which you can seamlessly swap your tokens.

Aerodrome Liquidity

For those wishing to invest in pools to earn passive rewards, Aerodrome Finance offers a “Liquidity” tab with a huge number of investment options.

For user convenience, liquidity pools are divided into active, stable, volatile, incentivized and low TVL so that each liquidity provider can easily choose the option that suits its desires and preferred risk level. Investors choose the liquidity pool provision with Aerodrome as the platform offers a wide selection of investment strategies, different types of pools, high APRs and minimal fees. Currently Aerodrome Finance offers liquidity providers 126 pools for investing and receiving passive rewards.

Aerodrome Crypto: AERO and veAERO

Aerodrome Finance uses two tokens for its governance and utility management - AERO and veAERO.

- AERO is the native ERC-20 token of the platform that is responsible for utility. It is the AERO crypto that is distributed to liquidity providers through emissions for depositing their cryptocurrency in Aerodrome’s pools. Thus, LPs receive $AERO token proportionally to the votes the pools accumulate.

«The initial supply of $AERO is 500M, with 450M distributed as vote-locked ($veAERO) tokens» -Aerodrome.

- veAERO is a ERC-721 non-fungible token which is used for Aerodrome’s governance. Users holding $AERO can vote-escrow their tokens and receive a $veAERO in return.

In addition, Auto-Max Lock is available for veAERO, «which are treated by the protocol as being locked for the maximum duration of 4 years, and their voting power does not decay» - Aerodrome.

Why Invest with Aerodrome?

Liquidity pools themselves are a fairly important part of the world of decentralized finance, as they allow to do swaps. However, investing in a liquidity pool provision has a number of other advantages offered by Aerodrome:

Pros

High rewards

Users who provide their crypto assets to liquidity pools earn a portion of the transaction fees occurring in their pools. Thus, liquidity providers earn passive income which depends on the chosen investment strategy. Aerodrome’s average APY is 233.99%, which indicates a large number of profitable pools.

Low fees

Aerodrome Finance is known for its low slippage and minimal fees, which makes it an attractive option for traders. Moreover, AERO crypto lockers pay some of the lowest fees on the platform.

Variety of pool options

For the convenience of users, Aerodrome has grouped pools by type so that each investor can choose the option that suits them. While beginners can invest in stable pools, experienced users may want to consider more profitable volatile options. Moreover, it currently offers 126 pools to choose from!

Safety

Since Aerodrome Finance has fully inherited the contract architecture from Velodrome V2, it is secure for providing liquidity. Moreover, Velodrome V2 has been audited and runs a bug-bounty program, which indicates an additional level of asset safety.

Overall market liquidity

Since liquidity pools are decentralized, it not only increases security but also contributes to the development of decentralized finance. Providing assets to these pools, in turn, also strengthens the DeFi ecosystem and reduces price volatility.

Aerodrome: Investment Strategies

If you are starting to explore the world of liquidity pool provisions, below you can look at the profitable pool options in 2024. Investments in these strategies through Notum are not only convenient and safe, but also guaranteed to bring high income.

https://app.notum.ai/investments/0xcDAC0d6c6C59727a65F871236188350531885C43?protocol=Aerodrome&chainId=8453

The WETH-USDC liquidity pool is a fairly popular investment strategy on Aerodrome due to its high rewards and low risk level. By investing in WETH-USDC on Base, users earn around 83%-84% APY. It is also important to note that this strategy is incentivized by AERO - Aerodrome’s native token.

In addition, the strategy has a fairly high total value locked of over $28 million, which indicates its proper level of security. However, it is still subject to some minimal risks such as impermanent loss and smart contract vulnerabilities.

https://app.notum.ai/investments/0x6cDcb1C4A4D1C3C6d054b27AC5B77e89eAFb971d?protocol=Aerodrome&chainId=8453

This investment strategy on Base is one of the most profitable liquidity pools on the platform, as the total APY for providing assets is about 320%. Thus, the combination of the USDC stablecoin and the naive token of the platform brings users huge passive income with minimal risks, such as impermanent loss.

However, USDC-AERO has a fairly good TVL of almost $18 million, which makes the pool quite safe and promising for potential investors.

You can explore other profitable Aerodrome liquidity pools on the Notum platform in the Investments tab. Here you will get all the necessary information about the pool, including risk level, TVL and average APY.

Aerodrome Finance: Risks and Disadvantages

Even though Aerodrome Finance has gotten the contract architecture from Velodrome V2, which has also been audited and has a bug-bounty program, it is still not 100% secure. That is why before investing in liquidity pool provision on Aerodrome, it is important to study its weak points:

Cons

Smart contract risks

Any platforms operating on smart contracts are subject to minimal risks associated with them. Thus, despite all the security of Aerodrome Finance, vulnerabilities and bugs in smart contracts can lead to some losses.

Impermanent loss

Assets deposited into a pool can change their value, so liquidity providers always face the risk of possibly losing part of their assets.

Dependency on Base

Since Aerodrome Finance only supports one blockchain, this may be a disadvantage relative to other platforms that provide users with a large number of networks.

Notum’s Verdict

Aerodrome Finance is an innovative AMM and DEX with a medium risk level, user-friendly interface, numerous investment strategies and a fairly large TVL. It allows traders to make simple and convenient swaps with low slippage and fees, and investors to earn money by investing liquidity.

The platform offers users over 120 liquidity pools to provide assets and generate high passive income with an average APY of 233.99%. Having its own government and utility tokens, AERO and veAERO, the platform operates independently and is quite popular despite the short history of its existence.

Aerodrome Finance rewards investors with its own token AERO, which has shown an incredible growth trend over the past year. Even while still facing some risks, Aerodrome's investment strategies on Notum are an excellent option to generate additional DeFi yield and contribute to the development of DeFi ecosystem.

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

What is Aerodrome Finance?

Aerodrome Finance is a next generation AMM serving as Base's primary liquidity hub. Aerodrome combines a large number of features, from a liquidity incentive mechanism to a vote-lock governance model, and also has all the latest features of Velodrome V2.

2.

How does Aerodrome Finance work?

Aerodrome allows traders to swap tokens with a minimal slippage and offers liquidity providers opportunity to deposit their tokens on the platform and receive AERO tokens as rewards.

3.

Is Aerodrome Finance safe?

Aerodrome Finance has inherited the contract architecture from Velodrome V2, which pretty is secure. Since Velodrome V2 has been audited and runs a bug-bounty program, Aerodrome is also safe to use. However, like any other DeFi protocol, it cannot guarantee 100% safety.

4.

What is an Aerodrome token?

AERO is the native ERC-20 token of Aerodrome Finance. This utility token is distributed among liquidity providers through issuance and has an initial supply of 500 million.

5.

Is AERO a good investment?

It is hard to answer whether AERO is a good investment since it largely depends on market behaviour. However, over the past year the token has shown an excellent growth trend and is at the peak of its price in February 2024.