Automated Liquidity Management Investments

Maximize earnings potential with smart ALM strategies.

Working with the best in industry

Gamma

Automated Liquidity Management in Numbers

$432M

Total TVL Across All Supported Networks

Medium Risk

Generally considered as balanced risk-reward investment

Passive

Control-free. Hold & Earn.

38.35%

Average APY you can expect on Notum

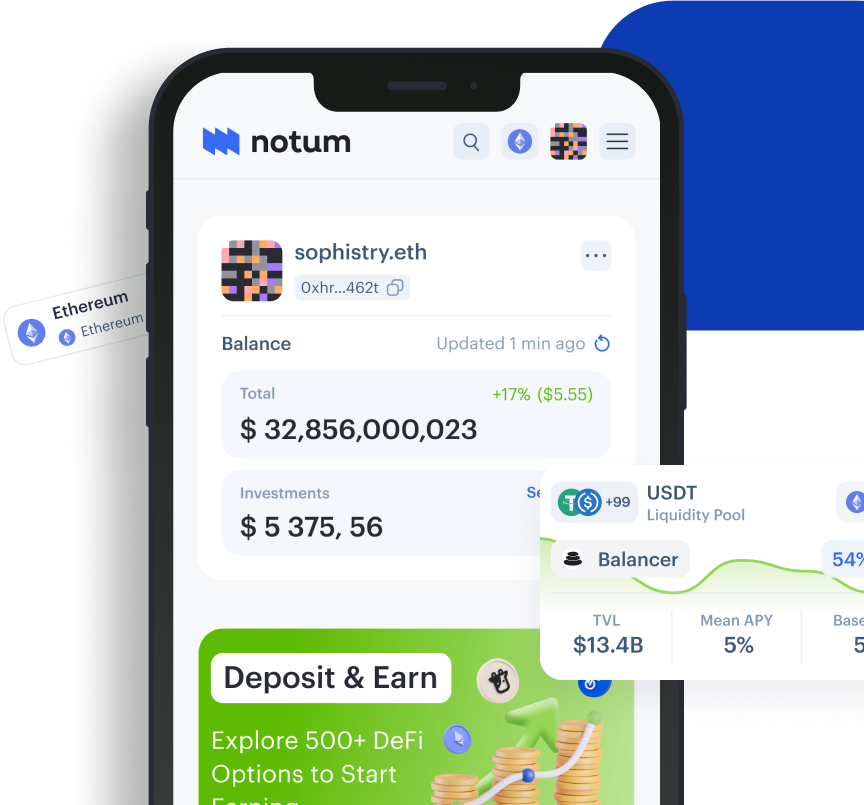

How to Invest in Automated Liquidity Management on Notum

Over the past years, a number of people who have been using cryptocurrency as an investment to generate passive income increased significantly. Since this market is now larger than ever, there are multiple crypto strategies that allow users to deposit their assets and receive regular income. Among all the opportunities appeared in the cryptocurrency market, one of the most popular investment strategies in 2024 is liquidity management.

Liquidity managers automatically move the deposited cryptocurrency between different pools depending on market conditions to obtain the greatest profit.

This investment strategy allows users to earn money by contributing assets to liquidity management protocols. These protocols then manage provided cryptocurrencies and invest them in liquidity pools. Investors receive maximum profit by automatically moving their assets between different pools that are more beneficial at the moment. Users who invest in automated liquidity management receive a share of the fees or interest generated by their assets.

Currently, the market offers users a huge number of different protocols that manage invested assets, optimize the efficiency of liquidity provision on platforms, and also bring decent rewards.

Today Notum will help you understand what an automated liquidity pool provision is, how this type of investment works, whether it is worth using it and which platforms to choose. We'll also take a look at popular investment strategies that could bring you rewards in 2024.

How to Invest in ALM

One of the popular ways to generate income from cryptocurrency is liquidity pool provision. Users contribute their assets to pools on the chosen platform and receive rewards for investing liquidity.

Using automated liquidity managers, users also place their assets into liquidity pools on the platform. However, unlike liquidity pool provision, their cryptocurrency is automatically moved between the best pools to maximize profits.

Thus, automated liquidity management can be described as a type of crypto investment that aims to maximize the return by relocating funds to where they will bring the greatest profit.

Liquidity managers reduce the complexity of pool management for the user, which is a big advantage for beginners and users who do not want to actively participate in liquidity pool provision. Seasoned users who prefer receiving passive income from their cryptocurrency also prefer automated liquidity management as this strategy brings a higher profit.

The greatest profitability is achieved because strategies are processed in real-time and are adjusted to the market situation and the activity of assets in the pool. By placing investments in the most profitable pools, a user receives the biggest rewards.

Thus, automated liquidity management is a medium-risk strategy with a low level of involvement, that offers high rewards and minimal asset management.

- Risk Level: Low-Medium

- User Involvement: Low-Medium

- Potential Returns: Moderate

- Automated or not: Automated

- Potential Risks: Smart-Contract Risks, Protocol Changes, Market Volatility

- Key Features: Automated Liquidity, High Rewards

- Common Platforms: Gamma, Arrakis

Why Invest in ALM?

Automated liquidity management platforms are an important part of the DeFi world as they stimulate users to deposit assets into pools, thereby contributing to the development of the ecosystem as a whole. They also play a crucial role in providing liquidity to decentralized exchanges, platforms, protocols and other dApps. Moreover, this type of investment has several significant advantages that make it an excellent choice for investors around the world.

Pros

Automated liquidity.

By providing assets on automated liquidity management platforms, users do not need to manage cryptocurrency and move it between different pools themselves. Liquidity managers are automated and move cryptocurrency to the most profitable pools depending on market conditions.

Low risks.

Since the process is largely automated, liquidity management platforms involve minimal risks and eliminate human factor errors.

High rewards.

Liquidity managers automatically move deposited assets into more profitable liquidity pools, which results in maximizing income by finding the best options on the market.

Increased liquidity.

Automated liquidity management platforms incentivize users to provide their assets and thereby help increase overall liquidity on decentralized markets.

Cons

Smart contract risks.

Since automated liquidity management platforms operate on smart contracts, vulnerabilities in these contracts can lead to exploits and potential losses.

Market risks.

Since the cryptocurrency market is known for its volatility, price changes may affect liquidity and result in some losses for liquidity providers.

Impermanent loss.

If the value of user’s assets relative to holding them outside the liquidity pool is lower, investor may also face impermanent loss, which will affect overall returns.

Despite the minor disadvantages of this investment type, the crypto market offers a huge number of different liquidity management platforms to help users optimize their investments.

Notum will tell you about two popular liquidity management platforms - Gamma and Arrakis, as well as introduce investment strategies for generating income in 2024.

ALM with Gamma

Gamma is a non-custodial protocol for active liquidity management and market making strategies, offering both automated and enterprise strategies for generating income.

- TVL: $86,450,000

- Risk Level: Low-Medium

- Blockchains: Polygon, Arbitrum, Gnosis, BSC, Ethereum, Polygon zkEVM, Optimism, Moonbeam, Rollux, Linea, Manta, Base, Avalanche, Mantle, Celo, Metis, Kava, Fantom, OpBNB

- Average APY: 23.98%

- Foundation Date: 2020

Gamma uses a variety of strategies to maximize profitability and minimize impermanent losses. Since protocol strategies are automated, it uses various triggers to perform the required actions. Besides, Gamma supports active management of concentrated liquidity across such platforms as QuickSwap and Uniswap.

«Gamma helps liquidity providers to issue liquidity in protocol-supported pools to actively manage their positions and earn returns» - Notum.

Source: DefiLlama

Gamma Strategies Overview

WMATIC / USDC on Polygon

Total APY - 123.80%, TVL - $1,31m

This investment strategy on Polygon allows users to invest their WMATIC and USDC assets to receive fairly high rewards. Since the pool’s total value locked is more than $1 million, it is reliable and relatively safe for investment. The advantage of this strategy is that liquidity ranges are automatically rebalanced as soon as certain rebalance triggers are identified. Rewards for depositing assets into the WMATIC/USDC pool range from 120% to 125% APY.

Source: Gamma App

WETH / OP on Optimism

Total APY - 342.49%, TVL - $863,04k

Another popular Gamma strategy that generates fairly large rewards is WETH / OP on Optimism. This pool consists of 87% OP and 13% on WETH and has a TVL of more than $860k, which indicates the safety of investment. WETH/OP on Optimism uses auto-rebalancing which allows users to earn passive income from 340% to 345% APY.

Source: Gamma App

Gamma Strategies: Pros & Cons

Pros

Automated rebalancing.

Since Gamma is an automated liquidity manager, when certain triggers are tracked down, liquidity ranges are automatically rebalanced, thereby moving assets for the greatest benefit.

High rewards.

Gamma liquidity pools offer investors quite large APY for providing liquidity and have impressive TVL, which indicates their safety.

Passive LP Experience.

Since the protocol takes care of liquidity management, investors don’t need to actively engage in the process and monitor the assets in the selected pool.

Cons

Difficulty of usage.

Since the protocol works with a large number of exchanges, supports various blockchains and offers a wide range of investment pools, it can be quite difficult to understand its use.

Smart contract risks.

Since Gamma, like most DeFi protocols, runs on smart contracts, it is also susceptible to various bugs and vulnerabilities.

Why Invest in Gamma?

Gamma is a liquidity management protocol with a low-to-medium risk level that seeks to maximize profitability and minimize permanent loss through actively managed strategies.

The platform has been audited by large firms such as Arbitrary execution, so despite some shortcomings it is an excellent investment option that will bring you great income.

ALM with Arrakis

Arrakis Finance is a liquidity management protocol that runs algorithmic strategies on Uniswap V3 and implements market-making strategies due to concentrated liquidity AMMs.

- TVL: $140,680,000

- Risk Level: Low-Medium

- Blockchains: Ethereum, Polygon, Arbitrum, Optimism

- Average APY: 6.12%

- Foundation Date: 2021

As a liquidity manager, the protocol uses unique Arrakis Vaults to automatically and efficiently manage assets. Arrakis relies on automated execution and works with large volumes of data in real time, thereby utilizing various systems to make decisions regarding liquidity management. The protocol also has two versions V1 and V2, each of which offers users a large number of investment opportunities. You can find out more about Arrakis here.

«Distinctive features of Arrakis V2 are multiple concentrated liquidity positions, liquidity provision in different fee tiered pools and cross protocol rebalancing» - Notum.

Arrakis Strategies Overview

LYRA / WETH on Ethereum

Total APY - 25.34%, TVL - $1,38m

This investment strategy on Arrakis V1 vaults invites users to invest their assets in the LYRA / WETH pool on Ethereum. With a total value locked of more than $1.3 million, the strategy has a relatively low level of risk and offers rewards from 25% to 26% APY.

Source: Arrakis

GEL / WETH on Ethereum

Total APY - 28.65%, TVL - $276,61k

Another popular strategy offered by Arrakis V1 is the GEL/WETH liquidity pool on Ethereum. Despite the relatively small total value locked compared to other pools, this investment strategy brings users rewards from 28% to 29% APY and has a fee tier of only 1%.

Source: Arrakis

Arrakis Strategies: Pros & Cons

Pros

Liquidity management options.

Arrakis uses actively managed concentrated liquidity on Uniswap v3 and offers users various ways to store it. These include managed vaults, self managed vaults and trustless vaults, depending on the experience and preferences of the investor.

Reduced risks.

Arrakis moves assets between different pools due to the automated execution. As a result it leads to minimization of impermanent losses.

Composability.

Arrakis Finance is a highly composable protocol which allows it to easily integrate new vaults into DeFi.

Automated decision-making.

Arrakis uses a variety of systems coupled with automated execution processes to make informed asset management decisions across pools based on factors affecting the market.

Cons

Market conditions.

Even though liquidity managers move assets between pools to minimize risks and achieve the highest returns, the volatility of the crypto market can still lead to some losses.

Risk of smart contracts.

Any platform operating on smart contracts, including Arrakis Finance, is susceptible to bugs and vulnerabilities associated with them, which can also affect the loss of assets.

Impermanent loss.

As the asset prices in the liquidity pool may change depending on the market, users may experience impermanent loss and lower returns than holding assets separately.

Why Invest in Arrakis?

Arrakis Finance is one of the most popular liquidity management protocols with low-to-medium risk level and TVL of more than $140 million. The platform is known for both algorithmic market maker strategies and liquid staking vaults to receive fairly large passive rewards. Despite the risks associated with market volatility and smart contracts, Arrakis Finance offers secure and transparent financial transactions and is an excellent investment in 2024.

Notum’s Verdict

Automated liquidity management is a type of investment that is suitable for both beginners and experienced users who want to earn passive income. Automatic movement of liquidity between pools allows users to maximize their profits without active involvement in management, which is what made liquidity managers so popular and in demand in the DeFi market.

Gamma and Arrakis Finance offer users numerous investment options and hundreds of liquidity pools with fairly high APYs and reduced risks, making these protocols an excellent option for investors looking for the most profitable liquidity managers to invest in.

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started