Liquid Staking Investments

Earn impressive yield by using liquid staking strategies.

Working with the best in industry

Frax Ether

Lido

Swell

Stakewise

Liquid Staking in Numbers

$41B

Total TVL Across All Supported Networks

Low Risk

Generally considered as a low risk investment

Passive

Control-free. Hold & Earn.

13.1%

Average APY you can expect on Notum

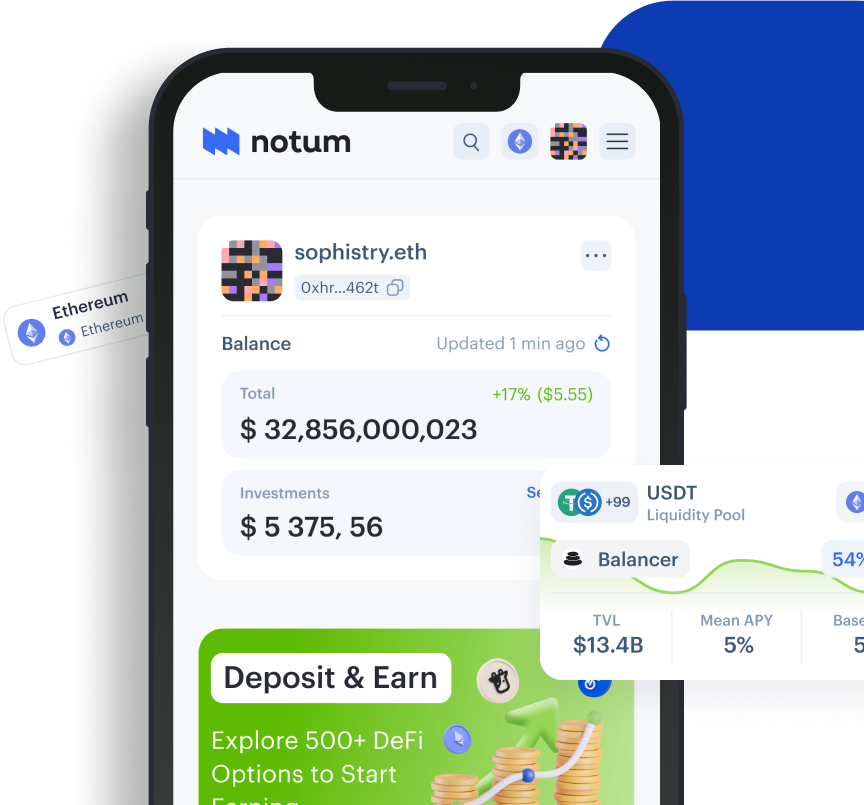

How to Invest in Liquid Staking on Notum

Liquid staking (or LS) is an innovative way to generate passive income by placing and locking crypto assets in a liquidity pool while receiving additional tokens in return.

LS allows users not only to receive rewards from staking assets based on the pool's performance but also to use additional tokens in other DeFi apps.

Example: If you have an ETH asset and want to earn passive income, you lock it in the liquidity pool on the platform and receive additional stETH tokens in return. These tokens can be used to vote or participate in DeFi applications and receive rewards for your contributions to the network.

The main advantage of LS is the ability to earn money from your crypto assets while still being able to freely use them in the DeFi space.

- Risk Level: Low

- User Involvement: Low to Moderate

- Potential Returns: Low

- Automated or not: Mostly Automated

- Potential Risks: Market Volatility, Smart Contract Risks, Protocol Changes

- Key Features: Staking Rewards, Liquidity

- Common Platforms: Lido, RocketPool

What Are the Benefits of Liquid Staking?

While investing in liquid staking, users receive additional tokens that represent their assets, which they can still use and at the same time profit from real holdings. Thus, they can not only maintain access to assets while staking but also earn passive income.

LS enables users to maintain liquidity by participating in staking networks, while still earning rewards.

Liquid staking is an investment strategy that is worth choosing if you want to not only contribute to the security of the network but also receive high profits and increased liquidity compared to traditional staking.

Pros

Potential for high returns;

Enhanced liquidity compared to traditional staking;

Contribution to network;

Access to a growing sector in DeFi.

Cons

Market volatility can affect potential returns;

Exposure to smart contract risks;

Limited control over staked assets;

Regulatory uncertainty in the DeFi space.

If you decide to invest in liquid staking, but don’t know which platform to choose, below you can consider two popular options — Lido and RocketPool.

Liquid Staking with Lido

Lido is one of the leading platforms for liquid staking services, allowing users to earn rewards without locking up their assets.

- TVL: $16,000,000,000

- Average APY: 5.13%

- Risk Level: Low

- Blockchains: Ethereum, Polygon

- Foundation Date: Oct, 2020

Lido operates through a network of node operators who manage the technical aspects of staking and enable users to earn rewards while maintaining liquidity. Lido nodes distribute rewards to stakers and ensure the security and decentralization of the network.

By staking on Lido, users receive additional staking tokens (such as stETH for Ethereum) which can be used in DeFi protocols. These tokens are more liquid and flexible, as they allow users to use them in the DeFi space while still earning staking rewards.

Investment Strategies on Lido

https://app.notum.ai/investments/0xae7ab96520de3a18e5e111b5eaab095312d7fe84?protocol=Lido&chainId=1

When users stake ETH on Lido, their asset is locked and can't be used within the DeFi space. However, they receive additional tokens (stETH in the case of ETH) that they can still utilize when their real asset is used to generate rewards. Staking ETH on Lido brings users APR of around 3-4%.

Pros

High liquidity

Lido allows users to stake their assets and receive liquid stETH or stMATIC tokens in return. These tokens can be traded, used in DeFi protocols, or easily transferred, providing users with instant liquidity for their staked assets.

No lock-up periods

Unlike traditional staking, Lido doesn't have a lock-up period. Users can easily access their staked assets at any time, allowing for more flexibility in managing their investments.

Potential for high returns

By participating in PoS networks through Lido, users can earn rewards and still use their assets. Even though there is a risk associated with the underlying blockchain network's performance, it's less risky than other investment types, like trading or yield farming.

Cons

Smart contract risks

While smart contracts can automate processes and enhance transparency, they can have coding errors or vulnerabilities that may be used to steal users' assets. Besides, the smart contracts may require updates that can lead to bugs or disruptions to the platform's functionality.

Market volatility

When users stake assets through Lido, they are still exposed to the crypto's price fluctuations. The returns generated through staking are not guaranteed and may vary significantly based on the market price.

Network performance

Factors like transaction costs and network scalability issues can influence the efficiency of the staking process and the returns users receive. If the network experiences congestion, it can lead to higher gas fees and affect your returns.

Why Invest in Lido?

Lido is a low-risk investment according to the potential for high returns, added liquidity, and no lock-up period.

Lido offers a secure and efficient way to stake Ethereum and Polygon assets, allowing users to earn staking rewards without running their own validator node. Besides, Lido provides liquidity for the staked assets, allowing users to use them in the DeFi space.

Liquid Staking with RocketPool

RocketPool is a liquid staking protocol that offers decentralized and permissionless Ethereum staking.

- TVL: $2,025,000,000

- Average APY: 3.03%

- Risk Level: Low

- Blockchains: Ethereum

- Foundation Date: Sept, 2016

RocketPool operates by allowing users to deposit their Ether into a smart contract. Then it is used to participate in Ethereum's PoS network, generating staking rewards.

With RocketPool users can deposit their assets to the liquidity pools for generating rewards and at the same time receive additional tokens, known as rETH. These tokens can be used and traded in the DeFi space, while original assets are bringing passive income.

Investment Strategy on RocketPool

https://app.notum.ai/investments/0xae78736cd615f374d3085123a210448e74fc6393?protocol=Rocket+Pool&chainId=1

While staking ETH on Rocket Pool, users block their assets in the pool and receive additional rETH tokens. They can use rETH as they wish within the DeFi space and still get paid for staking ETH. Rocket Pool's staking of ETH brings users a potential APR of about 3-4%.

Pros

User-friendly interface

Its intuitive design and easy-to-navigate platform ensure that both newcomers and experienced crypto investors can efficiently manage their investments and participate in staking pools for earning rewards.

High returns with reasonable risk

By participating in a staking pool, users can enjoy high returns on their investments. The risk is managed collectively within the pool, decreasing some of the volatility associated with individual staking.

No lock-up period

Users can withdraw their funds at any time without facing a lock-up period. This advantage provides liquidity and allows flexibility in investment decisions.

Cons

Market volatility

Since the price of rETH is influenced by the overall crypto market, users may experience fluctuations in the value of their staked assets. This can lead to both gains and losses, depending on the market's performance.

Limited staking options

Rocket Pool mainly focuses on Ethereum 2.0 staking, which means that it has limited options compared to other platforms that support various crypto assets.

Smart contract risks

Even though smart contracts offer security, they can still have bugs, vulnerabilities, or exploits. Users who stake their assets on Rocket Pool are exposed to smart contract risks, which could lead to the loss of their assets in case of a security breach or technical issues.

Why Invest in RocketPool?

RocketPool is a low-risk investment according to its decentralized and secure approach to Ethereum 2.0 staking, offering a reliable way to earn rewards without the lock-up period. RocketPool allows users to comfortably stake Ethereum while maintaining control of their funds. The platform's flexibility offers to enter and exit staking at any time, providing liquidity to staked assets.

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

Why is liquid staking considered as low-risk investment?

Liquid staking could be considered a low-risk investment strategy as it mostly involves de-pegging, security, hacks, and slashing risks. That's why you're advised to use trusty protocols and platforms when liquid staking. We remind you of the DYOR procedure, and you can also find some helpful information about risk assessment in Notum's Docs.

2.

Why is there low user involvement in liquid staking?

Since liquid staking is the process of depositing assets into a liquidity pool to receive rewards, it does not require much user involvement. For example, many platforms such as Lido use a network of node operators to handle the technical aspects of staking, so that the user does not need to be actively involved in the process.

3.

What are liquid staking potential returns?

Liquid staking rewards can vary greatly depending on market conditions, platform, and asset chosen. On average, potential returns from liquid staking range from 3 to 8 percent. For example, liquid staking on Lido usually has an APR of around 3-5%.

4.

Can liquid staking be automated?

Liquid staking is mostly an automated process, but this factor still depends on the chosen platform. Basically, the user only needs to lock crypto assets in a liquid pool, after which he can receive rewards without actively participating in the staking process.

5.

What are the potential risks of liquid staking?

Even though liquid staking is a simple and convenient way to get passive income, it is not without risks. This may include market volatility that can affect potential returns and exposure to smart contract risks.