Yield Farming Investments

Discover passive income with yield farming techniques

Working with the best in industry

Trader Joe

Convex Finance

Yield Farming in Numbers

$192M

Total TVL Across All Supported Networks

Medium Risk

Generally considered as balanced risk-reward investment

Active

Hands-on management for higher returns

11.62%

Average APY you can expect on Notum

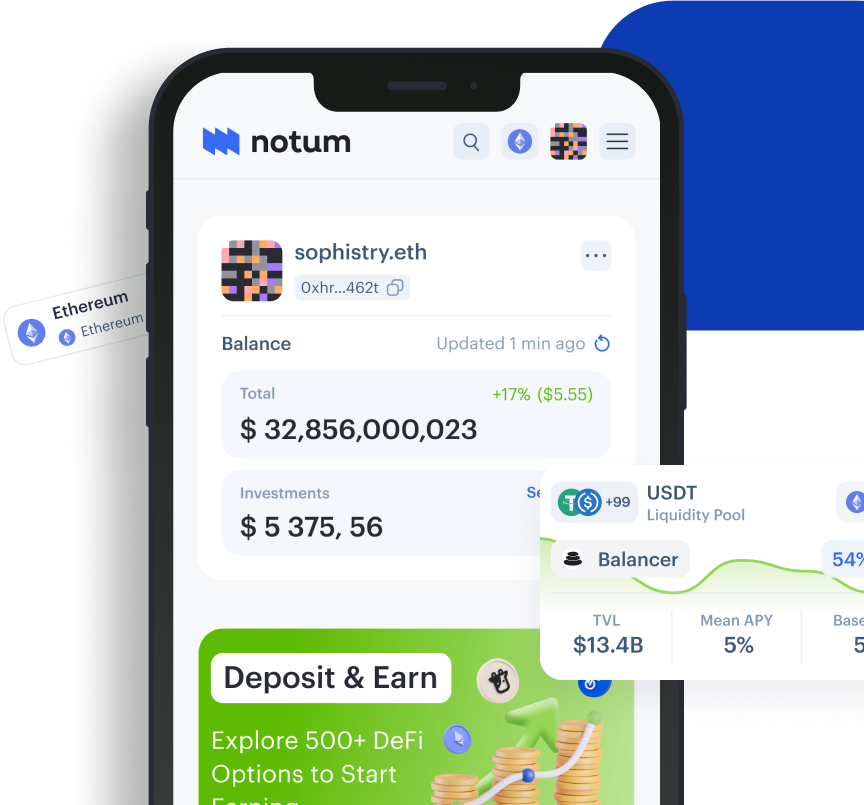

How to Invest in Yield Farming on Notum

The year 2023 can be characterized by another surge of interest in cryptocurrency. A huge number of users and investors have begun to explore decentralized exchanges and popular investment strategies to generate additional profits. Yield farming is one of the few strategies that offers relatively high rewards with a moderate level of risk, which attracts users around the world. Yield farming is a way to receive rewards by locking your assets in DeFi protocols for their further use in the crypto space.

Since there are now a huge number of platforms and options for making money through farming, it can be quite difficult for users to find a solution that is suitable for them. In today's article from Notum, we will take a detailed look at yield farming, its main advantages and disadvantages, platforms for farming, as well as their investment strategies that are worth considering in 2023.

How to Invest in Yield Farming on Notum

In simple terms, farming cryptocurrency can be described as the activity of placing cryptoassets in DeFi protocols to receive rewards. This allows users to participate in liquidity farming pools, as well as use lending services while receiving a profit.

The name of this crypto strategy is directly related to how it works: users “farm” their assets where they will bring the greatest benefit, and receive a so-called “yield” in the form of crypto assets for this.

Although users can provide crypto farm services directly by lending funds to another user, most of them still prefer to use liquidity pools that contain cryptocurrency provided by farmers for profit. This option is suitable even for novice investors who do not have a huge start-up capital.

A liquidity pool is a storage of tokens that provides the ability to carry out transactions on the crypto market.

By using a liquidity pool, users receive a kind of guarantee of security in their transactions, however, this entails fees that can vary between the pool, cryptocurrency, and platform. In return for providing liquidity, investors receive additional tokens representing their stake in the pool, which can also be used to generate additional income.

- Risk Level: Medium - High

- User Involvement: Medium - High

- Potential Returns: Variable, Moderate

- Automated or not: Not Automated

- Potential Risks: Market Volatility, Smart-Contract Risks, Protocol Changes

- Key Features: Earning rewards

- Common Platforms: Convex, Pendle, Trader Joe

Why Invest in Yield Farming?

Yield farming is undoubtedly one of the most important areas of the DeFi sector, as it allows users to earn yield from cryptocurrency by locking funds, which are then used to provide loans and other operations on DeFi platforms. However, in addition to making a profit for providing liquidity, investors can earn additional profits, which makes this strategy especially attractive.

While the liquidity provider's cryptocurrency is locked in the protocol, most often paired with another asset, they are still free to use additional tokens for extra returns.

Thus, the main advantage of farming crypto is the multi-channel income, which is formed from interest rates for the provided liquidity and the use of additional tokens in the DeFi ecosystem. Despite this, yield farming has both a number of advantages and disadvantages that are worth considering.

Pros

High income

Users who farm crypto often receive more income than from any other crypto investment strategies.

Ability to use assets

Assets can be used not only to participate in various DeFi protocols, but also to receive additional profit.

Availability of strategy

Farming is an attractive option for generating income because novice investors don’t require a large initial capital to invest and receive rewards.

Cons

Difficulty of use

The farming process is not automated and includes a large number of different strategies and options that you need to understand before investing.

Impermanent loss

The value of tokens in a liquidity pool is often different from holding them individually.

Market volatility

The cryptocurrency market is famous for its volatility, which means prices for a particular asset can change over a short period of time.

Today we'll take a look at two popular platforms, Convex and Trader Joe, that allow users to invest in yield farming, and pay attention to their investment strategies.

Yield Farming with Convex

Convex is a decentralized finance platform that optimizes yield and provides rewards for providing liquidity on Curve. In addition, the platform has a native ERC-20 CVX crypto token, which is distributed to investors for providing their assets through Curve.

- TVL: $1,819,000,000

- Average APY: 3.50%

- Risk Level: Medium-high

- Blockchains: Ethereum, Arbitrum, Polygon

- Foundation Date: May, 2021

Convex is a popular yield optimizing platform as it allows users to not only receive rewards for providing liquidity, but also stake their CRV tokens for additional rewards. Moreover, Convex Finance has an easy-to-understand interface and does not charge any fees for funds withdrawal. More information about Convex can be found here.

Investment Strategies on Convex

This liquidity pool with a moderate level of risk allows users to earn fairly high rewards for depositing their CRV and YCRV assets on the Ethereum network. Potential APYs range from 32% to 33%, making the pool a profitable investment strategy. As a profit for providing liquidity, users receive CRV and CVX reward tokens. However, when investing in this strategy, users should be aware of the potential impermanent loss.

https://app.notum.ai/investments/0x99f5aCc8EC2Da2BC0771c32814EFF52b712de1E5?protocol=Convex+Finance&chainId=1

The SETH/FRXETH pool on Ethereum is another investment strategy offering potentially high APYs of 37% to 38%. The pool consists of a combination of SETH and FRXETH tokens and has fairly low asset and pool risks. Rewards for providing liquidity are in the form of CRV and CVX tokens, which can also be used in the DeFi environment for additional profit.

https://app.notum.ai/investments/0x4d9f9D15101EEC665F77210cB999639f760F831E?protocol=Convex+Finance&chainId=1

Pros

High profitability

Convex strategies offer users quite high APY of about 37% in the case of SETH / FRXETH on Ethereum.

Extra income

Convex is an excellent investment platform because after depositing tokens, investors can simultaneously receive Curve trading fees and take CRV for additional profits.

Fees

Convex has no withdrawal fees, which is a big advantage for many crypto investors.

Cons

Impermanent loss

The total income received from farming on Convex may vary as the value of tokens in the pool often differs from holding them individually.

Smart contract risks

Convex, like most other DeFi platforms, operates on smart contracts, which are susceptible to various bugs, attacks and vulnerabilities.

Complicated user experience

Convex is a platform that is connected to Curv, which means the user needs to understand the operating features of both platforms.

Why Invest in Convex?

Convex is a convenient yield optimizing DeFi platform with a moderate level of risk, offering users a large number of investment solutions with potentially high rewards. Although Convex has been on the DeFi market since May 2021, it already ranks first in the yield TVL ranking with TVL over $1.819 billion.

Yield Farming with Trader Joe

Trader Joe is an AMM-based DEX and comprehensive DeFi trading platform that provides a huge number of services where users can yield farm, swap tokens, stake tokens, shop for NFTs, borrow and etc. It also offers a huge number of auto pools, allowing investors to receive rewards without active asset management.

- TVL: $156,420,000

- Average APY: 7.95% - 10.26%

- Risk Level: Medium

- Blockchains: Ethereum, Arbitrum, Avalanche, BSC

- Foundation Date: June, 2021

Trader Joe was originally an AMM-based DEX launched on Avalanche, but is now a full-scale project with many opportunities for DeFi investors. One of the big developments for Trader Joe's was the introduction of a new protocol called Liquidity Book, providing concentrated liquidity and zero-slippage trading.

“The team developed their own unique CLMM, an NFT marketplace, lending and borrowing markets, and staking with real yield accrued from platform trading fees” - Notum.

Investment Strategies on Trader Joe

https://app.notum.ai/investments/0xed8cbd9f0ce3c6986b22002f03c6475ceb7a6256protocol=Trader+Joe&chainId=43114

This liquidity pool, consisting of WAVAX and USDT.E on Avalanche, offers users fairly high APYs from 42% to 43% with a low level of risk. With an excellent asset accessment and a good level of security, this Trader Joe’s strategy can be a good solution for investors who want to get maximum profits from yield farming.

https://app.notum.ai/investments/0xf4003f4efbe8691b60249e6afbd307abe7758adb?protocol=Trader+Joe&chainId=43114

Another popular strategy from Trader Joe's that brings fairly high rewards is WAVAX/USDC. This low-risk liquidity pool consists of two assets, WAVAX and USDC, yielding between 41% and 42% APY. Despite the fact that this pool has fairly good performance, potential investors should pay attention to the possibility of impermanent loss.

Trader Joe Strategies: Pros & Cons

Pros

High rewards

Trader Joe's investment strategies allow users to deposit funds into liquidity pools and earn about 40% APY for doing so, which is much higher than many other platforms.

Variety of options

The platform offers a huge number of liquidity pools across four different networks, which means the user can choose the low-risk option that suits them.

Auto pools

Trader Joe's has the option of investing in auto pools, so investors no longer need to spend time actively managing their investments.

Cons

Smart contracts risk

Trader Joe operates on smart contracts, which, although they provide management, have their own risks of bugs and vulnerabilities that should be taken into account before investing.

Potential exploits

Even though Trader Joe's is tested by several firms to identify problems, it can still be susceptible to exploits, attacks and other threats.

Why Invest in TraderJoe?

Trader Joe is a popular DeFi platform with a huge number of investment opportunities and a moderate level of risk. It offers a simple and user-friendly interface, high rewards, and also allows investors to choose from a huge number of different liquidity pools.

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

What is yield farming?

Yield farming is the process of blocking user’s crypto assets in DeFi protocols in order to obtain relatively high rewards for providing liquidity.

2.

How does yield farming work?

While crypto farmers place their assets in DeFi protocols, these protocols use the funds for such purposes as lending, providing liquidity, and more. Investors can optimize their returns by allocating assets across different DeFi platforms to get the highest returns.

3.

Is yield farming profitable?

Although DeFi yield farming can be a fairly profitable investment strategy, the potential return depends on many factors, such as the chosen platform, asset, market volatility, etc.

4.

Is yield farming safe?

Despite the attractiveness of the strategy and its high rewards, DeFi yield farming is associated with certain risks, such as the vulnerability of smart contracts, market volatility, impermanent loss, etc.

5.

What Is APY in yield farming?

APY is an acronym that stands for “annual percentage yield” and refers to the rewards received for yield farms. Depending on the chosen cryptocurrency and protocol, crypto yield farming can bring daily, weekly or monthly interest.