Balancer Protocol Stats

$ 809.0M

Total TVL Across All Supported Networks

Medium Risk

Generally considered as balanced risk-reward investment

Passive

Control-free. Hold & Earn.

53.57%

Average APY you can expect on Notum

How to Invest in Balancer on Notum

The crypto world is growing and evolving, thereby offering users a variety of options and investment opportunities. One of the most popular strategies in 2024 is the liquidity pool provision, allowing users to deposit their assets and receive fairly high rewards in return.

💡 A liquidity pool is a collection of assets deposited by users into smart contracts. Money held in liquidity pools is available for various financial transactions, such as decentralized financing, trading, lending, and so on.

One of the main purposes of these pools is to provide liquidity to various decentralized exchanges. In order to incentivize investors to provide their assets, they are paid rewards in the form of trading fees and additional tokens.

There are now a huge number of different platforms and protocols for providing liquidity to pools to generate income. Today's article from Notum will help you get acquainted with one of the most popular protocols for providing liquidity to pools - Balancer, as well as study its main features, profitable investment strategies, and pay attention to its advantages and risks.

Balancer Protocol: The Essentials

- Balancer TVL: $987,980,000

- Average APY: up to 16,5%

- Risk Level: Medium - High

- Blockchains: Ethereum, Polygon, Arbitrum, Gnosis, Optimism, Avalanche, Base

- Foundation Date: 2018

Balancer Labs is an decentralized finance AMM protocol designed to automatically balance a token portfolio in DeFi applications. The protocol runs on Ethereum and allows users to create liquidity for various tokens, manage a portfolio, and earn fees for lending assets. Thus, any investor can provide liquidity to the Balancer pools by simply depositing assets there.

💡Automated market maker (AMM) is an algorithm that uses liquidity pools instead of actual market makers to provide users with the most secure and free environment for trading crypto assets. Thus, instead of direct user interaction, such transactions use smart contracts.

Users who contribute crypto assets to Balancer's liquidity pools receive a portion of the trading fees paid to the network for using their funds as a reward. In addition, the protocol also rewards investors with its own cryptocurrency, BAL. Depositing assets into pools provides the liquidity that users need to buy and sell assets on Balancer.

«This means Balancer must incentivize both sides of its market in order to operate – crypto users who might wish to make some of their holdings available to be traded, and traders seeking the best possible price for an asset» - Kraken.

Although the Balancer operates similar to other decentralized exchanges such as Uniswap, it offers users a number of distinctive features. For example, the protocol has the ability to bundle up to eight tokens in the same pool and use liquidity in different proportions.

💡 Balancer offers private, public and smart pools, which means each user can choose the option suitable for their needs and risk level.

Balancer V2

- Balancer V1 TVL: $139,25m

- Balancer V2 TVL: $841,86m

As you know, Balancer V1 was released back in 2018 based on the Balancer Protocol. However, on May 11, 2021, Balancer Labs, the company responsible for the development of the platform, introduced Balancer Version 2. The main components of the new version were capital and gas efficiency, flexibility and security.

A distinctive feature of Balancer V2 is the new single Vault architecture, which is not only capable of managing all assets added to the protocol pools, but also significantly simplifies pool contracts. Thus, the new version included asset managers that allowed to increase capital efficiency with the following features:

- a single vault for all Balancer Pool assets;

- reduced trading costs and gas fees.

Why Invest With Balancer?

The liquidity pool provision is not only an important part of the DeFi sector, but also allows investors to receive fairly large rewards. Balancer Finance, in turn, has a number of advantages that make investing in liquidity pools especially attractive:

- Decentralization. The Balancer protocol runs on the Ethereum blockchain and uses smart contracts to automate trading and portfolio management. Thus, the protocol is decentralized and safe to use, which is very important in a crypto environment.

- Automated portfolio. A definite advantage of Balancer is the automatic balancing of the token portfolio in accordance with predefined parameters. This way, investors can maintain the proportions of assets in their portfolio they want without the need for active involvement.

- Multi-token pools. Unlike many other liquidity protocols, Balancer allows users to create liquidity pools with more than two tokens, which sets it apart from most competitors. Currently, the protocol allows you to combine up to 8 tokens in one pool.

- Pool flexibility. Investors providing liquidity to the protocol's pools can customize the parameters of their pools, such as token allocation percentages and trading fees. Thus, Balancer provides significant flexibility and control over money management.

- Token swaps. The protocol provides users with exchange one token for another through liquidity pools, which makes trading assets on Balancer quite comfortable and safe.

- High rewards. Users who contribute their assets to Balancer liquidity pools receive a portion of the transaction fees that occur in the pools and also earn BAL tokens as rewards.

- Compatibility with other protocols. As Balancer runs on Ethereum, it can integrate with other DeFi protocols on the network, allowing user funds to secure the decentralized finance system.

Balancer: Investment Strategies

As mentioned, Balancer.Finance offers users a large number of different investment strategies to earn rewards for providing liquidity on the platform. On the protocol website, in the “pools” section, users can select one of 7 networks and then filter the pools of the selected network by tokens.

Balancer also has several types of pools to choose from - Weighted, Stable, CLP, LBP, and New so that the users could find the most suitable option for them. In addition, investors have the opportunity to create a pool themselves by selecting tokens and weights.

Today we will look at two popular investment strategies on Balancer with a medium level of risk that will allow you to earn quite high rewards in 2024:

This liquidity pool on the Arbitrum network allows users to deposit RDNT and WETH assets to receive fairly high rewards. Total APR in the pool varies from 18% to 27%, and dynamic swap fees are 0.5%. Pool weight is 80.00% RDNT and 20.00% WETH. Although the pool itself is immutable, swap fees can be edited by the pool owner.

MAGIC/USDC is a moderate-risk liquidity Balancer pool on Arbitrum that allows investors to deposit MAGIC and USDC tokens, each weighing 50.00%. The total APR of this pool ranges from 24% to 28%, while swap fees are currently fixed at 0.3%. As with RDNT/WETH, the attributes of this pool are immutable, with the exception of the swap fee, which can be edited by Management.

However, Balancer, like other decentralized finance platforms, faces certain risks that should be considered before investing. Smart contract vulnerabilities pose a significant threat as bugs or exploits can lead to loss of funds. In addition, market risks such as sudden price fluctuations or low liquidity of certain assets may lead to slippage and negatively impact users' earnings.

Another potential risk is vault hacking, thanks to which attackers can gain access to all tokens of the protocol. However, in May 2021, the protocol underwent a thorough audit, which indicates an adequate level of security.

Why Use Balancer?

Balancer is a fairly popular AMM decentralized finance protocol that offers a large number of advantages, such as automatic portfolio balancing, multi-token pools and others. The protocol is built on the Ethereum blockchain and is decentralized, which is ensured through the use of smart contracts. In addition to Ethereum, Balancer supports six other networks and a huge number of tokens, giving the user a wide variety of investment strategies.

The protocol is not automated and requires medium to high user involvement, which is most suitable for investors with some experience. However, the advantage of Balancer is the potentially high rewards, which depend on the chosen network, strategy and tokens. Despite potential risks such as market volatility, protocol changes, smart contract risk and others, Balancer is a fairly reliable option that will help you get started in the world of investing in liquidity pools.

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.

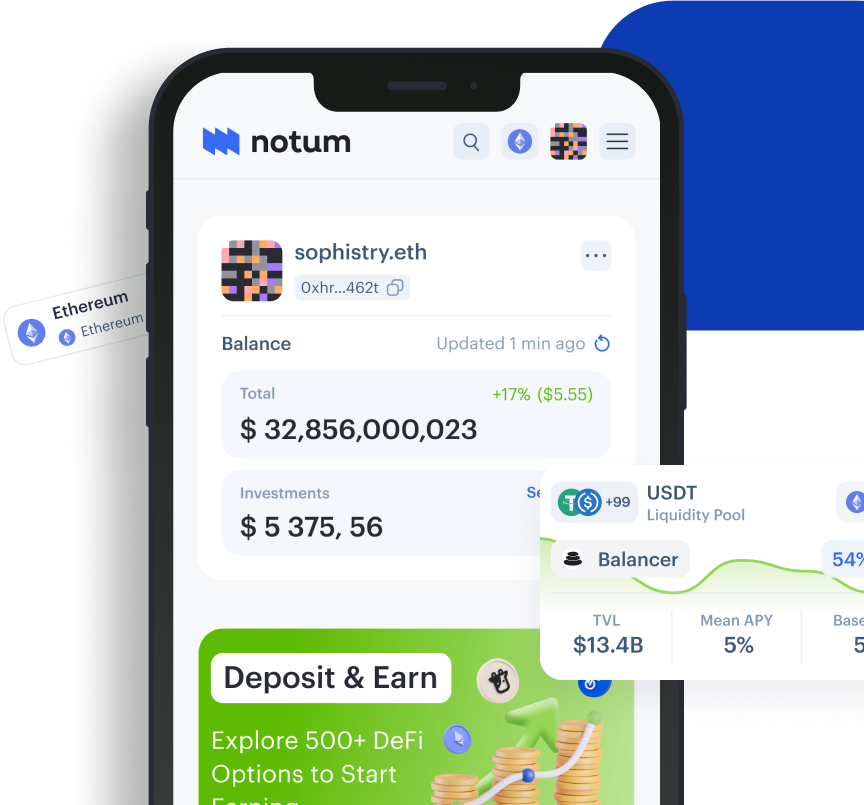

Try All Notum's Unique Features Without Log In

Cryptocurrency risks assessment, all-time gains insights and profit, and a loss calculator at your fingertips!

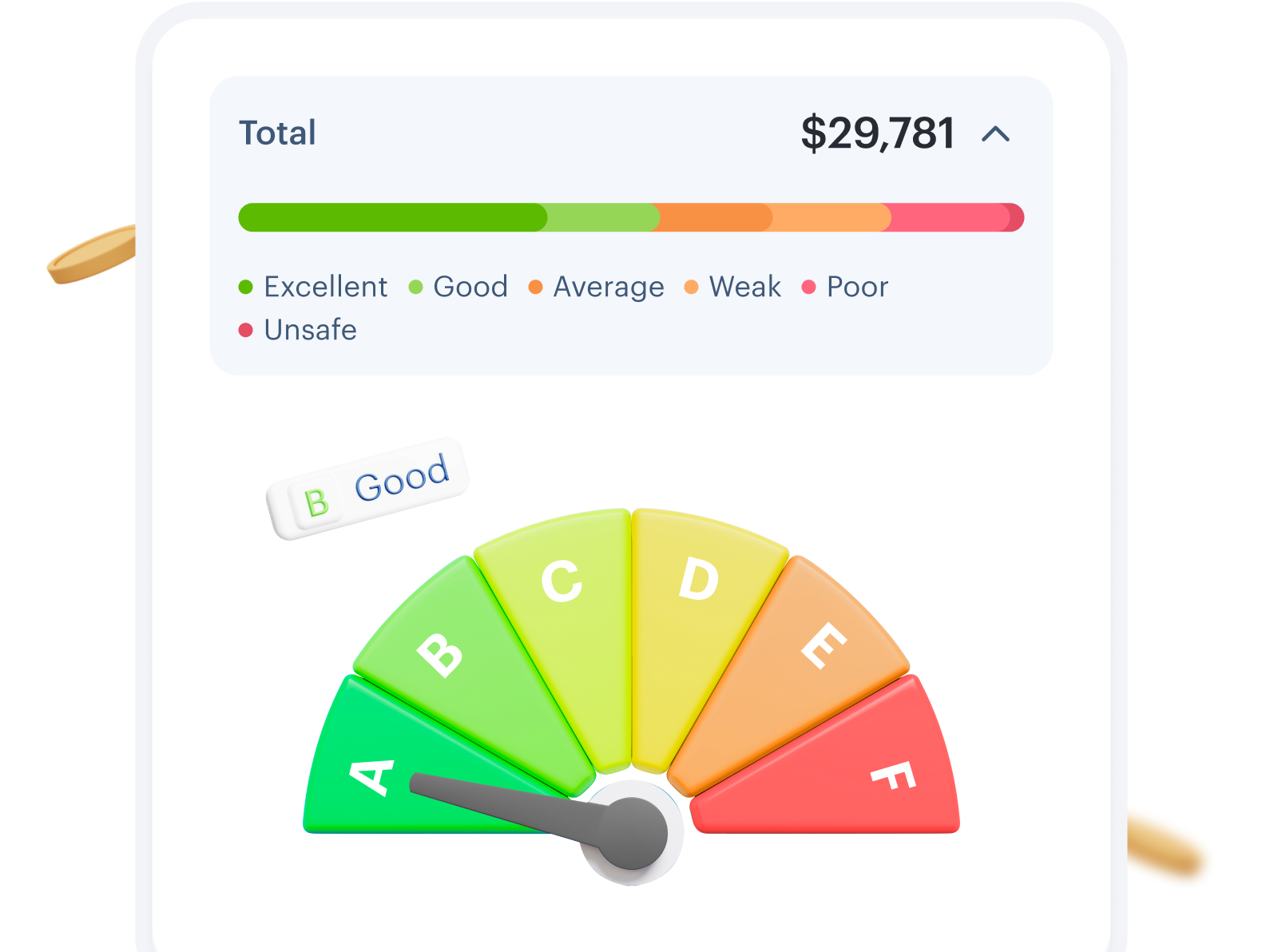

Wallet Risk Assessment

Get assessed crypto risks and helpful insights to control your investments.

Learn More

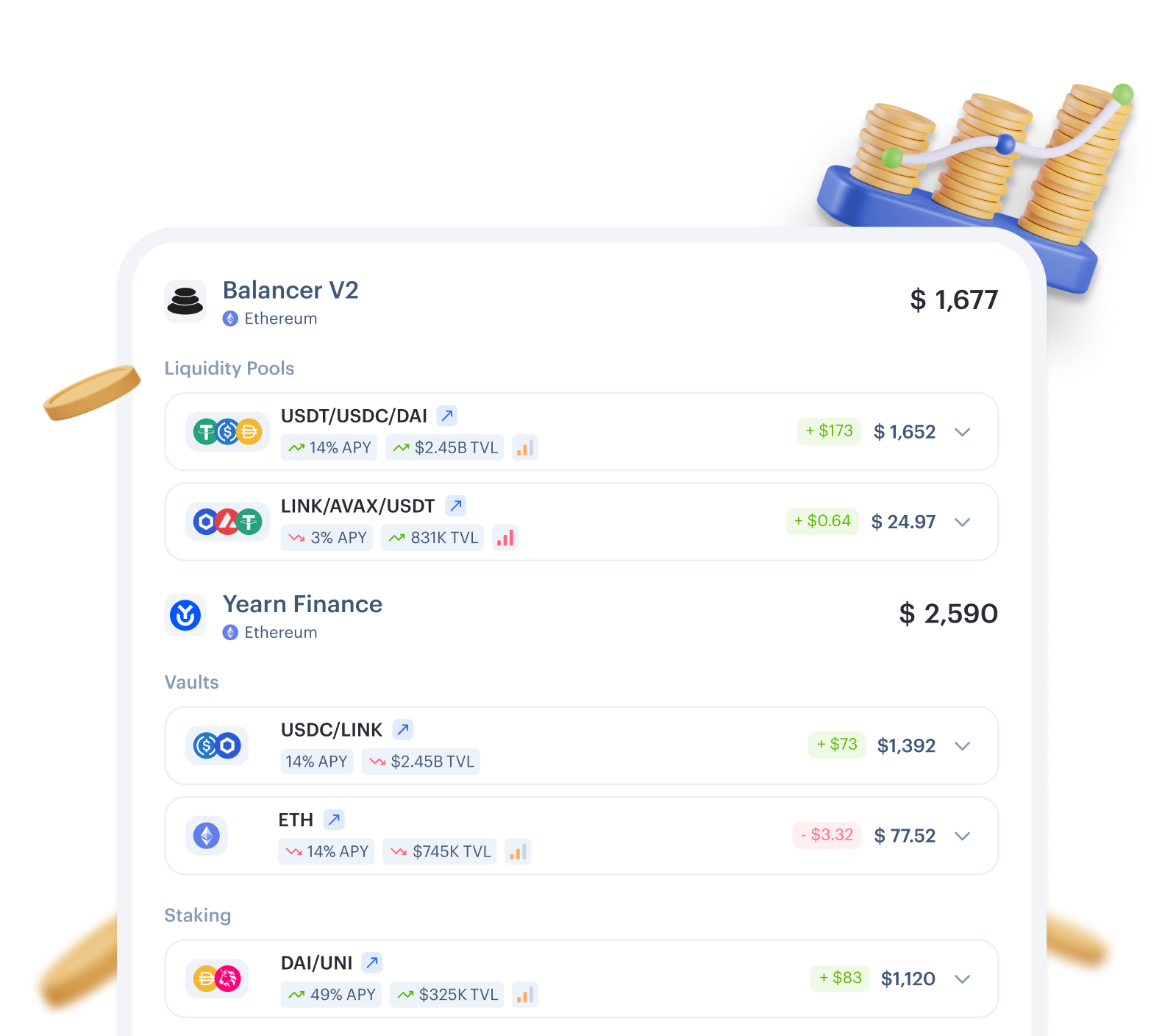

Profit and Loss Calculator

DeFi calculator to check on how profitable your current investments are.

Learn More

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

What is Balancer protocol?

Balancer is an AMM DeFi protocol that automatically balances a token portfolio in different applications across crypto space. Protocol uses algorithms that manage and stimulate interactions between liquidity providers, traders and liquidity pools by rebalancing pools and finding the best price across them.

2.

How to use Balancer?

To start investing, userы needs to connect their crypto wallet on the protocol website, select a network and explore the different types of liquidity pools available on Balancer. In addition, investors can independently create their own liquidity pool, which can combine up to eight tokens.

3.

Is Balancer decentralized?

Yes, Balancer App is decentralized and allows users to create and participate in decentralized liquidity pools, providing automated portfolio management and token trading. Balancer's decentralization is ensured through smart contracts and a network of participants in the DeFi ecosystem.

4.

Is Balancer on Ethereum?

Balancer is built on the Ethereum blockchain, but the protocol itself supports many other blockchains, including Polygon, Arbitrum, Gnosis, Optimism, Avalanche and Base.

5.

Has Balancer ever been hacked?

Balancer was once subject to a Domain Name System (DNS) attack on September 19. However, protocol has since taken measures to improve its security and address potential smart contract issues and vulnerabilities.

6.

Is BAL a good investment?

Whether Balancer crypto (BAL) is a good investment for you depends on many factors, including your portfolio, market trends, potential risks and more.