Lido Protocol Stats

$ 27.9B

Total TVL Across All Supported Networks

Low Risk

Generally considered as a low risk investment

Passive

Control-free. Hold & Earn.

3.59%

Average APY you can expect on Notum

How to Invest in Lido on Notum

In 2024, liquid staking has become one of the most popular ways to earn passive income in the crypto space. Since this investment strategy has a low level of risk and does not require active user involvement, it's in demand among both experienced investors and newcomers.

💡 The ability to use staked assets without a lock-in period is also one of the main reasons why users prefer liquid staking over traditional ones.

Lido is a platform that has practically monopolized the liquid staking market, offering users profitable APRs, a simple interface, and an almost automated process of receiving rewards. Today's review from Notum will delve into how the Lido platform works, what advantages it offers, and why you consider investing in liquid staking with Lido.

As liquid staking continues to grow and develop, Lido, as a matter of logic, will also align with this financial trend in the future. Besides, some experienced researchers, such as HashKey, also claim that liquid staking derivatives, and therefore Lido, will soon become the most dominant DeFi sector.

Lido Protocol: The Essentials

- TVL: $16,000,000,000

- Average APY: 5.13%

- Risk Level: Low

- Blockchains: Ethereum, Polygon

- Foundation Date: Oct, 2020

Lido is a decentralized protocol for liquid staking of ETH on the Ethereum network and MATIC on the Polygon network.

💡 Solana was also available on Lido, but from the 16th of October, 2023, the protocol stopped supporting this network.

Lido protocol dominates the liquid staking market and provides users with the opportunity to stake ETH and MATIC and along with it receive additional tokens (such as stETH) that can be used in the DeFi space. This way, users can earn income from liquid staking while maintaining liquidity and the ability to quickly exchange their funds for other assets.

“By issuing a liquid, tradeable asset, stETH, Lido enables users to utilize their interest-bearing staked ETH as a productive asset in DeFi.” - Mjl.capital

As said, Lido provides users with the ability to place liquidity staking through its platform on Ethereum and Polygon networks. The operating principle of Lido is quite simple: the user deposits an asset, for example, ETH, into the Lido smart contract and receives an additional one (stETH – or staked Ethereum if the user stakes ETH) in return.

💡 The advantage of this additional staked token is that while staking the main asset, the user can still use stAsset in the DeFi space. For example, stETH can be exchanged for the original asset or even sold at the market price of ETH.

One of Lido's main goals is also to maintain security through its distributed validator nodes and governance mechanisms. As known, “Lido operates through a network of node operators who manage the technical aspects of staking and enable users to earn rewards while maintaining liquidity.” - Notum. In addition, protocol users have the opportunity to participate in the governance of Lido through governance tokens, influencing decisions related to protocol updates.

Why Invest in Liquid Staking With Lido?

As you know, users choose liquid staking as an investment strategy for several reasons:

- Increased liquidity. Liquid staking allows users to have access to their crypto assets even while staking, namely selling or trading their stTokens. Moreover, they can also withdraw their funds from the pool at any time, which provides high liquidity compared to other forms of crypto investments.

- Additional tokens and rewards. Besides the main assets that users stake, liquid staking also provides users with additional stTokens that can also be used to earn extra rewards.

- Participation in decision-making. By choosing liquid staking, token holders can usually vote on key issues of the chosen protocol or platform, propose changes, and influence their development.

“Liquid staking enables users to maintain liquidity by participating in staking networks, while still earning rewards.” - Notum

Lido is the best solution for investing in liquid staking since it is the largest player in the crypto investing market. As of November 2023, Lido has over 77% of all staked ETH on its platform. Lido's closest competitor in Ethereum staking is Rocketpool, which has only 8.77% of the market share.

💡 Also, compared to other liquid staking platforms, Lido offers one of the best LSD APR which is 4.00%. Rocketpool, for example, only offers 3.43%.

However, before investing in liquid staking with Lido, remember that it only supports two networks – Ethereum and Polygon. So, if you are interested in liquid staking of ETH or MATIC, Lido will be the best option on the market due to its interest rates, global recognition, and contribution to network security.

Lido: Investment Strategies

As known, now Lido has only two supported networks for staking tokens - Ethereum and Polygon. Let's take a closer look at thr investment strategy offered by Lido on Notum:

Pool

Protocol

Risk

Base APY

Total APY

TVL

LidoFi offers users the opportunity to stake any amount of Ethereum and receive daily rewards for their contribution to network security. When staking Ethereum on Lido, users receive an additional stETH token that represents the staked version of Ethereum. This additional token allows users to use it across the DeFi ecosystem and L2, including exchanging and selling. The protocol currently has over 8.9 million stETH staked and has paid out over 452 thousand ETH rewards.

Since the amount of stETH in balance can change daily due to staking rewards, Lido encourages users to use a wrapped version of stETH (wstETH). The advantage of wstETH is that it keeps your stETH balance unchanged, using a share system for reflecting your staking income.

What Can You Do With stAssets?

As you know, when staking ETH or MATIC, users receive additional stETH and stMATIC tokens, which they can also use in the DeFi space. However, what exactly are the use cases for stTokens?

- Holding tokens. If you don't want to actively interact with stAssets, you can simply store your stTokens in your crypto wallet and accumulate staking rewards.

- Providing liquidity. You can use your stETH and stMATIC for liquidity and exchange them for other assets.

- Decentralized applications. You can use your stAssets in various dApps that support these tokens.

- Sale or Exchange. The advantage of stTokens is that if you wish, you can sell or exchange these tokens at any time.

- Trading. stTokens are also available for trading on various centralized and decentralized exchanges.

- Lending/Borrowing. You can also use stETH and stMATIC as collateral for a loan or lend them out through other platforms.

Is Lido Staking Safe?

Lido is the number one liquid staking protocol recognized by the crypto community, so its use is quite safe. At the moment, Lido offers the largest Ethereum pool in the entire DeFi space, which also speaks of the efficient liquidity and security of the protocol itself. In addition, Lido has a global community that also takes part in updating the protocol and building its future.

The protocol regularly improves security measures to ensure that staking on Lido is as safe as possible. For example, the protocol is open source and regularly checks all code for errors. To avoid the risk of staking, Lido also has the best-elected validators, and the use of DAO for decision-making also contributes to risk management. You can read more about the security of the Lido protocol on their official website in the FAQ – Security section.

💡 Lido has been audited by a large number of platforms, including Certora, StateMind, and Hexens.

However, Lido, like any other protocol, has some risks that should be considered before investing in liquid staking. The main risks of the protocol include smart contract security, splashing, and stToken price risk.

Why Use Lido?

Lido is a unique protocol that has monopolized the liquid staking market and has the largest Ethereum staking pool in existence. Founded in 2020, Lido already has a TVL of over $16 billion and offers a simple and secure way to earn passive income through staking. Lido supports the Ethereum and Polygon blockchains, allowing users to receive rewards for staking ETH and MATIC. Since liquid staking is expected to be a dominant part of DeFi in the future, Lido, as a monopolizer of this strategy, will also remain popular and will most likely offer new investment solutions

The Lido protocol is more popular due to its relatively high APR from 3 to 5%, low-risk level, and low user involvement. However, although Lido offers users increased liquidity, additional tokens and rewards, and participation in decision-making, it only interacts with two blockchains, which should be taken into account before you start investing.

However, despite some risks, Lido continues to own the largest part of the market share and is more than twice as large as its closest competitor, which indicates its impeccable reputation and undoubted potential for future development and obtaining new inflows.

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.

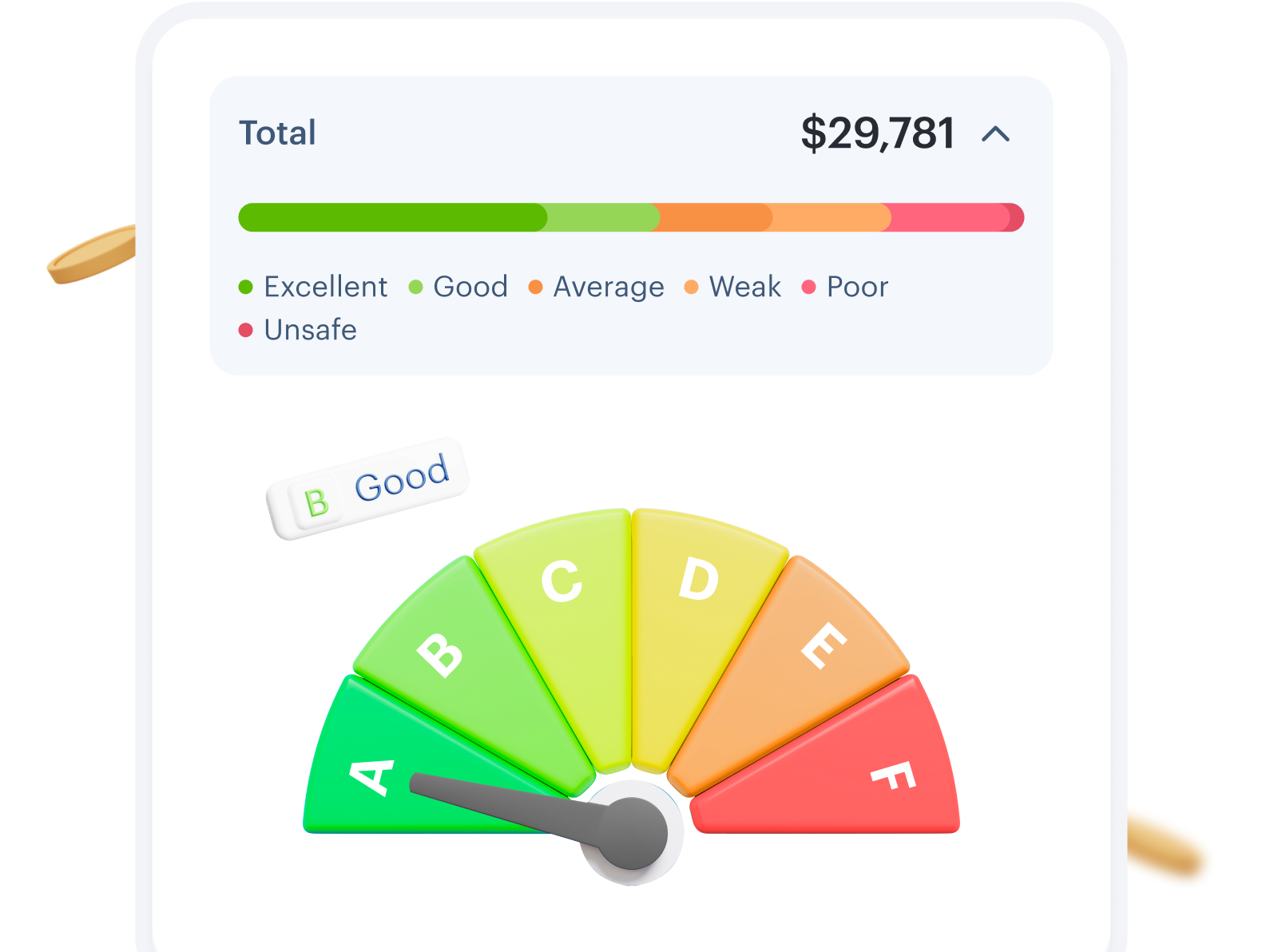

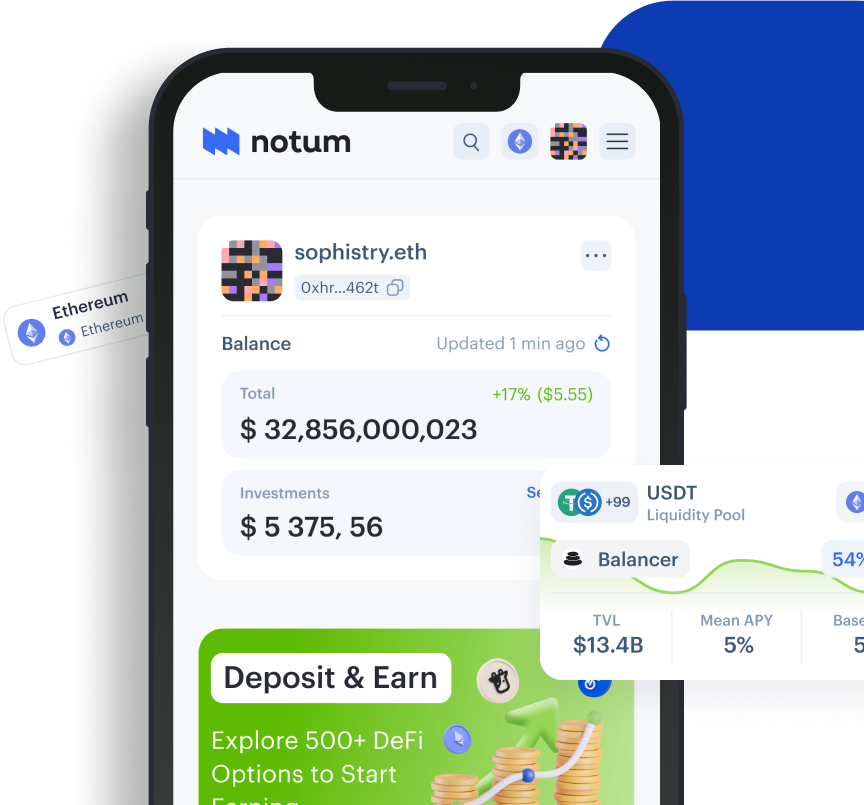

Try All Notum's Unique Features Without Log In

Cryptocurrency risks assessment, all-time gains insights and profit, and a loss calculator at your fingertips!

Wallet Risk Assessment

Get assessed crypto risks and helpful insights to control your investments.

Learn More

Profit and Loss Calculator

DeFi calculator to check on how profitable your current investments are.

Learn More

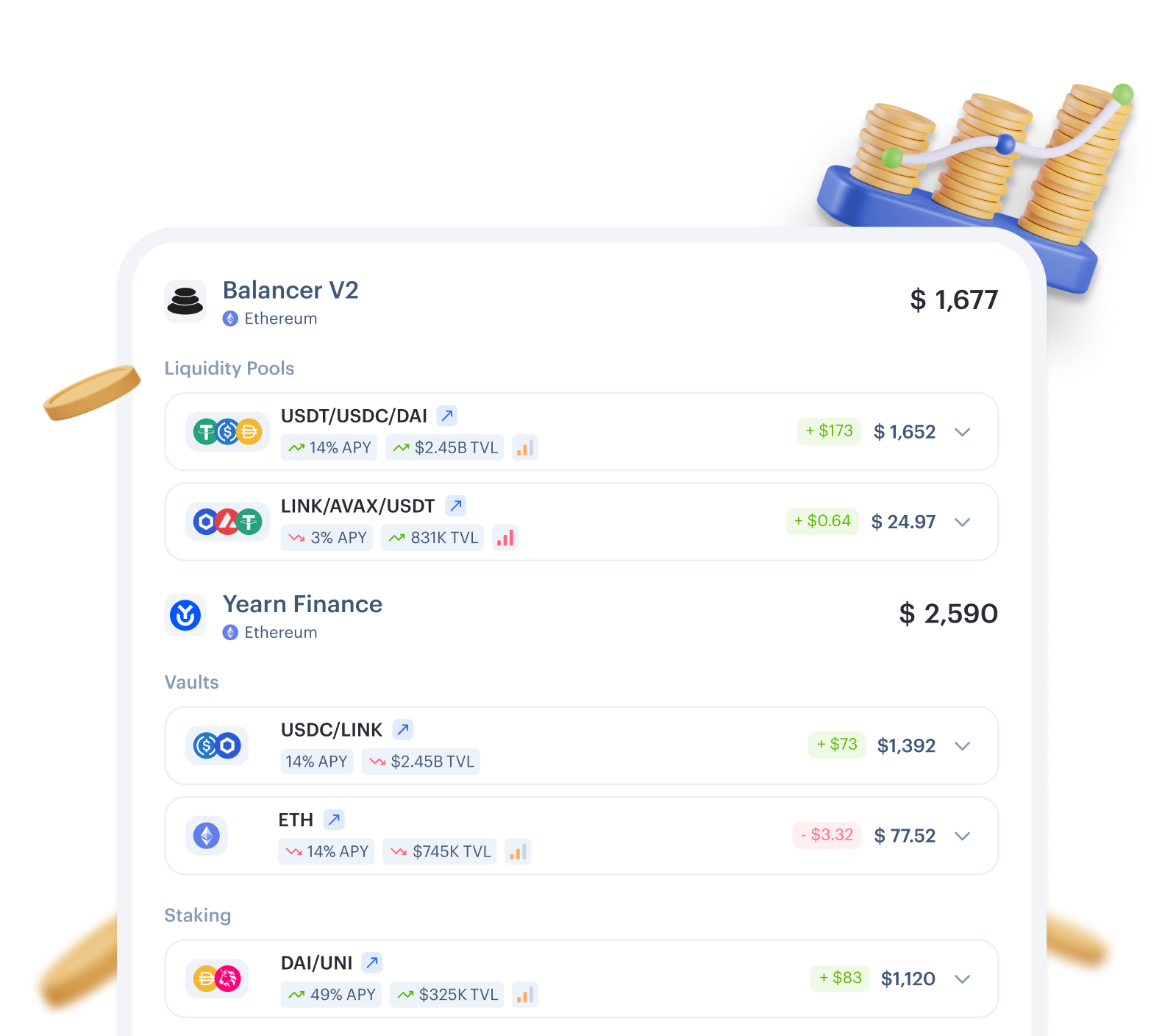

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

Why Lido Is Low-Risk Investment?

Lido is a low-risk protocol as it has no lockup period meaning the user can withdraw their funds at any time, offers high returns compared to other options on the market and provides additional liquidity for extra rewards.

2.

What Are Lido Potential Returns?

The potential rewards you may receive will depend on the strategy and investment asset you choose. On average, liquid staking with Lido brings about 3-5% APR.

3.

What Are Lido Risks?

Despite its security, Lido still has several risks. These include smart contract security, splash, stToken price risk, as well as network performance and market volatility.

4.

Is Staking on Lido Safe?

Staking on Lido is safe as the protocol is open source, which is regularly checked for errors. Lido Finance also selects the best validators to avoid the risk of staking and uses DAO for risk management.

5.

How to Use stETH?

After receiving stETH, you can use it as you wish in the DeFi ecosystem, for example for trading, providing liquidity, lending, borrowing and other purposes.

6.

What Is wstETH and How to Use wstETH?

wstETH is a wrapped version of your staked Ether. It is used to keep the stETH balance fixed, as this is a requirement of some DeFi protocols. Besides, “uses an underlying share system to reflect your staking rewards.” - Lido

7.

How to Unstake ETH on Lido?

You can unstake ETH at any time in the Withdrawals section. In order to do this, you need to click on the Request tab, enter the amount of staked Ether you want to withdraw and click on the ‘Request withdrawal’ button.