Radiant Protocol Stats

$ 151.5M

Total TVL Across All Supported Networks

Medium Risk

Generally considered as balanced risk-reward investment

Passive

Control-free. Hold & Earn.

2.48%

Average APY you can expect on Notum

How to Invest in Radiant on Notum

Radiant is a DeFi platform on Arbitrum allowing users to lend and borrow digital assets across multiple blockchains. The platform wants to overtake fragmented DeFi capital as evidenced by the dozens of different money markets, all with their own liquidity.

The protocol achieves high composability by using LayerZero as a cross-chain infrastructure. Besides, Radiant is up to integrate LayerZero’s omnichain technology in Radiant v3 and v4. This might end in the omnichain lending business going to new levels. Thus, that would be particularly interesting to dive deeper into the project.

With the launch of v2 they migrated the RDNT token to the LayerZero OFT (Omnichain Fungible Token) format, making cross-chain fee sharing more seamless and enabling quicker launches on additional chains.

Radiant V1: Distinct Features

- TVL: $233.58m

- TVL Ranking by Lending: #9

- Average APY: 1.50%

- Blockchains: Ethereum, Arbitrum & Binance Smart Chain (BNB Chain)

Radiant is a crucial part of the so-called Arbitrum Avant-Garde which refers to the new generation of protocols native to it by sharing some key characteristics such as real yield, sustainable tokenomics, engaged DAO governance, and progressive decentralization.

These protocols boast low-cost transactions when introducing new services, and their central ideology is sustainability and profitability. This fresh generation has access to a better tech stack and other protocols experience. Let’s take a look at some prominent features Radiant Capital has under its hood.

Borrow, Lend & Stake Triad

- Borrow: Users can borrow from the platform with their own collateral for liquidity without selling their assets and closing their positions, also without being taxed.

- Lend: Users provide liquidity to borrowers on the platform by depositing crypto assets.

- Stake: Users provide liquidity by pairing $RDNT/$WETH on SushiSwap then staking in Pool2 of the platform to earn interest in $RDNT.

Locking & Vesting

- $RDNT Lockers: Users who lock up $RDNT will gain 50% of the platform fee. Besides, when locking $RDNT, users commit to a 90-day lock and cannot unstake until the 90-day lock is complete. This lockout commitment may get additional penalty fees from those who vested $RDNT for less than 90 days.

- $RDNT Vesters: Users receiving $RDNT rewards from DeFi activities within the platform have to participate in vesting 28 days.

Cross-Chain Borrowing

Apart from well-known lending and borrowing functions, users have an ability to borrow cross-chain, and all this goes along with great user experience.

Let’s look at an example, Ada keeps her funds on Arbitrum but wants to interact with the project on Avalanche. A usual flaw looks like this: Ada borrows the funds on Arbitrum and then bridge these to Avalanche, which involves numerous permissions and multiple transactions. Radiant’s borrow and bridge batches all these steps into one transaction. Ada could repay her loan on the origin chain.

Source: Radiant Capital Docs

Radiant is live on Ethereum, Arbitrum and Binance Smart Chain as origin chains where users can deposit and originate loans. Radiant plans to expand to other EVM chains and integrate more supported asset classes.

Being live on Ethereum mainnet makes it possible for radian’t users to skim all advantages that liquidity on Ethereum has while accessing cheaper and faster blockchains, as well. Radiant’s omnichain nature allows it to launch on additional chains within the Layer Zero ecosystem.

Radiant & LayerZero

Radiant leverages LayerZero’s Stargate to achieve its cross-chain functionality. LayerZero is a communication protocol, and Stargate is the first dApp built on LayerZero. Usually bridges use a lock and mint strategy when assets are locked on the source chain, and a synthetic asset is minted on the destination chain. Using these wrapped assets involve more smart contract risks and an additional swap on the destination chain.

On the contrary, Stargate provides instant finality, uses a single liquidity pool across various chains for deep liquidity, and swaps in native assets.

LayerZero is at the heart of omnichain interoperability allowing blockchains to pass messages between each other. It works as an endpoint using a messaging protocol Ultra-Light Node that any blockchain can support, creating a fully connected network of nodes. It acts as a translator between blockchains to speak to each other.

💡 RDNT, the native token of Radiant Capital, is an OFT-20- a token standard from LayerZero. The OFT token fuels the multichain functionality and allows for hyper-market efficiency.

To interact with other chains, users burn tokens, receive a receipt, and show this receipt to the destination chain. The total supply of tokens stays constant but the location is totally flexible.

The OFT token allows money to go wherever in the most cost-efficient ways. Currently, in crypto, there is liquidity scattered around the ecosystem where it does not want to be due to the difficulty of moving it and all the third-party fees associated with its movement. The OFT standard makes it possible to enjoy full location mobility, and markets can retain all this excess value.

Radiant V2: Updates & Improvements

Radiant v2 is an omnichain lending protocol. It’s an improved version with the migrated to the LayerZero OFT (Omnichain Fungible Token) format that makes cross-chain fee sharing more seamless and enables quicker launches on additional chains.

Radiant’s great ambition is to be the go-to money market and source for cross-chain liquidity across all of DeFi. The protocol aims to generate real yield through organic economic activity and protocol fees.

The protocol has substantial liquidity on Arbitrum ($117m), BNBchain ($86m) and Ethereum ($32m).

The goal is for Radiant v2 to be named the protocol with the lowest price to fee ratio in all of crypto — whilst continuing to offer seamless omnichain lending.

The recent V2 upgrade made Radiant Capital the lowest price to fee ratio in all of crypto while offering its unique product of omni-chain lending.

Radiant Capital also got the #1 in the category “Fees to Market Cap” project in all of DeFi.

As for Radiant v2’s priorities, they lay in moving the ERC-20 RDNT token to the LayerZero OFT (Omnichain Fungible Token) format. This move will make cross-chain fee sharing much easier, enabling quicker launches on additional chains, and permitting native ownership of bridging contracts instead of relying on third-party bridges.

Exit Penalties in V2

If in Radiant v1, users must vest their RDNT emissions for 28 days or incur a 50% reduction in claimable emissions to receive their tokens, v2 version gives users who exit early between 10–75% of all emissions, depending on the remaining vesting time. As for vesting time, it is increased from 28 to 90 days.

Expired Locks

Expired locks in v1 received the same treatment as locked RDNT. In v2 expired locks will be from the emissions pool. Users could use an “auto-relock” option in the UI, which allows them to get emissions automatically as they normally would.

Changes to Protocol Fees

In Radiant v1, protocol fees generated from borrowers were emitted equally between RDNT lockers & lenders. Radiant v2 will provide a better utility proposition for liquidity providers. The ratio of protocol fee splits will be improved while reducing the impact of vesting RDNT.

The split for v2 will look like:

- 60% of protocol fees is allocated to dLPs;

- 25% is allocated to the lenders’ base fee;

- 15% is allocated to DAO controlled Operating Expenses Wallet.

As for other crucial changes in the project, the Radiant Protocol, contributors made the Radiant website and app much easier to interact with. The team believes it will help to attract new users thanks to a more intuitive design and onboarding process.

Another important thing to mention is that Radiant will continue to provide users with borrowing and lending cross-chain. Those are the platform's pillars. However, if users want to be eligible for RDNT emissions, they will need to own a minimum 5% threshold in locked Dynamic Liquidity relative to the total value of their deposit.

RDNT Token & Tokenomics

- Market Cap: $136,485,471

- Circulating Supply: 426,896,503 RDNT

- Maximum Supply: 1B RDNT

- Ranking: #295

RDNT, an OFT-20, is Radiant's native utility token.

LayerZero’s OFT token interoperability solution allows native, cross-chain token transfers. After voting for Governance Proposal RFP-4, RDNT emissions ecosystem participants to provide utility to the platform as dynamic liquidity providers (dLP).

Only users who locked dLP (liquidity tokens) activate eligibility for RDNT emissions on their deposits or borrows.

Besides, dLP’s share in the utility of Platform Fees is captured in blue-chip assets such as Bitcoin, Ethereum, BNB, and stablecoins from borrowers paying loan interest, flash loans, and liquidation fees.

Radiant DAO provides its users with decentralized discussions, voting, and governance, which includes influence on the decisions, and the vision of the Radiant ecosystem.

The RDNT token has a circulating supply of $300M with a total supply of $1B. It has an emission rate of approximately $20M every month following this token release schedule.

- The initial RDNT token launch date: 24 July 2022.

- The maximum supply of RDNT is capped at $1B, with an inflationary type emission rate since genesis.

- The supply of RDNT is expected to be fully vested on 24 Aug 2024.

What Is dLP?

Dynamic Liquidity Provisioning (DLP) is a one of a kind feature of Radiant. It's implemented to attract long-term liquidity and reward protocol participants. To get dLP users can ZAP ETH or BNB on Radiant or lock RDNT-BNB / RDNT-ETH liquidity dLP on BNB Chain. dLP participants also become a part of the Radiant governance system.

How dLP Works?

- Deposits and Locking of dLP Tokens: to become a Dynamic Liquidity Provider (dLP) users:

- Deposit their assets into the protocol;

- Lock a certain amount of dLP tokens (RDNT-BNB), which are liquidity tokens obtained from the deposited assets. A user should have a minimum of 5% locked dLP tokens relative to the size of the user's deposit to activate RDNT emissions.

- Activation of RDNT Emissions: when users lock the required amount of dLP tokens, they become exposed to RDNT emissions on their deposits and borrows.

- Locking Period and Rewards: the locking dLP tokens process varies from 1 to 12 months and must be locked again after maturity to continue getting platform fees.

The dLPs also share in the utility of platform fees captured in blue-chip assets such as Bitcoin, Ethereum, BNB, and stablecoins from borrowers paying loan interest, flash loans, and liquidation fees.

dLP: Profits

- Incentivized Participation: DLP encourages long-term participation in the Radiant Protocol which allows dLP holders to earn rewards just by providing liquidity.

- Attraction of Liquidity: potentially, RDNT emissions and platform fees may attract more liquidity providers, leading to stronger and stable Radiant Protocol markets.

- Governance Participation: dLP tokens provide governance voting power, allowing dLPs to contribute to the decision-making and development of the Radiant Protocol ecosystem.

Why Use Radiant?

In situations when you need a loan, you firstly need to go to a bank or other financial institutions to get it through all red-tape procedures the one may face. Radiant gets rid of the intermediaries from asset trading, futures contracts, and savings accounts.

As we know, a lending protocol operates on a network with high activity volume and broad adoption among institutions to operate to the fullest.

Radiant utilizes optimistic rollups implemented by the Arbitrum network to solve the Ethereum monopoly dilemma with its rather high gas cost. You can enjoy Arbitrum’s compatibility with Ethereum and Ethereum’s security strengthen making it one of the most powerful blockchains.

According to the latest DeFi narratives, cross-chain borrowing and lending may be a significant industry in the future. Radiant has gained substantial traction on Arbitrum and BNB chain, and obviously, has a great potential to grow and evolve.

The RDNT token is used by lenders to secure a share of platform fees and emissions. If the team can grow TVL it should increase demand for the RDNT token and bring additional value to the project.

The project’s governance system is nicely done in terms of protecting the developers who are about to launch the project from scratch with no funding. It is a protocol that will be a part of the omnichain future.

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.

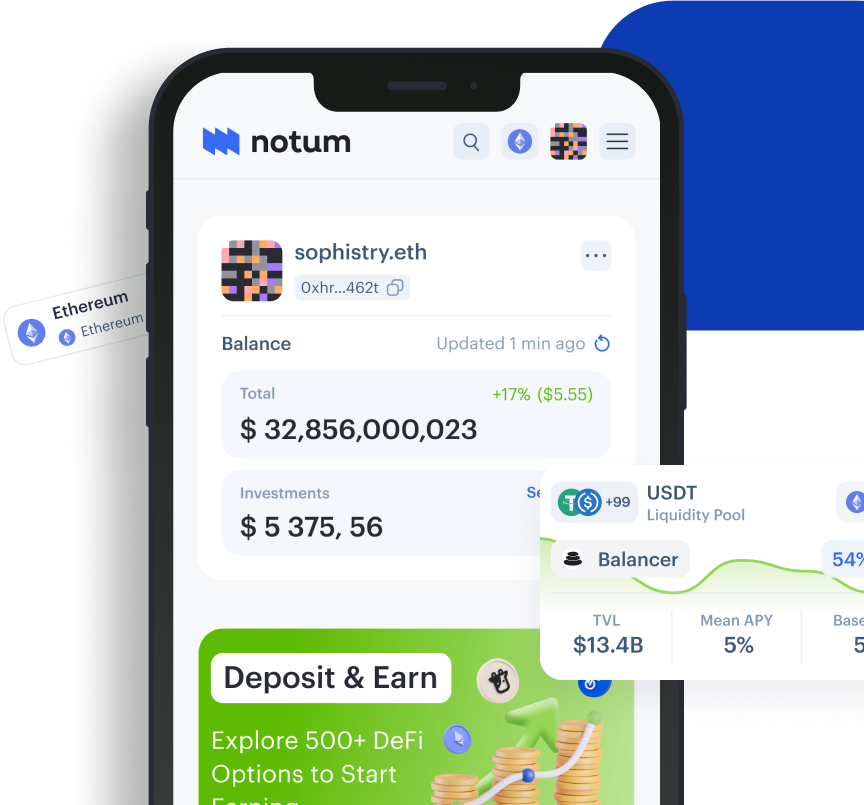

Try All Notum's Unique Features Without Log In

Cryptocurrency risks assessment, all-time gains insights and profit, and a loss calculator at your fingertips!

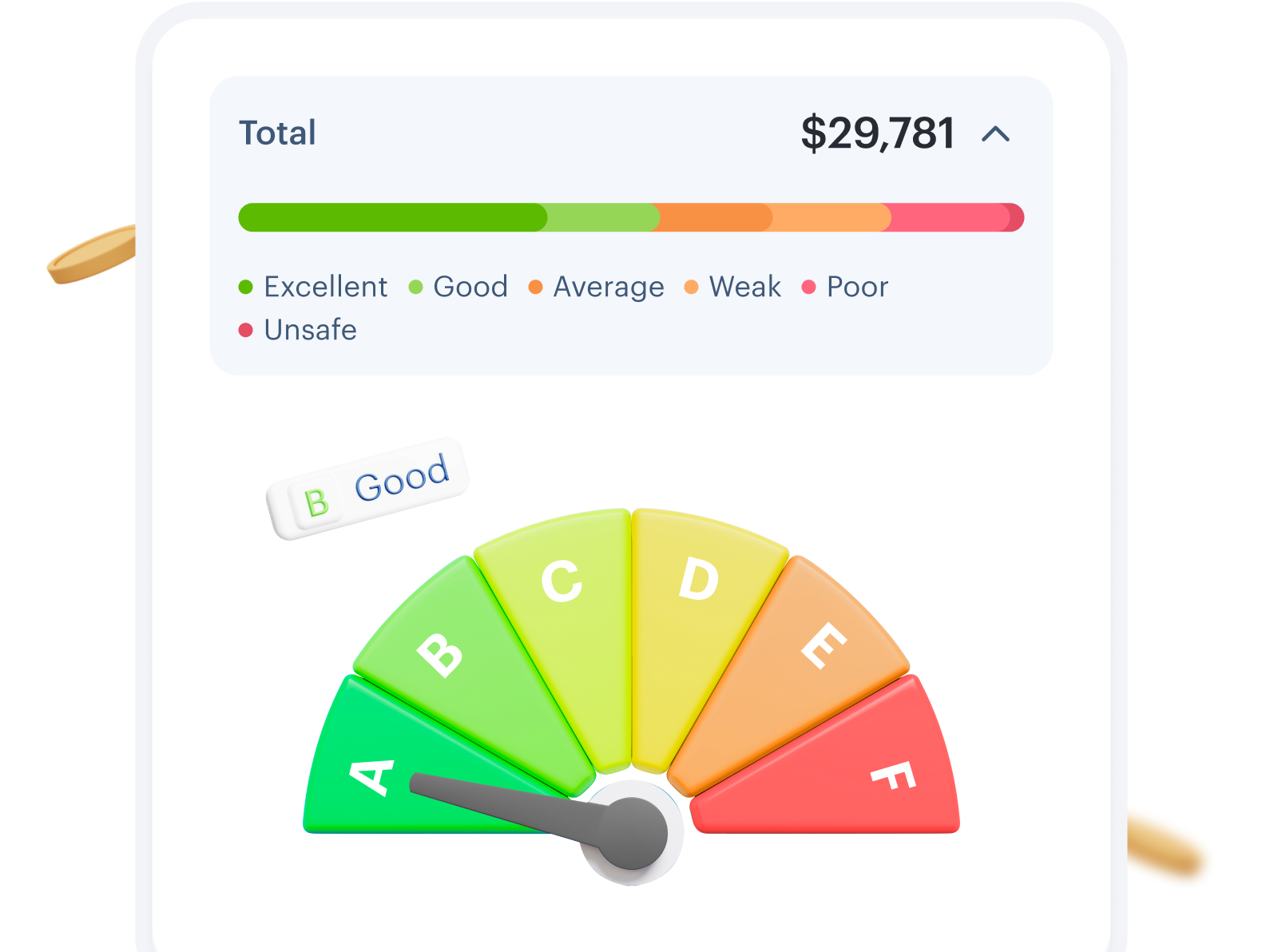

Wallet Risk Assessment

Get assessed crypto risks and helpful insights to control your investments.

Learn More

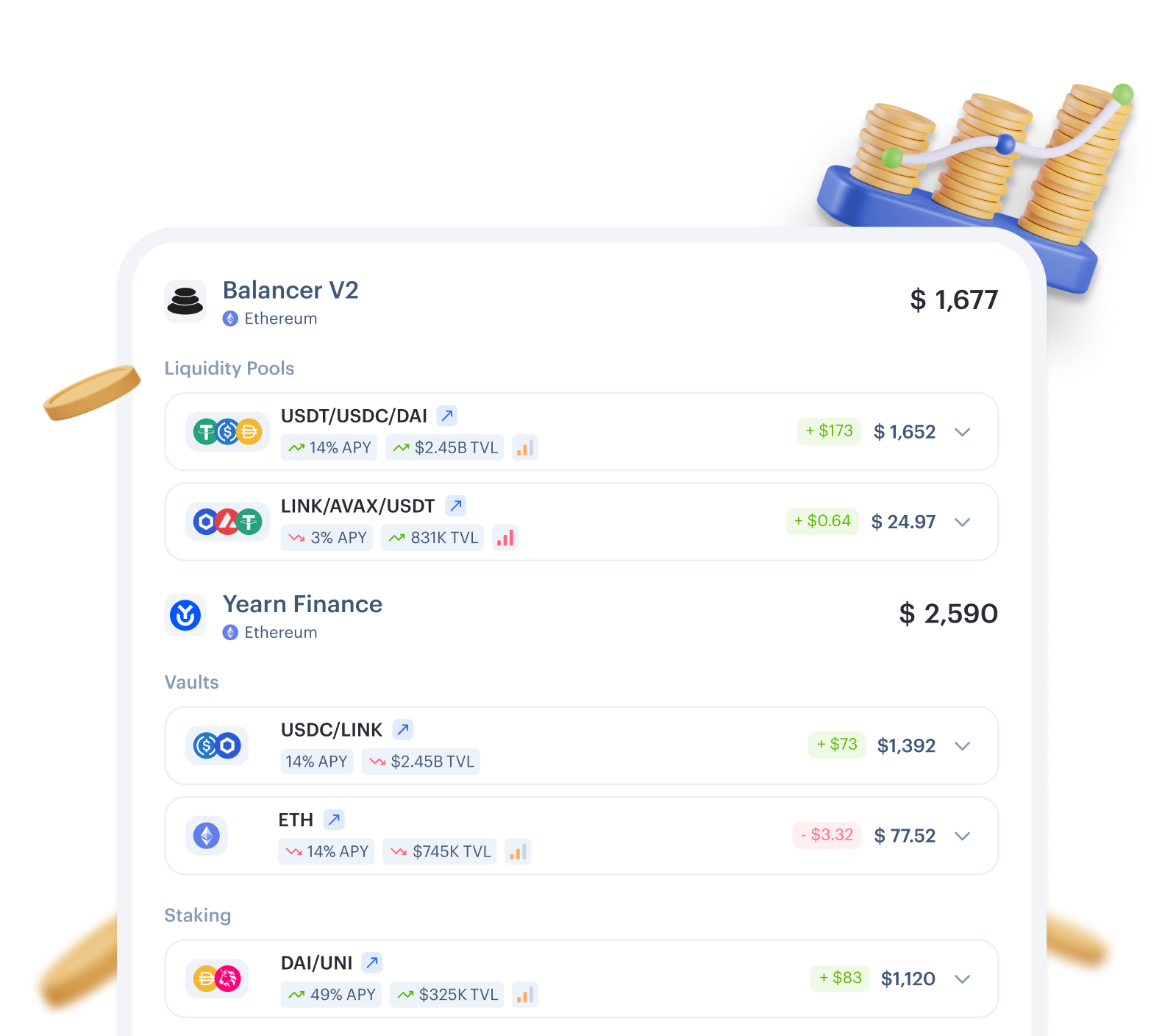

Profit and Loss Calculator

DeFi calculator to check on how profitable your current investments are.

Learn More

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started