Yearn Finance Protocol Stats

$ 301.5M

Total TVL Across All Supported Networks

Medium Risk

Generally considered as balanced risk-reward investment

Passive

Control-free. Hold & Earn.

48.73%

Average APY you can expect on Notum

How to Invest in Yearn Finance on Notum

In the finance world, the DeFi protocols play an important role by offering financial transparency and efficiency. They challenge the traditional banking system by providing a wide range of decentralized financial services. DeFi protocols have gained immediate popularity due to their ability to facilitate peer-to-peer transactions, automate complex financial processes, and remove the need for intermediaries.

One of the most remarkable and influential DeFi protocols is Yearn.Finance. This protocol is an example of how blockchain technology and smart contracts can be used to optimize yield farming and asset management. Thus, Yearn.Finance has garnered attention for its innovative approach to yield optimization and risk management. In this article from Notum, we will take a closer look at the Yearn.Finance protocol, explore how it has transformed the DeFi landscape, and pay attention to the way it works and the advantages it offers.

What Is Yearn.Finance?

Yearn.Finance is a decentralized finance protocol built on the Ethereum blockchain. It was created by Andre Cronje and launched in July 2020. Yearn.Finance aims to automate and optimize yield farming in the DeFi ecosystem.

Basically, Yearn.Finance is a yield aggregator that allows users to automatically and efficiently earn the highest possible returns on their crypto holdings by moving funds between different liquidity pools and lending platforms. The protocol uses a set of smart contracts and algorithms to find the best yield farming opportunities and execute transactions on behalf of users, saving them time and effort. Also Yearn.Finance has its native token, YFI, that allows users to participate in governance decisions and earn rewards for providing liquidity to the protocol. Thus, to put it shortly, Yearn.Finance is a DeFi project, offering a user-friendly way to maximize returns on crypto assets while minimizing the need for active management.

Why Was Yearn.Finance Created?

Yearn.Finance was created to solve several challenges and inefficiencies in the DeFi ecosystem. The primary goal behind its creation was to simplify and automate the process of yield farming, which involves moving crypto funds between various liquidity pools and lending platforms to earn the highest possible returns. Yield farming can be complex and time-consuming, requiring users to constantly monitor and adjust their investments to optimize yields. Yearn.Finance aimed to ease this process by using smart contracts and automated strategies.

Andre Cronje, the founder of Yearn.Finance, presented a DeFi ecosystem where users could maximize their earnings without the need for in-depth DeFi knowledge. Yearn.Finance achieves this by pooling user funds and employing complicated strategies to find the best yield farming opportunities across various DeFi platforms. This automation not only simplifies the user experience but also reduces the risk of human error. Besides, Yearn.Finance introduced the concept of yield farming vaults, where users can deposit their assets, and the protocol takes care of the rest, making it accessible to a broader range of crypto investors. The creation of the YFI governance token further empowered the community to make decisions about the protocol's direction and stimulated users to participate actively. Shortly, Yearn.Finance was created to democratize access to DeFi yield farming and make it more efficient and user-friendly.

How Does Yearn.Finance Work?

As Yearn.Finance aims to simplify and automate the process of yield farming and liquidity provision in the DeFi space, it offers a variety of products and services, including vaults, yCRV, veYFI, yBribe, and yETH.

- Vaults

Yearn.Finance's primary product is its vaults. These are smart contract-based strategies that automatically optimize the yield generated from various DeFi protocols. “The vaults use complex strategies to move funds between different protocols, such as Aave, Compound, and Curve, to maximize returns.” – Beincrypto. Users deposit assets into these vaults, and the smart contracts manage the assets by actively seeking the best yield opportunities across different DeFi platforms. The profits generated are then distributed back to vault participants.

- yCRV

yCRV is a token that represents the share of assets in the Curve Finance pool. Yearn's CRV strategy involves depositing stablecoins into Curve's liquidity pool, which allows users to earn trading fees and yield from providing liquidity to the pool. yCRV tokens can be minted by depositing stablecoins into the yCRV vault, and they represent a claim on a user's share of the assets in the Curve pool.

- veYFI

veYFI is a token that represents voting power within the Yearn.Finance ecosystem. To obtain veYFI, users need to lock their YFI tokens into the governance contract. Holding veYFI allows users to participate in on-chain governance decisions, such as proposing and voting on changes to the protocol.

- yBribe

yBribe is a governance tool within Yearn.Finance that allows users to participate in Yearn's governance proposals more effectively. Users can delegate their voting power to a specific address, known as a "Bribe" wallet. This allows for more strategic voting, as users can support a delegate who meets their interests and who can vote instead of them.

- yETH

yETH is a product offered by Yearn.Finance that allows users to earn yield on their ETH holdings. Like the vaults, the yETH strategy seeks to optimize yield by automatically depositing and managing ETH in various DeFi protocols. Users deposit ETH into the yETH vault, and the smart contracts do the rest, aiming to generate the highest possible yield.

The Advantages of Yearn.Finance

Yearn.Finance offers several advantages within the DeFi space:

- Automated Yield Optimization. Through its vaults, Yearn actively manages deposited assets, seeking the best yield opportunities across multiple DeFi protocols. This automation saves users the time and effort required to constantly monitor their holdings.

- Reduced Risks. Yearn's vaults are designed to reduce risk by diversifying assets across different DeFi platforms. This diversification helps to decrease the protocol's vulnerabilities or issues. This can lead to more stable returns compared to manually managing DeFi investments.

- Liquidity Provision. The yCRV product allows users to participate in Curve Finance's liquidity pools, earning trading fees and yield from providing liquidity to stablecoin pools. This can be an attractive option for users seeking passive income while maintaining access to stablecoins.

- Governance Participation. Holding veYFI tokens allows users to participate in the governance decisions of the Yearn.Finance ecosystem. This allows them to influence the platform's direction, propose changes, and vote on important decisions. Besides, yBribe facilitates more effective governance participation by allowing users to delegate their voting power to trusted addresses.

- Yield Generation. With yETH, users can earn a yield on their Ethereum holdings without actively managing their assets. Yearn's automated strategies aim to maximize yield while minimizing risk, providing a hassle-free way to earn on ETH.

- Decentralization. Yearn.Finance is built on Ethereum's decentralized blockchain, which means it operates without centralized intermediaries. Smart contracts handle most of the operations, and users have full control over their funds.

- Interoperability. Yearn.Finance is often integrated with other DeFi protocols, allowing users to easily move their assets and strategies between different platforms.

- Transparency. Users can track the performance of Yearn's vaults and strategies on-chain, allowing for real-time monitoring of investments.

YFI Token

YFI, or Yearn.Finance, is a cryptocurrency that was also launched in 2020 by Andre Cronje. YFI is the native token of the Yearn.Finance platform, that operates on the Ethereum blockchain and is governed by its community of users through a DAO.

One of the distinctive features of YFI is its unique distribution model. Unlike many other cryptos, YFI was not pre-mined or sold in an ICO. Instead, it was distributed to the platform's early users and liquidity providers, fostering a strong sense of community ownership. YFI holders can participate in governance decisions, such as proposing and voting on changes to the protocol and its parameters.

How to Use Yearn Finance?

To use Yearn.Finance, follow these steps:

- Connect to Yearn.Finance. Use a crypto wallet that supports Ethereum (ETH) and other compatible assets, such as Yearn.Finance operates on the Ethereum blockchain. Visit the Yearn.Finance website and connect your wallet to the platform. This will allow you to interact with the Yearn.Finance smart contracts.

- Deposit Funds. Once connected, you can deposit your ETH or other supported assets into Yearn.Finance Vaults or other yield-generating strategies. These Vaults will automatically seek the best returns for your deposited assets.

- Monitor Your Investments. Check your deposited assets and the returns generated by Yearn.Finance. You can withdraw your assets, including the generated yield, at any time.

If you hold YFI tokens, you can participate in the governance of the Yearn.Finance protocol by voting on proposals and changes to the platform.

Is Yearn.Finance Safe?

Yearn.Finance, like many DeFi platforms, operates in a decentralized manner, which means it relies on smart contracts on the Ethereum blockchain. The security of Yearn.Finance primarily depends on the quality of its smart contract code and the efforts of the development and auditing teams to identify and fix vulnerabilities. Over time, the protocol has undergone multiple security audits by reputable firms to enhance its safety.

However, no platform is entirely risk-free. Smart contracts can have vulnerabilities, that's why users should conduct thorough research before investing. It's also necessary to stay informed about any potential security updates or vulnerabilities associated with Yearn.Finance. Even though Yearn.Finance has taken steps to enhance its security and has a strong community, users should weight potential risks associated with the protocol.

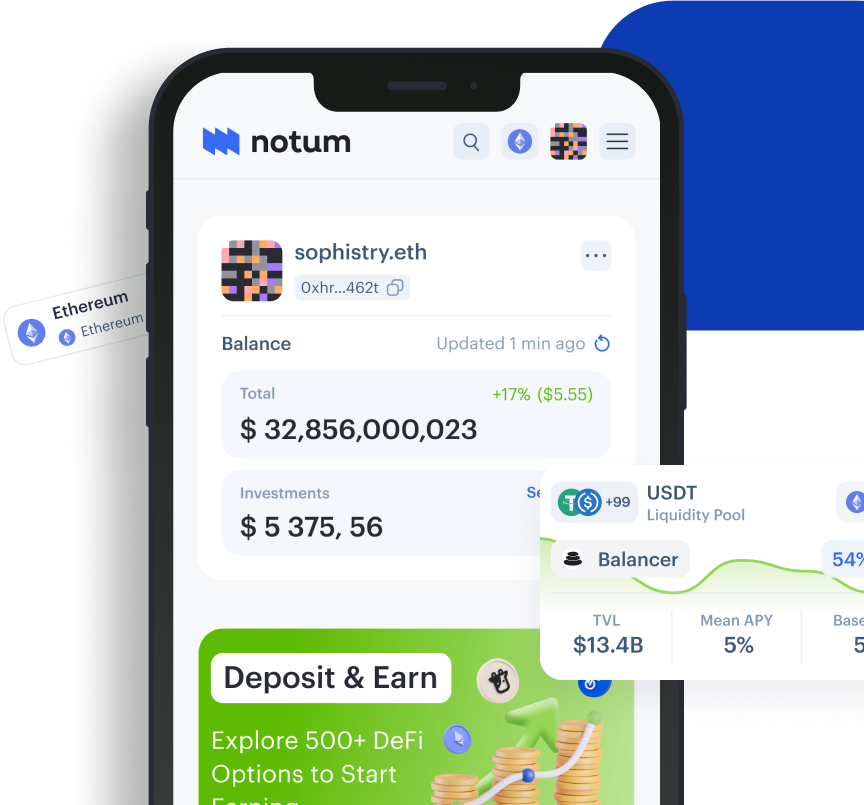

Try All Notum's Unique Features Without Log In

Cryptocurrency risks assessment, all-time gains insights and profit, and a loss calculator at your fingertips!

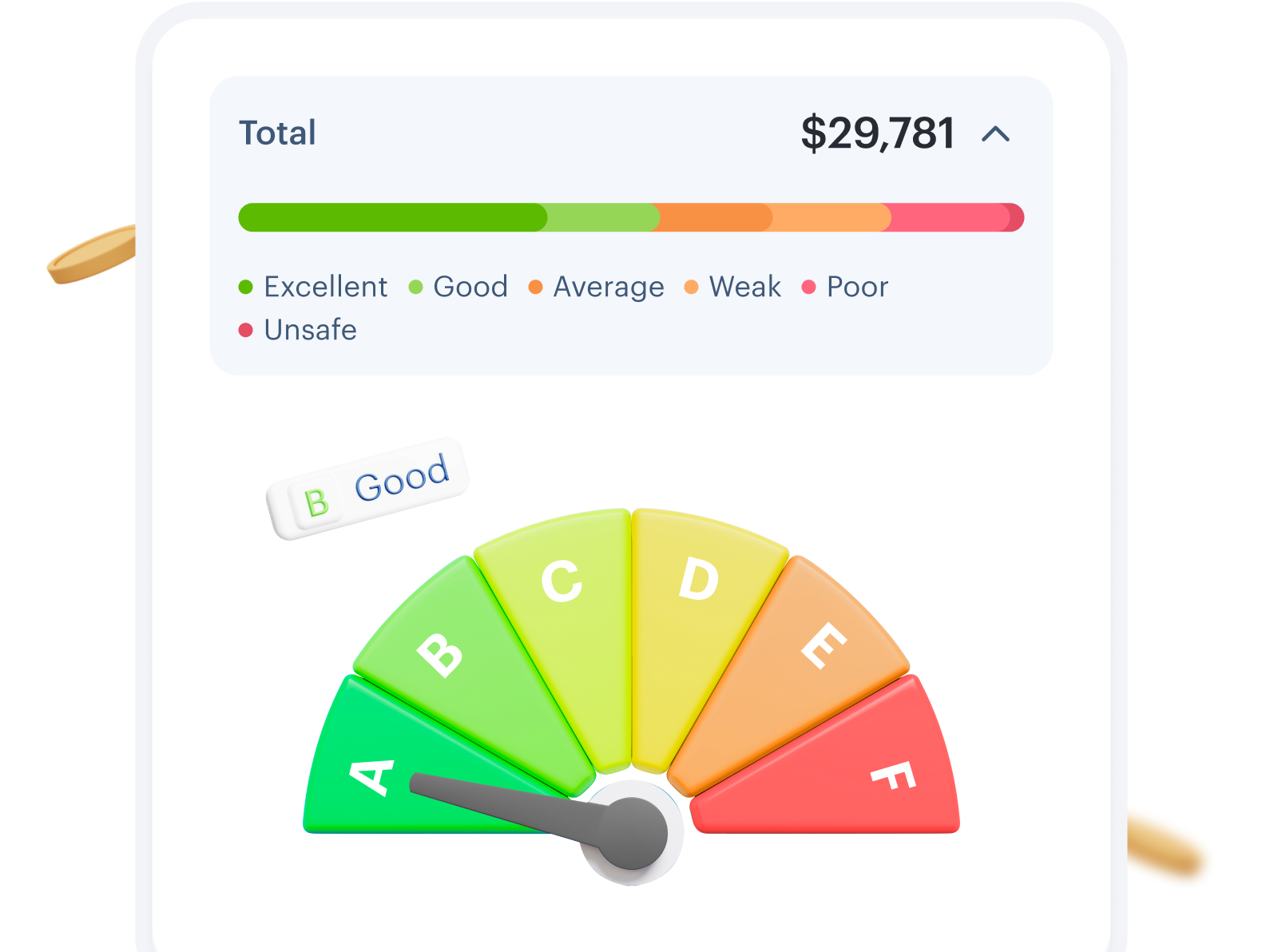

Wallet Risk Assessment

Get assessed crypto risks and helpful insights to control your investments.

Learn More

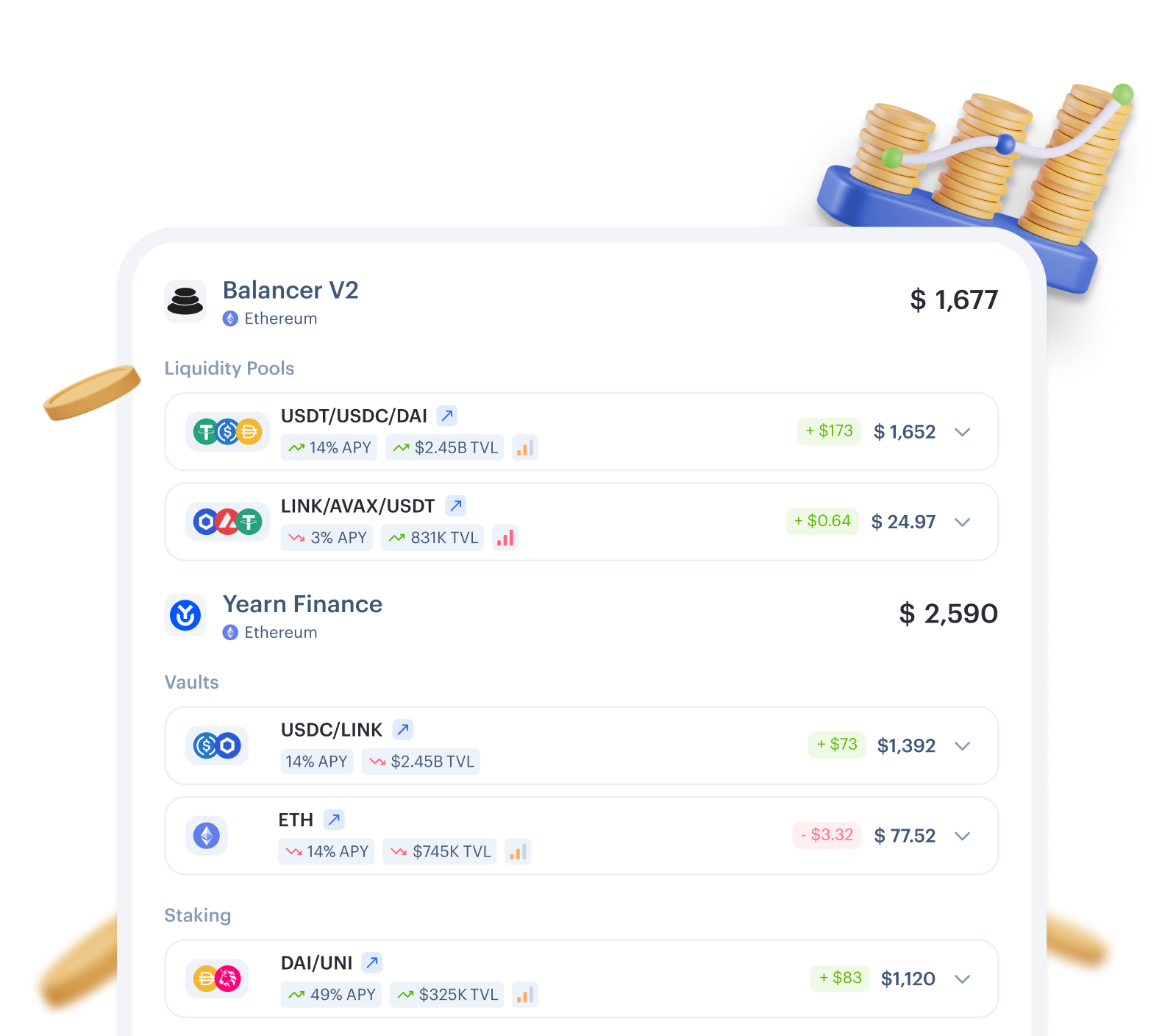

Profit and Loss Calculator

DeFi calculator to check on how profitable your current investments are.

Learn More

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started