Intro

In 2023, the DeFi space is almost impossible to imagine without yield aggregation since this strategy offers users maximum rewards from their crypto investments. Yield aggregation combines various smart contracts and strategies, puts user investments together, and automatically invests them in the most profitable projects.

Even though yield aggregators are similar in many ways, they are distinguished by the blockchains they support and the strategies they use.

Yield Yak is one of the most popular DeFi projects to increase yield from farming. Even though the platform only operates on two blockchains, it offers unique innovative features and high rewards. Today's review from Notum will help you understand how the Yield Yak DeFi platform works, what its main functions and tools are, as well as what networks and currencies it supports. In addition, we will talk about the risks of this yield aggregator and shed light on its native cryptocurrency YAK.

As interest in crypto investment strategies continues to grow, yield aggregation, as one of the most profitable, will continue to grow and develop in the future. Yield Yak, as one of the innovative platforms, will also continue to surprise users of the DeFi sector with its features and capabilities.

Yield Yak Platform: The Essentials

- TVL: $25,980,000

- Average APY: 5.13%

- Risk Level: Medium

- Blockchains: Avalanche, Arbitrum

- Foundation Date: 2021

Yield Yak is a platform that combines several products: namely auto-compounder, DEX aggregator, yield booster, and Avalanche liquid staking provider. In other words, this project offers various investment tools for DeFi users.

Initially, Yield Yak was a platform that operated only on the Avalanche network, but now the project also supports Arbitrum.

Yield Yak's innovation lies in its community-driven initiative, meaning its team independently supports the most diverse and accessible auto-compounders on the market. The Yield Yak community has also made it self-sufficient as it offers new methods and ways to improve the project. At the moment, Yield Yak farms can continuously exist without requiring team intervention.

Yield Yak works the following way: users contribute their assets to pools on the platform. Each pool is a farm that earns reward tokens, and then this farm reinvests the rewards. Thus, Yield Yak farms increase the deposit of each user, and each investor receives a high frequency of Yield Yak compounding.

Yield Yak auto-compounded yield farm rewards allow users to earn high rewards on their deposits.

At the moment, the platform provides users with several investment tools:

- Yak Swap. This feature allows you to perform swaps at the best price with just one click. In addition, Yak Swap independently takes into account all commissions and executes multi-hop routes. Currently, Yak Swap is not only the fastest DEX aggregator on Avalanche, but also constantly introduces innovative swap sources such as Woo Finance.

- Yak Pools. Yield Yak offers users a huge number of autocompounding pools allowing them to receive fairly high APYs. With Yield Yak, investors can earn rewards even on stablecoins such as USDC and USDT.

- Liquid Staking. Yield Yak also provides the option to receive native rewards without having to lock up funds from the Avalanche network. The average APR for liquid staking on the platform is 5.53%.

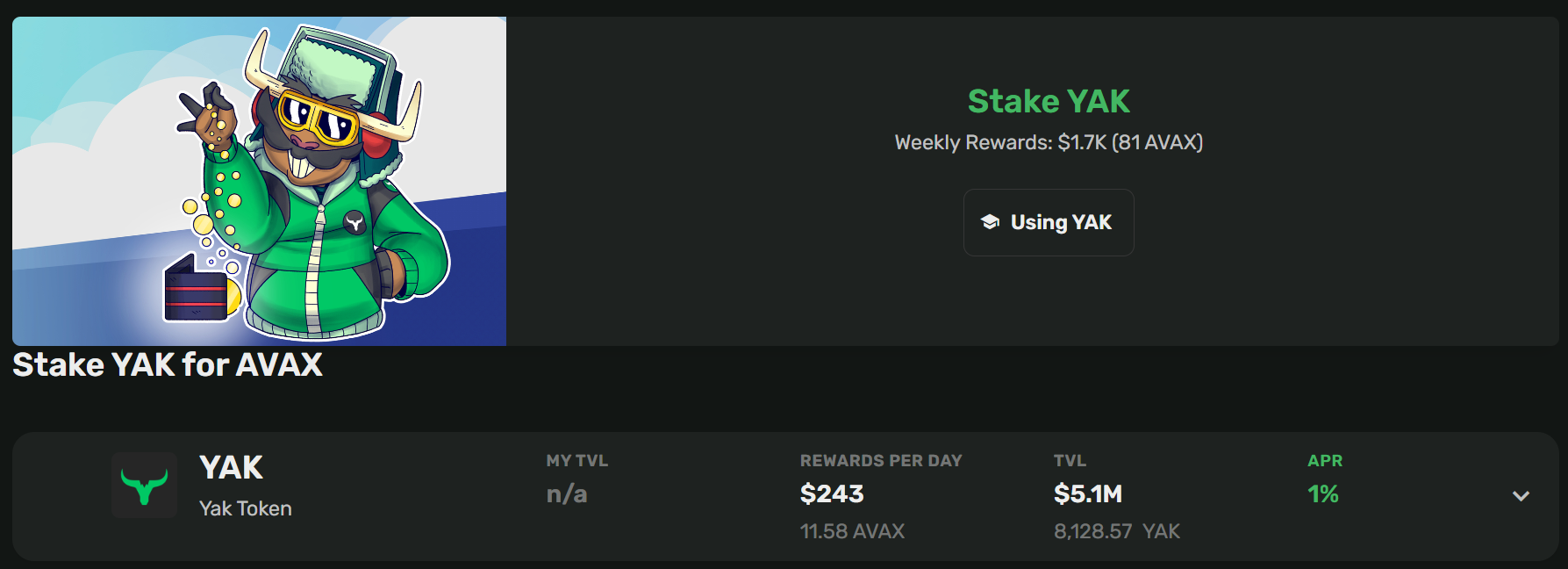

In addition to the above features of Yield Yak, holders of the native currency of the YAK platform can stake it and earn from platform fees.

Currently, the APY for staking YAK on the platform is 1.8%.

Source: Yield Yak

Why Invest in Yield Aggregation With Yield Yak?

Yield aggregation is an investment strategy that has a large number of advantages. Yield Yak, in turn, offers the following investment benefits:

- Automatic reinvestment. The platform helps users maximize profits by automatically reinvesting rewards received from farms. Thanks to this, Yield Yak investors receive income from the pools and rewards from reinvesting winnings.

- Innovative solutions. The platform's community has made it the best and most diverse yield optimizer. Now farms on Yield Yak automatically compound rewards, which saves the user time. Moreover, the Yield Booster on the platform's website allows you to get greater rewards using Yield Yak strategies than the user can get on their own.

- DEX Aggregation. Yak Swap on the protocol website offers users a one-click trade execution. Moreover, investors can also benefit from multi-step routes and low slippage.

“Yak Swap executes your swap at the best price with one-click, while querying all on-chain liquidity sources and taking into account gas costs, slippage, and swap fees.” - Yield Yak.

Investment Strategies on Yield Yak

As mentioned, Yield Yak offers a large number of different investment strategies. Today we will look at two popular options that you can use to make a profit on the platform:

AVAX on Benqi

Total APY – 3.7%, TVL - $4.55M

This investment strategy allows users to deposit AVAX into a pool to receive rewards in the form of AVAX tokens. Profit rates from farming can vary and are often between 3 and 4%. The way this strategy works is that it repeatedly lends and borrows AVAX to optimize the rewards as much as possible. Besides, depositing AVAX on Yield Yak is a low-risk strategy.

Source: Yield Yak

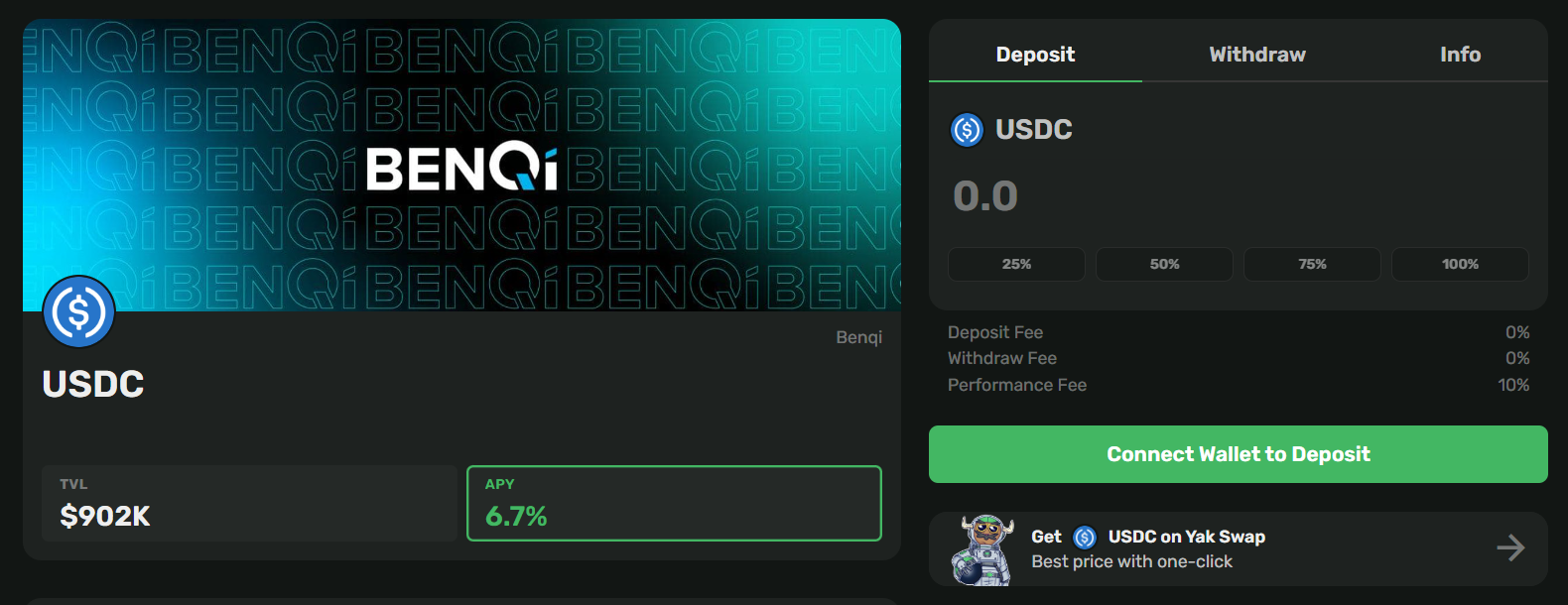

USDC on Benqi

Total APY – 6.7%, TVL - $905K

This strategy on Yield Yak allows users to earn rewards from stablecoin farming. By placing their USDC in pools, users can expect to earn an APY of 6 to 7%. This strategy also optimizes the rewards for the user by lending and borrowing the asset to get the most USDC as income. Even though USDC farming also has low risks, it brings quite high income.

In addition, in the Yak Pools tab, the platform allows users to explore the most popular pools on Yield Yak, the most popular pools for stablecoins, native AVAX, and recently added pools, which helps to easily navigate the site.

Source: Yield Yak

YAK Native Token I Tokenomics

- Circulating supply: 10,000 YAK

- Total supply: 10,000 YAK

- All-time high YAK coin price: $16,040

- All-time low YAK coin price: $185.38

Yield Yak platform has its own cryptocurrency called YAK with a total supply of 10,000 tokens. Users can stake this fixed-supply token to earn platform fees. The YAK tokenomics is quite unique in that no additional YAK tokens can be minted. As of December 1, 2023, the value of Yield Yak crypto is $611.89.

There are currently several ways to use YAK. For example, users can stake it on the platform to receive AVAX and ETH rewards. Investors can also deposit tokens to earn additional Yield Yak tokens.

Is Yield Yak Safe?

Despite that all DeFi platforms try to make their use as secure as possible, they all involve certain risks, and Yield Yak is no exception. The main ones are:

- Smart contracts. Yield Yak is a project that uses smart contracts from other platforms that it cannot control. Thus, these contracts may be unaudited and contain bugs and vulnerabilities that lead to loss of funds.

- Farms audit. The platform itself warns that although it partners with CoinFabrik to audit high-TVL strategies from time to time, not all of them are verified. This is why it is important to do your own research and pay special attention to new strategies.

- Farming risks. Also, before depositing money into Yield Yak, be aware of the known risks of yield farming, such as price volatility, protocol risks, security and regulatory risks, liquidity risks, and others.

Notum’s Verdict

Yield Yak is a fairly popular DeFi platform aimed at increasing yield from farming. With a TVL of over $25 million and a medium risk level, Yield Yak offers various investment tools for DeFi users on two networks - Avalanche and Arbitrum. On the platform, users have access to Yak Swaps, Yak Pools, and liquid staking to receive fairly high rewards. Yield Yak works by reinvesting user rewards earned from farming their tokens, thereby providing investors with maximum rewards. The uniqueness of Yield Yak lies in its community, which has made it the most diverse and accessible auto-compounder on the market.

The platform's investment strategies provide users with regular rewards that vary by network, asset, and platform. The most profitable liquidity pools such as LYD-AVAX can bring the user APY up to 59.5%.

Overall, Yield Yak is a convenient platform with a user-friendly interface that can help the user maximize profits from farming which will likely continue to gain popularity due to its innovative solutions, automatic reinvestment, and wide range of pools for providing liquidity with high APY.

Follow Us on Socials

Website | DApp | Twitter | Discord | Telegram | Mirror | DeBank

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.