DeFi Lending in Numbers

$25B

Total TVL Across All Supported Networks

Low Risk

Generally considered as a low risk investment

Passive

Control-free. Hold & Earn.

19.18%

Average APY you can expect on Notum

How to Invest in DeFi Lending on Notum

2023, as expected, has seen another surge in interest in DeFi, which also affected the adoption of blockchain technology in financial applications. The enormous popularity of DeFi protocols has led to the fact that now they have more than $20 billion locked, which directly highlights the bright future of decentralized finance. Interest in DeFi has influenced many areas, including DeFi lending, which allows users to receive fairly high rewards for lending their assets. Today's review from Notum will help you understand the world of DeFi lending, pay attention to its pros and cons, and explore the platforms and investment strategies that you can use to profit from your crypto assets.

How to Invest in DeFi Lending on Notum

DeFi lending is part of the cryptocurrency ecosystem, which appeared on the market relatively recently, but already has quite a lot of popularity and recognition in the crypto community. These types of DeFi loans provide users with the opportunity to lend their cryptocurrency and earn a profit for it.

DeFi lending is the provision of loans on decentralized platforms, where some users can borrow assets for their own purposes, while others earn interest on the coins provided.

Decentralized finance lending is a lot like traditional lending, where some people deposit money into a bank at interest, and others borrow that money from the bank. The difference between DeFi lending is P2P decentralized applications that provide transparency and security. Thus, DeFi lending platforms provide users with the opportunity to borrow and lend funds, which allows investors to receive interest on their crypto assets.

This type of investment is popular among crypto users and investors as it provides a transparent, open-source financial environment that does not require permission.

- User Involvement: Low

- Potential Returns: Conservative

- Automated or not: Automated

- Potential Risks: Smart-Contract Risks, Protocol Changes

- Key Features: Earning interest

- Common Platforms: AAVE, Compound, Venus, Maker DAO

How Do You Earn with DeFi Lending?

Since DeFi lending is in many ways similar to traditional lending, the principles of its operation are quite simple and easy to understand. It uses a trustless approach to provide crypto loans, which means users independently lock their assets on the DeFi platform without the need for an intermediary. Borrowers, in turn, can also independently choose a DeFi loan on a decentralized platform, relying on P2P lending.

DeFi lending allows users to act as a lender and provide their crypto assets to those in need, without having to interact with third parties like banks and share their profits with them.

Thus, a user who doesn’t use his crypto assets can lend them to another user and accrue interest on a loan, thereby making a profit. This happens thanks to lending pools, where users deposit their funds for subsequent distribution among borrowers using smart contracts.

Source: Appinventiv

Why Invest in DeFi Lending?

DeFi lending is undoubtedly an important part of the decentralized finance sector, as it allows users to seamlessly lend and borrow crypto assets without third parties. Besides this, this investment strategy is a great way to earn interest on your crypto that you are not going to use for some time.

DeFi offers much faster loans than traditional lending if the user meets all the necessary requirements.

Overall, this investment strategy offers users a lot of benefits and does not require active involvement in the process, so it is good for both beginners and experienced investors.

Pros

Speed

DeFi loans are processed as quickly as possible, which means users can access their funds immediately after loan approval. This speed is achieved since crypto lending platforms operate on cloud services, capable of detecting fraud and reducing other risks of decentralized finance.

Transparency and security

Since the blockchain is decentralized, it ensures the authenticity of all transactions and can also be verified by any user on the network.

Availability

The permissionless nature of decentralized finance allows virtually any user with a crypto wallet to get access to lending and other DeFi apps.

Cons

Risk of smart contracts

Like any DeFi applications and platforms built on smart art contracts, DeFi lending services also have the risk of bugs and vulnerabilities.

Scalability

DeFi transactions may take some time to confirm, while protocol transactions may become more expensive during the congestion period.

Human factor

Since DeFi lending works without intermediaries, the user is responsible for his decisions and deposited funds. Thus, if an investor makes a mistake, the DeFi platform is not responsible for it.

In today's article from Notum, we will look at two DeFi lending protocols - Venus and Compound. We'll take a look at their distinctive features, potential rewards, and the investment decisions these platforms are worth considering in 2023.

DeFi Lending with Venus

Venus is a community-driven decentralized protocol that, according to its official website, provides best-in-class functionality for various cryptocurrency markets. This DeFi lending protocol runs on the BNB Chain and allows users to offer and receive cryptocurrency loans.

- TVL: $778,470,000

- Risk Level: Low-Medium

- Blockchains: BNB Chain, the Binance Smart Chain

- Foundation Date: 2020

Venus lending protocol is a permissionless algorithmic money market that allows users to receive cryptocurrency loans at low-interest rates. Lenders who provide their assets to the DeFi lending pools receive rewards without involving an arbitrator.

Pros

Possible high income

Depending on the pool and asset chosen, users can receive relatively high rewards compared to banks and other traditional financial institutions.

Decentralization

Venus integrates traditional financial services into decentralized blockchain-based protocols, making the lending process secure without involving third parties.

Automated interest

DeFi lending interest rates on the platform are automated and depend on the requirements of a particular crypto market. However, during the protocol governance process, minimum and maximum interest rate levels are set.

Diversity of assets

The Venus Protocol supports a fairly large number of assets available for collateral and lending.

Cons

Smart contracts risk

Since DeFi projects like Venus use smart contract systems, they can be prone to bugs and vulnerabilities, which can lead to loss of funds.

Volatility

Crypto assets used as collateral or lending assets are often quite volatile, which can also lead to some losses.

Difficulty of usage

The large number of pools, assets and opportunities on Venus can confuse newcomers and lead to mistakes that will affect their investments.

Why Invest in Venus?

Venus is a low-to-medium risk decentralized lending protocol that offers lending services with the ability to receive and provide cryptocurrency at interest. Potentially high passive income and asset diversity make the platform a good choice for crypto users looking to invest in DeFi lending.

Venus offers users loans at low-interest rates while investors receive automated rewards.

DeFi Lending with Compound

Compound is a decentralized, blockchain-based protocol that allows users to lend and borrow crypto assets. Compound operates on the Ethereum network and works as a decentralized app.

- TVL: $2,366,000,000

- Risk Level: Medium

- Blockchains: Ethereum, Polygon, Arbitrum, Base

- Foundation Date: 2017

The compound supports 4 networks and allows any user who owns cryptocurrency to send, lock, deposit and lend crypto assets for any amount. This decentralized blockchain-based protocol locks the user's cryptocurrency in the Compound wallet, after which liquidity provider immediately starts earning rewards.

“The interest you earn is denominated in the same token that you lent.” – Gemini.

Investments Strategies on Compound

This investment strategy allows users to deposit their USDC assets on Polygon to receive passive rewards that often range from 11% to 12% APY.

Another well-known investment strategy on Compound allows users to invest USDT on the Ethereum network to earn rewards. The average APY for depositing a given stablecoin is often between 8% and 9%.

Pros

Supports various blockchains

The Compound platform currently supports Ethereum, Polygon, Arbitrum and Base networks, which provides users with more investment opportunities.

Safety

Compound calls itself “the most secure protocol for money” as the platform is audited and verified by multiple projects, such as Open Zeppelin, Trail of Bits and Certora. In addition, the protocol has a Bug Bounty Program, which encourages the community to review contracts, security, and identify problems.

Its own app

The platform offers users a convenient application where they can connect a wallet and get access to the dashboard, markets, extensions, and vote tabs.

Cons

Risk of smart contracts

As is known, platforms running on smart contracts may encounter bugs and vulnerabilities that could potentially lead to the loss of funds.

Difficult to use

Since Compound operates on 4 blockchains across 8 markets, it can be quite difficult for beginners to understand the structure of the platform and how to use it.

Market risks

DeFi interest rates on Compound are largely dependent on the market and are therefore notoriously volatile, which is often reflected in the lending or borrowing returns.

Why Invest in Compound?

Compound is a popular decentralized protocol with a moderate level of risk, which over 6 years of existence on the market has earned a good reputation and recognition from the community. It offers users lending and borrowing services with favorable interest rates. Investors, in turn, receive relatively high passive income without actively engaging in lending, which is why this platform can be a good option for both borrowers and lenders.

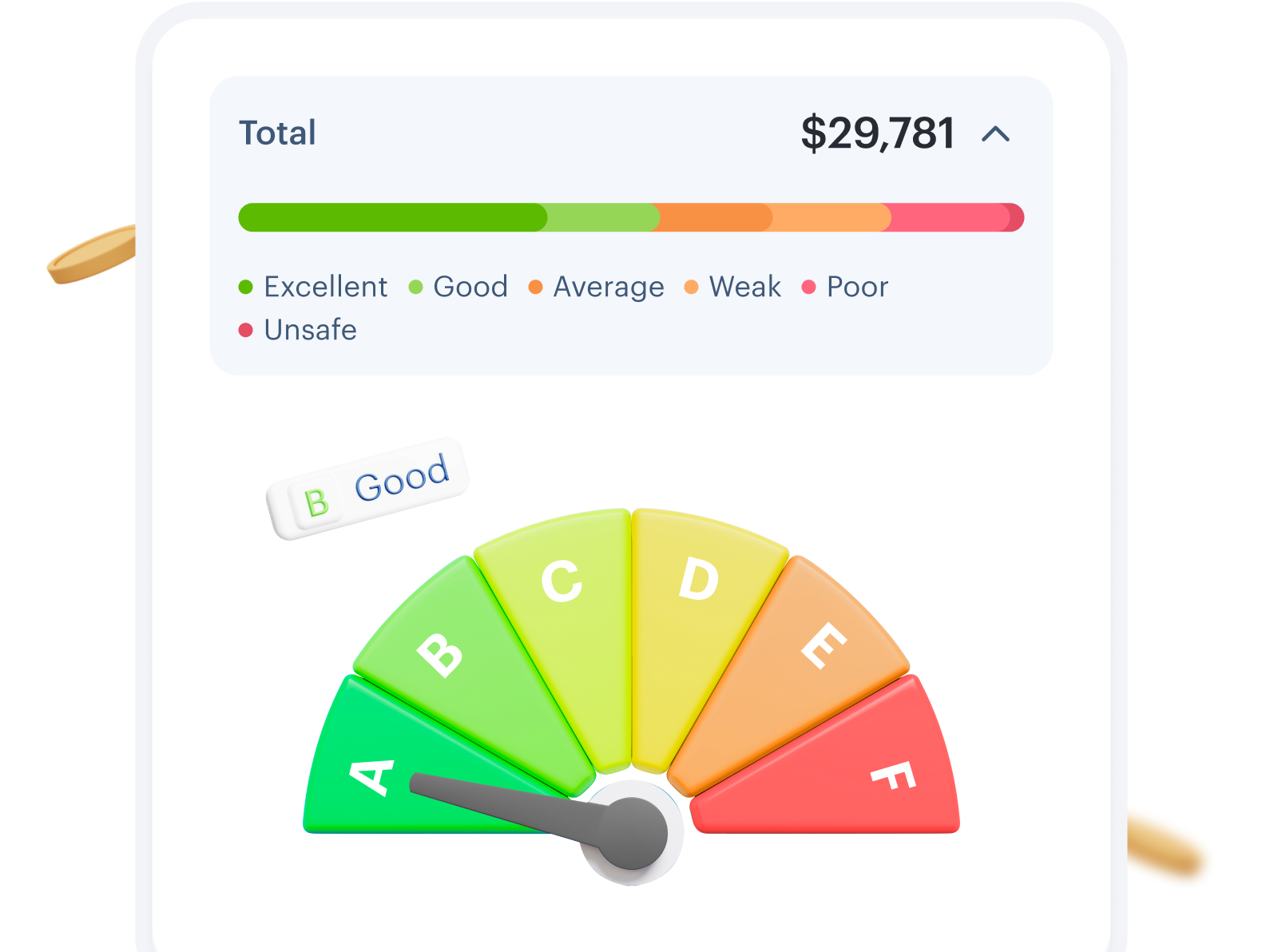

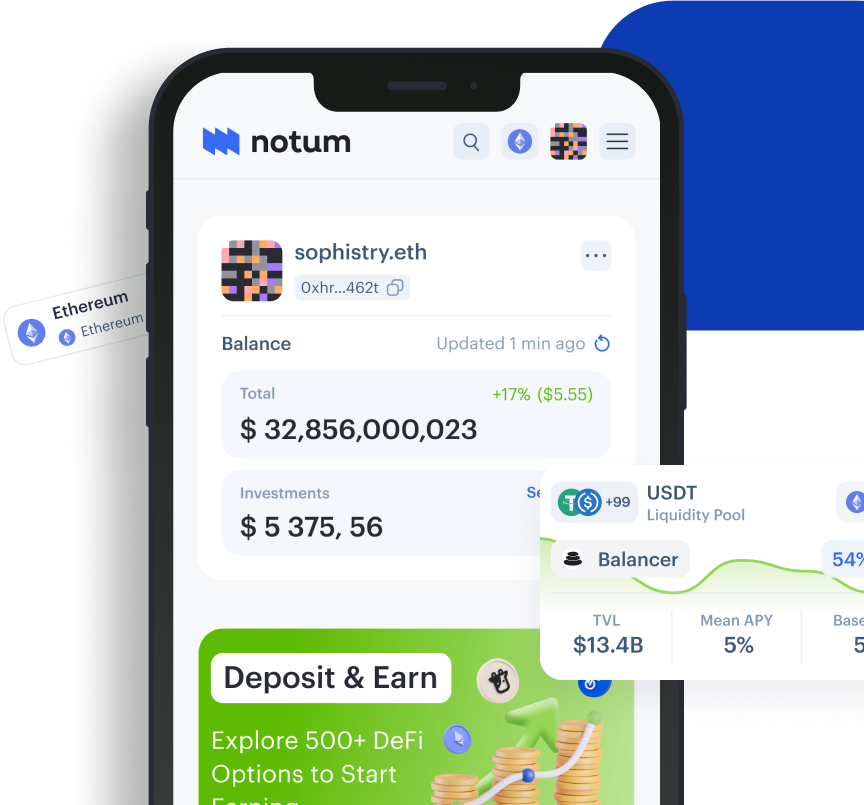

Try All Notum's Unique Features Without Log In

Cryptocurrency risks assessment, all-time gains insights and profit, and a loss calculator at your fingertips!

Wallet Risk Assessment

Get assessed crypto risks and helpful insights to control your investments.

Learn More

Profit and Loss Calculator

DeFi calculator to check on how profitable your current investments are.

Learn More

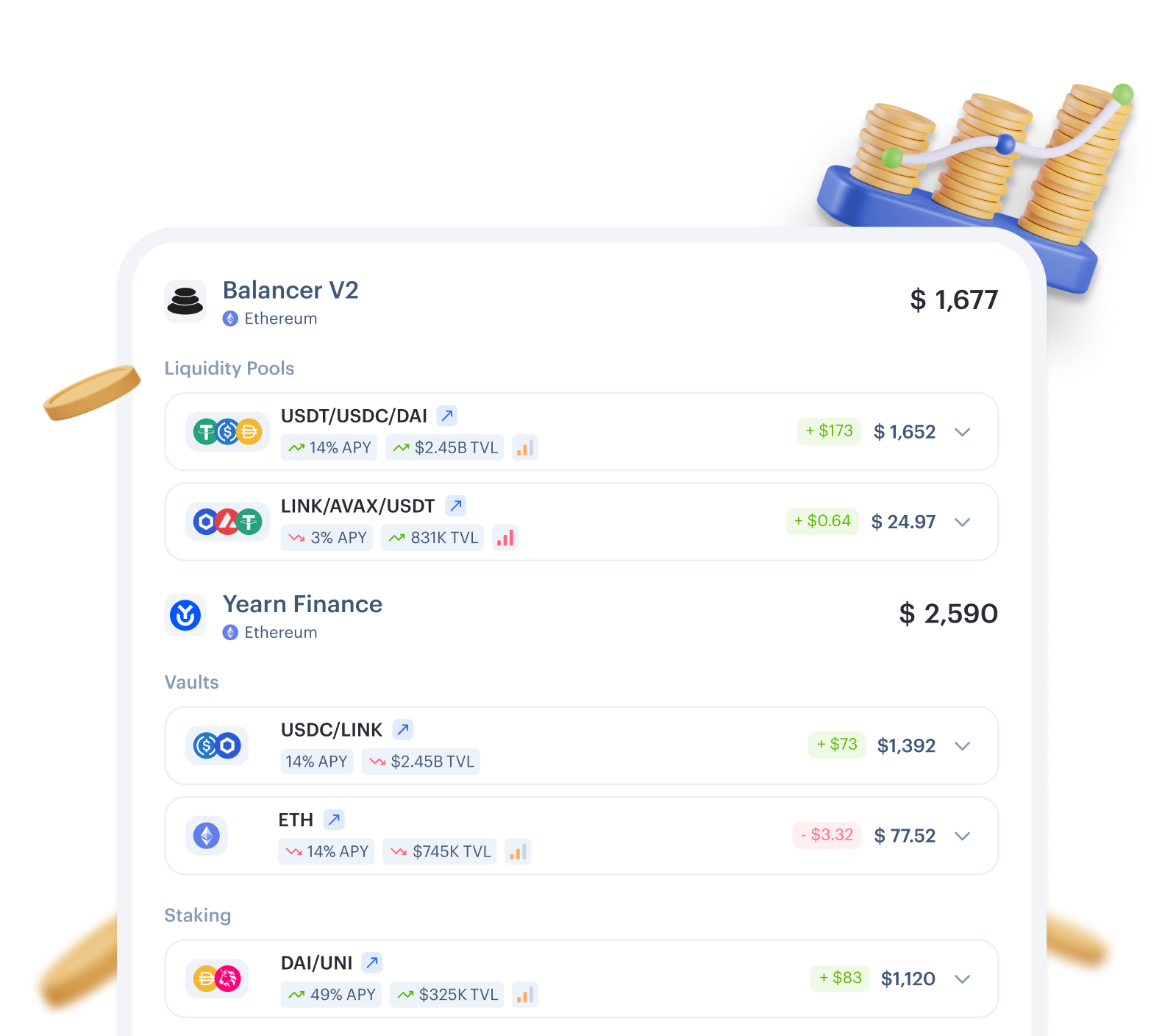

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

What is DeFi lending?

DeFi lending can be described as providing loans on decentralized platforms. While some users can borrow cryptocurrency against collateral, investors lend out their assets to earn rewards.

2.

How does DeFi lending work?

Liquidity providers deposit their crypto assets into liquidity pools and receive interest for it, while other users borrow money from there at a low interest rate for their personal needs.

3.

What are the risks of DeFi lending?

The main risks of DeFi lending include the risk of smart contracts, protocol changes, market volatility, etc.

4.

How do DeFi lenders make money?

Investors make money due to borrowers who take their assets from the liquidity pool at a certain interest rate. Thus, the liquidity provider who deposits his cryptocurrency receives a passive reward for providiing assets to DeFi lending platform.

5.

How can one get a loan from DeFi?

The user can visit any DeFi lending platform, such as Compound or Venus, connect a wallet and take out a loan secured by their own cryptocurrency at a low interest rate.

6.

What are the popular DeFi lending protocols?

The most popular DeFi lending protocols include AAVE, Compound, Venus, Maker DAO and others.