Liquid Restaking Investments

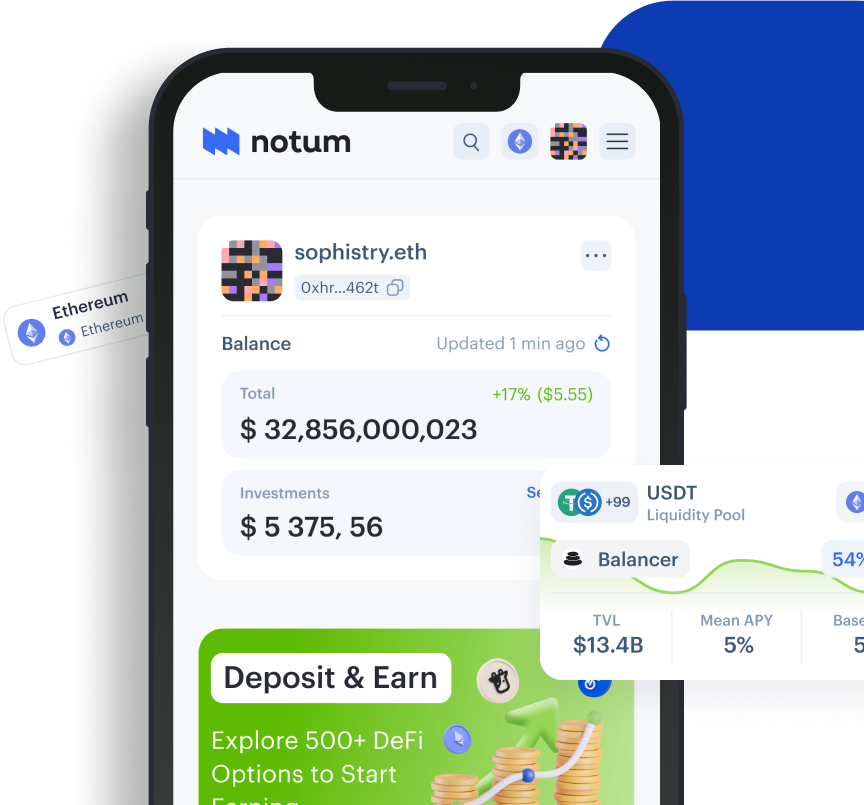

Delve into liquid restaking with Notum

Working with the best in industry

Swell

Liquid Restaking in Numbers

$10,44B

Total TVL Across All Supported Networks

Medium Risk

Generally considered as balanced risk-reward investment

Passive

Control-free. Hold & Earn.

3.02%

Average APY you can expect on Notum

How to Invest in Liquid Restaking on Notum

In 2024, more and more people are exploring different investment strategies to earn passive income through cryptocurrency. DeFi market now offers a huge number of investment opportunities that allow users to deposit their crypto assets into projects and protocols for profit, and staking still remains one of the most popular.

As investment opportunities grow and develop year after year, staking has also evolved and now offers various ways to generate income, such as liquid staking and restaking. Each of these options has its own advantages and offers passive rewards to liquidity providers.

Staking VS Liquid Staking: the Difference

To invest in restaking, it is important to understand the basics of another popular type of investment - staking, which offers users a stable income in return for providing liquidity. Traditional crypto staking is the process of locking assets for a certain period to maintain blockchain technology and its security.

Staking rewards are generated by using provided assets to power various platforms and DeFi applications. As a reward for providing cryptocurrency, users receive passive income in the form of additional tokens.

Interesting fact: Although staking brings yield and helps contribute to the security of the network, you will not be able to use the staked assets during the lock-up period.

Liquid staking, in turn, can be called an evolved version of staking that offers some significant advantages. While in traditional staking, when assets are locked, the user cannot use them, liquid staking solves this problem.

By investing in liquid staking, users receive additional tokens that can also be used for other activities in DeFi world. Thus, this type of investment allows liquidity providers to use their assets despite the lock-up period. More detailed information about staking and liquid staking can be obtained on Notum.

How to Invest in Restaking

As the name says, restaking is a process of staking cryptocurrency again after the initial staking. Thus, while restaking, the staked asset is available for staking on other platforms, which increases the utility of provided liquidity.

Restaking also offers investors additional rewards and a greater contribution to the security of the blockchain. Thus, restaking allows users to stake the same coins on both the main network and other protocols, while simultaneously ensuring the security of all these networks.

«Restaking protocols make it possible for other decentralized protocols to utilize staked assets on Ethereum to improve their own security» - CoinGecko.

- Risk Level: Medium

- User Involvement: Low-Medium

- Potential Returns: Moderate

- Automated or not: Mostly Automated

- Potential Risks: Slashing, Market Volatility, Network Performance

- Key Features: Improved Rewards, Flexibility, Scalable Security

- Common Platforms: EigenLayer, Octopus Network, Ether.fi, KelpDAO, Pendle, Puffer Finance

Why Invest in Restaking?

Restaking is an important part of the DeFi sector because, like staking, it not only provides liquidity to platforms and protocols, but also contributes to the security of the blockchain.

Pros

Passive income

By investing in restaking, users can earn passive rewards without actively participating in the process, which is good for both beginners and experienced liquidity providers.

Additional rewards

Since assets already involved in staking are used during restaking, investors receive double profits and get the maximum benefit from providing cryptocurrency, which results in increased utility.

Contribution to network security

By investing in staking and restaking, liquidity providers help secure blockchain technology and contribute to the development of decentralized finance world.

Staked tokens are available

Despite the fact that assets are locked during the staking period, restaking solves this problem and allows to kind of get rid of of lockup. Thus, despite the locking, investors can benefit from the same assets through restaking.

Cons

Market volatility

Since crypto market is known to be volatile, the price of the deposited asset may change during the staking process. Therefore, depending on market conditions, investors may be subject to some losses.

Smart contract risk

Since DeFi platforms and protocols operate on smart contracts, any vulnerabilities and bugs can lead to the loss of funds invested in restaking.

Slashing

In exchange for increased rewards, restaking entails additional slash conditions. Thus, depending on the selected protocol for restaking, slashing can lead to the loss of the assets provided.

If you are looking to invest in restaking and are looking for a suitable platform, EigenLayer, and Swell could be great options in 2024. Below, Notum will introduce you to these platforms and tell you about the strategies that you can use to get income.

Restaking with Eigen Layer

EigenLayer is a restaking protocol built on the Ethereum blockchain that uses actively validated services (avs) shared security to hyper scale Ethereum, which means new projects can also use the security of this blockchain.

«By incorporating restaking as a new primitive, EigenLayer empowers users to actively borrow Ethereum’s security offerings and validate new applications on the network» - Medium.

- TVL: $11,242b

- Risk Level: Medium

- Blockchains: Ethereum

- Foundation Date: 2021

EigenLayer’s restaking allows users staking ETH to participate in expanding network security for various applications in the DeFi world through its dynamic approach. The protocol incentivizes users to expand the robust ecosystem and thereby encourages the adoption of new apps on the Ethereum blockchain.

Source: Messari

At the moment, EigenLayer offers users native restaking and liquid restaking. To participate in native restaking, the user must be an Ethereum node operator and set validator's EigenLayer's smart contracts known as EigenPod.

EigenLayer Strategies Overview

EigenLayer’s restaking pools currently offer users one native restaking option and 12 liquid restaking opportunities. However, according to the official EigenLayer website, “Liquid Restaking deposits are currently paused”.

This investment strategy has a TVL of more than $1.2 million and allows users to restake ETH (rsETH) on Beacon Chain to receive rewards. In order to get started, the investor needs to create an EigenPod, change validator withdrawal credentials to EigenPod address and connect one of the proposed wallets - Metamask, Coinbase Wallet, WalletConnect and OKX Wallet.

EigenLayer and Its Strategies: Pros & Cons

Pros

Native and liquid restaking options

The protocol allows users to participate in both native restaking on Beacon Chain and liquid restaking. At the moment, EigenLayer offers one native and twelve liquid restaking options.

Staking ETH on several protocols

EigenLayer’s restaking allows users to utilize staked ETH across multiple protocols at once. This applies to both natively staked ETH and liquid staked tokens.

Multi-layer rewards system

Protocol’s validators and stakers receive rewards not only from the base layer of originally staked assets, but also from other layers or apps that benefit from restaked security. Thus, a multi-level reward system increases profitability and utility of the staked assets.

Improved security

By leveraging EigenLayer's robust base-layer blockchain security mechanisms, the security of additional layers and applications is also enhanced.

Cons

Security risks

Since users contribute to the security of multiple layers and projects during restaking, this increases security risks that should be taken into account before investing.

Liquidity issues

By providing crypto assets to multiple platforms at the same time, it may be more difficult for the user to relocate or withdraw them when necessary.

Profit fluctuations

The value of restaking rewards may vary depending on several factors, such as the security of the project, market conditions, changes in the reward structure, and so on.

Why Invest?

With EigenLayer, as the most popular restaking protocol, users not only receive additional income through the multi-layer rewards system, but also contribute to the security of several projects at once. As the clear leader in the restaking market with over $11.2 billion in TVL, EigenLayer is a great platform for maximizing your profits.

Liquid Restaking with Swell

Swell is a non-custodial protocol that was created to provide users with the best options for liquid staking and restaking. Thus, Swell simultaneously strives to make it easier for users to access the world of DeFi and provide the opportunity to earn high passive income.

- TVL: $1,095b

- Risk Level: Medium

- Blockchains: Ethereum

- Foundation Date: 2021

By investing in Swell, users get access to various staking and restaking options on Ethereum and earn not only blockchain rewards, but also additional restaked AVS profits.

In the case of restaking on the platform, the assets deposited by ETH holders are combined into a restaking pool and transferred to node operators. By restaking ETH on Swell, users receive rswETH ERC-20 liquid restaking token (LRT).

«It is a repricing token that represents a user's yield-bearing ETH that is being used by validators that attest to transactions on the Ethereum blockchain» - Swell Network.

Swell Strategies Overview

As stated, Swell offers ETH holders both staking and restaking options. Let's look at two strategies that will help you get passive rewards by investing in Swell.

https://app.notum.ai/investments/0xf951E335afb289353dc249e82926178EaC7DEd78?protocol=Swell&chainId=1

This investment strategy on Notum allows users to receive rewards through liquid staking on Swell. By depositing SWETH on Ethereum network, investors get a total APY of 3.77%. Since the pool has a TVL of more than $979 million and has low level of risk, it is quite safe for investment. Tokens received from liquid staking with Notum can also be used for liquid restaking. More information about the interaction between Swell and Notum can be found in this article.

Source: Swell’s X account

Another opportunity to receive rewards on Swell is by restaking ETH. By depositing their assets to the protocol, users receive rswETH with an exchange rate of 1 rswETH = 1.003 ETH. The total APY for providing liquidity on the platform is 3.77%, and the transaction fee is $34.11 USD.

In addition, the protocol has an Earn tab, where users can deploy their swETH tokens across the while Swell ecosystem. For example, the token can be used for providing liquidity, restaking on EigenLayer, minting stables and etc. All earning opportunities with Swell can be explored here.

Swell Network and Its Strategies: Pros & Cons

Pros

No minimum stake

Usually setting up a validator node on Ethereum costs 32 ETH, which is too large an amount for many users to deposit independently. Swell, in turn, allows any ETH holder to benefit from staking.

Higher yields

Swell allows users to not only stake but also benefit from DeFi capabilities in just one platform. Thus, by staking or restaking their crypto assets on Swell, users receive liquid swETH or rswETH which can be used in DeFi as they wish.

Full self-custody

While staking on centralized platforms requires users to hand over their assets, this can potentially result in loss of funds. However, by using self-custodial staking on Swell, investors can store ETH in their crypto wallets and still receive rewards.

Best node operators

Since incorrect and malicious behavior of node operators can lead to confiscation of funds, Swell’s staking pool is managed by top-notch specialists with the necessary skills to prevent problems.

Cons

Platform's complexity

Although Swell has a simple and user-friendly interface, it can still be problematic to understand. Since it offers vaults, staking and restaking options, and a yield tab, it can be difficult for an inexperienced investor to figure out the ecosystem’s operation.

Smart contract risk

Despite regular smart contract audits and running bug bounty programs, there is still a risk that Swell smart contracts may contain bugs and vulnerabilities.

Penalties and slashing

Validators run by node operators may face the risk of penalties and slashing by the Ethereum Beacon Chain. Thus, missed attestations or fulfilling a slashing condition could put a large portion of staked ETH at risk.

swETH price change

When markets are oversupplied with the swETH token, its price on secondary markets may fluctuate below the price of ETH, leading to the loss of funds.

Why invest?

Swell Network is a fairly popular staking and restaking option, offering users a large number of advantages such as best node operators, full self-custody for keeping assets safe, and no minimum ETH stake, which is a big plus for those who do not own 32 ETH. Although the platform is sometimes complex to use and has some risks, it is still a great option for staking and restaking ETH in 2024.

Notum’s Verdict

Restaking is a fairly popular type of investment among those who are already staking their crypto assets and seek to maximize their utility and profits. It has a large number of benefits, such as extra yield in addition to staking rewards, contribution to network security, and the ability to use assets that are already put to work.

With its moderate level of risk, restaking still has some disadvantages such as slashing mechanism, market volatility, network performance and smart contract risk, which are worth keeping in mind before investing. Eigen Layer and Swell Network are two popular restaking platforms, each of which has its distinctive features and risks that are important to keep in mind. Moreover, the market now offers many other protocols for restaking, such as EtherFi, Kelp DAO, Pendle and others.

However, if you are staking cryptos and want to maximize their profit through restaking while also improving network’s security, this type of investment will be a good option for you and bring decent passive income in 2024.

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

What is restaking?

Restaking is a process of staking cryptocurrency that is already used for initial staking, allowing users to earn additional rewards and contribute to the security of the blockchain and multiple protocols at once.

2.

What are the differences between staking and restaking?

Staking is the process of locking crypto assets to maintain the operation of the blockchain and make a profit. Restaking, in turn, allows to use staked assets on the main network and other protocols, which results in greater utility and increased profit.

3.

What is liquid restaking?

Similar to staking, liquid restaking reuses cryptoassets already involved in liquid staking to make maximum profit. Unlike native staking, liquid staking provides investors with additional tokens that can also be used in the DeFi space to generate profits.

4.

What are the differences between LST and LRT?

LST is a liquid staking token that represents the staked crypto amount on PoS blockhain and allows people to participate in DeFi world while still staking the main asset. LRT or liquid restaking token, is a tokenized version of staked assets that investor gets after staking. This asset can still provide liquidity while the initial crypto is still staking.

5.

How restaking affects the security of protocols?

By investing in staking, users contribute to the security of the blockchain as their assets are used in DeFi and provide liquidity to various protocols and apps. Restaking makes an even greater contribution because tokens can be used across multiple platforms and protocols at once.

6.

What is the risk of liquid restaking?

The main risks associated with restaking and liquid restaking are slashing, market volatility, network performance and others, depending on the specific protocol.