Idle Finance Protocol Stats

$ 24.4M

Total TVL Across All Supported Networks

Medium Risk

Generally considered as balanced risk-reward investment

Passive

Control-free. Hold & Earn.

10.34%

Average APY you can expect on Notum

How to Invest in Idle Finance on Notum

Interest in crypto investments is growing every year, and the beginning of 2024 was no exception. Now DeFi market is larger than ever and offers various passive income options, where yield aggregation is one of the most popular.

Yield aggregator is a set of smart contracts that combines user-deposited cryptocurrency and invests it in profitable projects using programmed, automatically executed strategies. Thus, yield aggregation combines various protocols and strategies to obtain maximum benefit from the liquidity provided.

This type of investment is quite popular among many investors as it does not require active asset managment. An investor only needs to deposit cryptocurrency to the selected yield automation platform, where vault’s smart contract will automatically move the assets to where they will bring the most rewards.

Now there are a huge number of platforms and protocols that function as yield aggregators, but they differ in the blockchains they support, smart contracts they use, rewards, and other functions.

Idle Finance: The Essentials

- TVL: $34,03M

- Average APY: 13.33%

- Risk Level: Low-Medium

- Blockchains: Ethereum, Optimism, Polygon, Polygon zkEVM

- Foundation Date: Nov, 2019

Idle is a decentralized protocol that uses DeFi world as a one-stop source of yield. The protocol allows investors to algorithmically optimize the allocation of their digital assets across leading DeFi protocols, leading to maximizing the return of the provided liquidity.

Currently, the Product Suite offered by Idle DAO includes:

- Best yield. This lending aggregator is available for Ethereum and Polygon networks, and is made to automatically analyze supply rate functions across integrated protocols and the total amount of funds deposited into the pool. Thus, the aggregator constantly rebalances liquidity across different protocols to obtain the highest rewards.

«The Best Yield vaults are single-sided liquidity pools that aim to offer the highest yield for supported stablecoins at all times» - Idle Finance.

- Yield tranches. Capital pools that automatically generate and tranche income and risks based on range of market-neutral yield strategies are called yield tranches (YTs). Idle pools are divided into Senior and Junior tranches.

Thus, Idle Finance offers a large and fulfilling set of products for DeFi yield optimization and risk diversification. In addition, the platform helps to manage crypto assets throughout the DeFi world from credit markets to optimized lending protocols.

Among other things, Idle Finance cares about its safety and has gone through audits from world-leading security companies. The main ones include protocol and governance audits by Quantstamp, as well as tranches audit by Certic and Consensus Diligence. The platform also has a bug bounty program that rewards users for finding a security vulnerability or smart contract bug.

Idle Token

Since November 2020, Idle Protocol is governed by the Idle DAO, which promotes and carries out various activities for proper protocol maintenance and its improvement.

Idle DAO uses IDLE crypto as the governance token. IDLE token holders contribute to the governance of the protocol and also influence its future developments and improvements. Total supply of IDLE token is 13,000,000 IDLE. The price of the Idle Finance crypto is $0.336 as of March 11, 2024.

At the moment, IDLE is distributed across three main programs - the Gauges system, Liquidity Mining and Long-term Rewards. More information about IDLE distribution can be found here.

«All admin powers have been transferred to $IDLE holders, allowing the community to lead the maintenance and development of the protocol» - Idle Finance.

Besides, IDLE tokens are also available for staking on the platform, giving holders a performance fee discount and enhanced yields. At the moment, total IDLE locked on the platform is $1.33m, where lock time can vary from 6 months to 4 years. By staking on Idle Finance, you will receive stkIDLE tokens equivalent to your deposit, which will reflect your stake.

Why Invest in Idle?

Idle Finance is a popular option that, along with its competitors, offers profitable investment strategies for yield aggregation. However, the platform has its own distinctive features that are important to pay attention to before proceeding to investments.

Pros

High passive income

Depending on the selected asset and investment strategy, Idle Finance has fairly large rewards for providing liquidity. Junior APY on the platform can reach 40%.

Automated lending aggregator

The platform offers users «Best Yield» vaults which have automated and algorithmic rebalance and charge zero gas cost for optimization. Thus, the deposited funds generate maximum profit due to the strategies used.

Pool options

Idle Finance offers users to choose from a large number of senior and junior tranches on Ethereum, Optimism and Polygon zkEVM. Thus, each investor can invest in vault suitable for their level of risk.

Safety level

Since Idle Finance has passed several audits from global security firms and has a bug bounty program with rewards for identifying vulnerabilities, the platform is being as secure as possible.

Integration and yield sources

Idle Finance integrates with leading platforms such as Harvest, Balancer and Enzyme, expanding its capabilities in the DeFi market. Idle's sources of income also come from large projects, namely Lido, Compound, Aave and others.

Idle Finance: Investment Strategies

If you want to start investing in yield aggregation with Idle Finance, below you can explore strategies that will help you get high passive income from providing liquidity.

wstETH on Ethereum

Total APY – 19.11%, TVL – $7,2m

This investment strategy allows users to deposit their wstETH assets on Ethereum network to receive rewards. Since the total value locked of this pool exceeds $7 million, it can be classified as a high liquidity pool, which indicates a decent level of security. Idle also offers investors to choose a senior or junior tranche, which will influence the final reward. While the senior tranche generates about 18.87% APY, the junior offers 40.24% on average.

USDT on Optimism

Total APY – 22.96%, TVL – $2,65m

Another popular investment strategy on Idle Finance allows users to provide USDT stablecoin on Optimism to receive rewards. This pool also has a fairly large TVL of over $2.6 million and generates fairly high rewards for providing liquidity. By choosing senior tranches, investors receive 11.87% APY, while juniors get 24.45%.

If you want to invest in other strategies on Idle Finance, you can look at all the pools on three different networks - Ethereum, Optimism and Polygon zkEVM.

Idle Finance: Risks and Disadvantages

Although Idle offers users a large number of pros and unique features, it is also not without risks and disadvantages that are important to pay attention to before investing:

Cons

Fees

The Best Yield vault strategies charge a performance fee on the income received when deposited funds are redeemed. While senior best yields have a 10% performance fee, junior ones have 15%.

Impermanent loss

If the value of an asset in the pool changes, the user may face a reduced fiat value and partial loss of funds.

Smart contract risks

When choosing any platform that operates on smart contracts, users may face potential risks such as bugs and vulnerabilities. Idle Finance managed to minimize it through audits and running bug bounty program, but even this does not provide a 100% guarantee.

Market volatility

Since the crypto space is famous for its price fluctuations and unexpected market turns, this can also affect the effectiveness of the chosen strategy and potential rewards.

Since Idle Finance takes vulnerabilities on the platform quite seriously, they try to cover all possible risks associated with the platform. More information can be found on the Covered Risks page.

Notum’s Verdict

Yield aggregation is a fairly popular type of investment that allows users to deposit their assets into a platform that will automatically move it to where they can generate the most profit. Since vaults do not require active management and bring investors high rewards, such yield aggregators as Idle continue to be in demand.

Idle Finance is a low-risk platform that supports four blockchains and has an average APY of 13.33%. It offers users “Best Yield” vaults, which operate on automated and algorithmic rebalance and bring investors maximum benefit for providing liquidity. In addition, the protocol has numerous senior and junior tranches on Ethereum, Optimism and Polygon zkEVM, which gives the user decent choice of options.

One of the main advantages of Idle Finance is its level of security, since the platform has not only passed audits from leading security firms, but also has a bug bounty program that rewards users for finding bugs and errors. Thus, if you are looking for a simple and secure yield aggregator for investment, Idle Finance will be a good solution in 2024.

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.

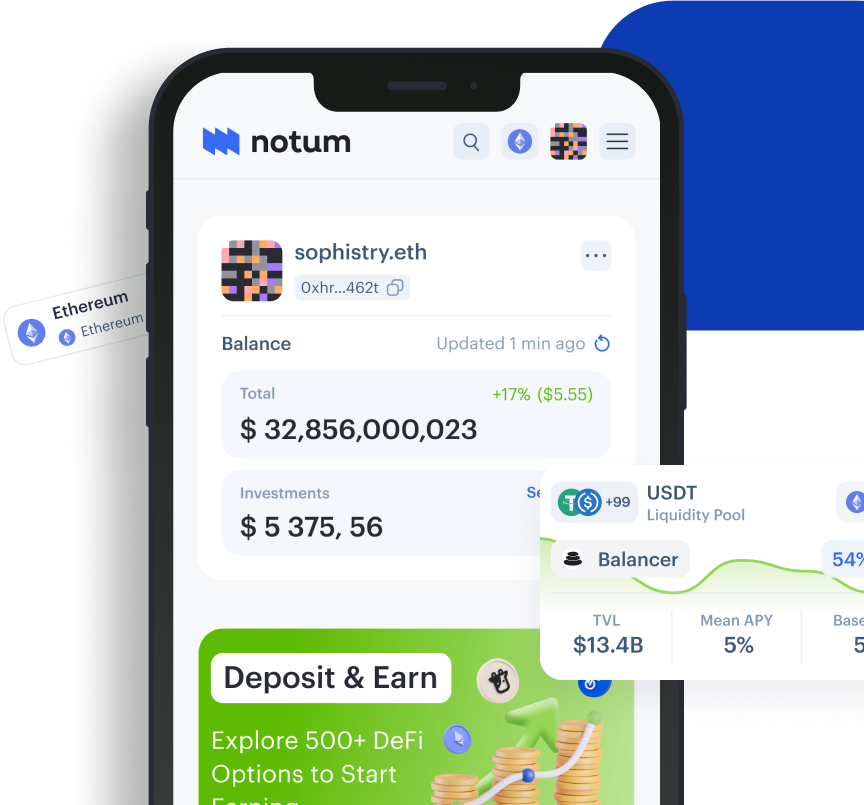

Try All Notum's Unique Features Without Log In

Cryptocurrency risks assessment, all-time gains insights and profit, and a loss calculator at your fingertips!

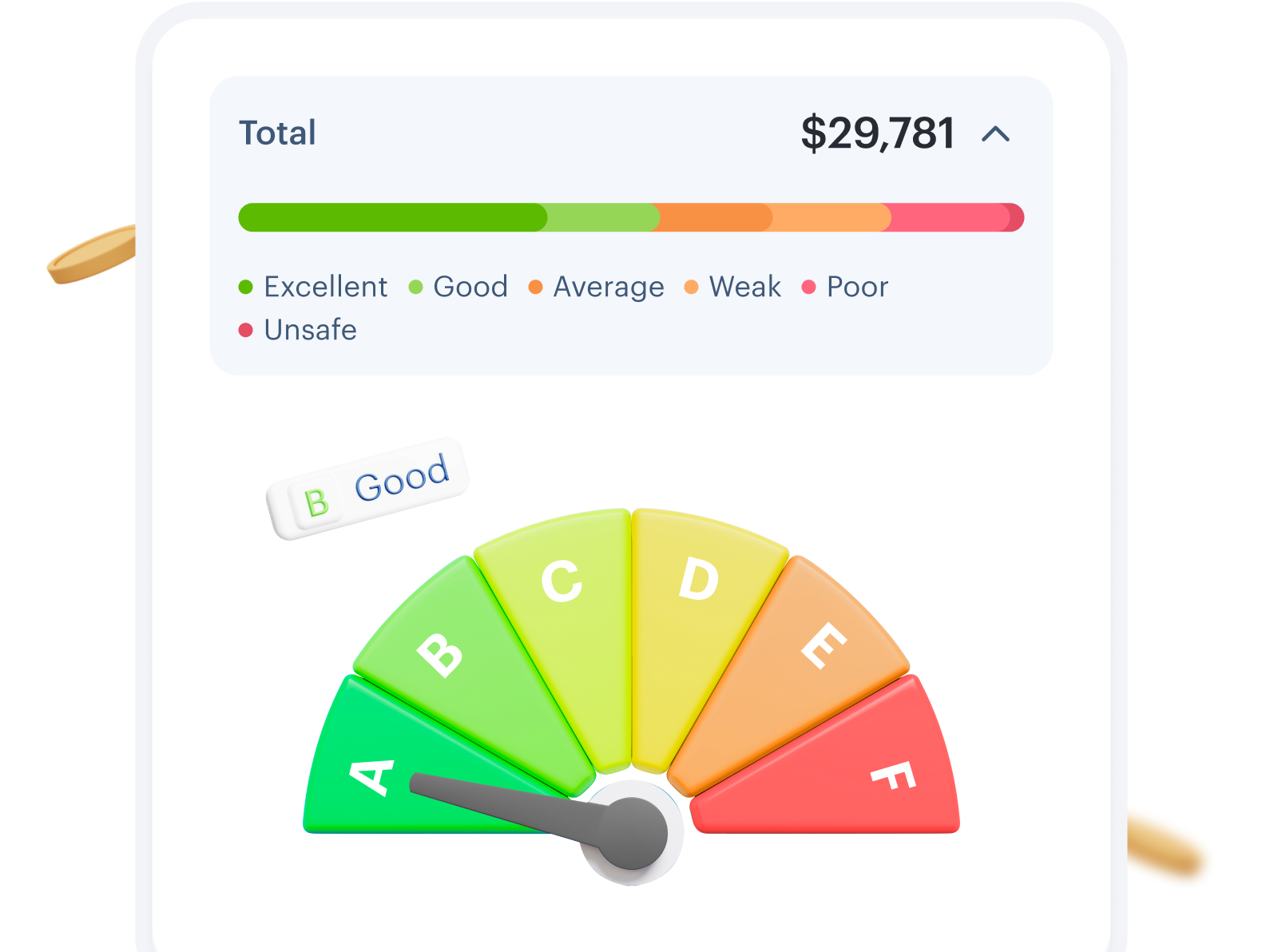

Wallet Risk Assessment

Get assessed crypto risks and helpful insights to control your investments.

Learn More

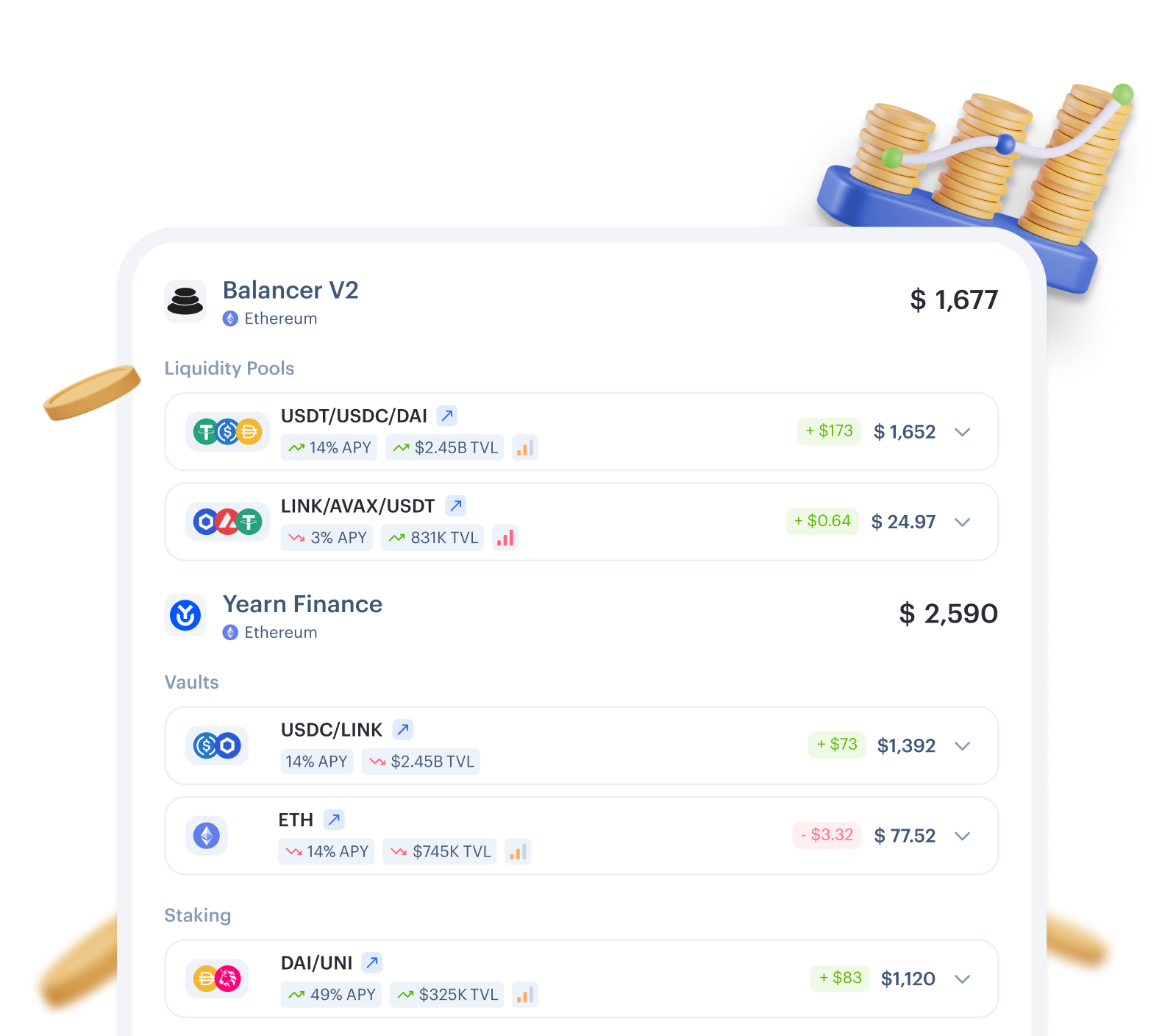

Profit and Loss Calculator

DeFi calculator to check on how profitable your current investments are.

Learn More

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

How does Idle Finance work?

Idle Finance algorithmically optimizes the allocation of deposited crypto across leading DeFi protocols to maximize users’ returns. The protocol also has its own IDLE cryptocurrency and offers staking with favorable interest rates.

2.

What is the Best Yield on Idle Finance?

Best Yield is a lending aggregator for Ethereum and Polygon that rebalances liquidity across different protocols to obtain the highest rewards. Thus, the Best Yield vaults on Idle Finance are liquidity pools that offer the greatest benefits.

3.

What are Yield Tranches on Idle Finance?

Yield Tranches are capital pools that automatically generate and tranche income and risks based on range of market-neutral yield strategies. Yield Tranches on Idle Finance are divided into Senior and Junior ones.

4.

How is the APY of Yield Tranches determined?

The APY of each tranche is determined by the ratio between the TVL of Senior and Junior options (APY = share of yield allocated to senior tranches/Senior TVL).

5.

Is there any locking period for staking?

No, Yield Tranches on Idle Finance don’t have any lockup period for staking.

6.

What are staking rewards on Idle Finance?

A part of farmed Idle governance tokens (IDLE) are redistributed among those users who stake their yield tranche tokens in specific tranche rewards contracts.

7.

How are fees collected on Idle Finance?

Fees are collected during each harvest event on Idle Finance. Usually the protocol charges 10 to 15% performance fees.