Aura Finance Protocol Stats

$ 414.6M

Total TVL Across All Supported Networks

Medium Risk

Generally considered as balanced risk-reward investment

Active

Hands-on management for higher returns

55.96%

Average APY you can expect on Notum

How to Invest in Aura Finance on Notum

In today's world, crypto investments provide serious competition to the worlds of traditional finance due to the level of decentralization and higher rewards. The most popular cryptocurrency option with a moderate level of risk and great rewards is yield farming. That’s why this investment type for generating yield is one of the most popular in 2024.

To put it simply, yield farming is a process of placing crypto assets in DeFi protocols, where they are locked to use them later within the crypto ecosystem (for example, to provide loans, liquidity, etc). Once the cryptocurrency is locked, DeFi protocols move the deposited assets to where they can bring the most profit. For providing liquidity, users receive additional tokens, representing their stake in the pool, which can also be used to generate additional income.

The crypto space now offers a large number of different yield farming platforms, allowing users to deposit assets into profitable liquidity pools to receive rewards. Today’s article from Notum will tell you about the Aura Finance yield farming protocol, its distinctive features, native token and risks. Besides, we will highlight popular investment strategies that can be considered to provide liquidity and get high rewards.

Aura Finance: the Essentials

- TVL: $644,68M

- Average APY: 74.08%

- Risk Level: Medium

- Blockchains: Ethereum, Arbitrum, Gnosis, Optimism, Polygon, Base, Polygon zkEVM

- Foundation Date: 2021

AuraFinance is a decentralized community-driven protocol built on top of the Balancer ecosystem. As a matter of fact, the platform offers various perks to Balancer investors and BAL stakers. These perks are provided through social aggregation of BAL deposits and the protocol's native token (AURA).

Users staking BAL receive a seamless process for obtaining veBAL by creating an auraBAL wrapper token. This way, when users stake their BAL tokens to get auraBAL, they still receive rewards from Balancer. In addition to this, investors earn a portion of the BAL tokens earned by Aura and a few additional AURA tokens.

«AuraBAL is a sort of packaged token. It represents what’s called an 80/20 BAL/WETH BPT (Balancer Pool Token) that’s been locked up for the longest period of time within Balancer» - Medium.

Thus, by locking BAL tokens, investors receive veBAL in return, which allows them not only to receive additional rewards in the ecosystem, but also gives the opportunity to vote on protocol changes.

Important! Once users have started staking their BAL tokens to receive auraBAL, the process cannot be reversed directly. However, if necessary, liquidity providers can exchange auraBAL to BAL back through the incentive liquidity pool.

Aura Finance: Governance

As said, Aura is a DeFi protocol that is completely community-driven, meaning token holders control all activities on the platform. The main things that require governance on the Aura system are:

- Aura treasury;

- Balancer Snapshot and gauge voting;

- Setting fee rates.

To take part in all the important protocol decisions, users must lock AURA for 16 weeks and delegate or self-delegate voting rights. Users who do this also influence decisions regarding the allocation of protocol-accrued veBAL and gain voting rights for Balancer governance.

Currently, Aura uses Snapshot and multisignature confirmations for everything related to protocol’s control. However, Aura is committed to moving to full-on chain voting with Governor bravo, provided that it is technically feasible and does not require any security compromises.

Aura Finance: Token

Aura Finance has its own crypto, AURA, which plays an important part in the protocol ecosystem and its governance. The token has a total supply of 427.28M AURA and maximum supply of 1B AURA. As of March 20, 2024, the Aura Finance price is $0.04208.

Since locked AURA makes it easier to manage the protocol, those who lock tokens and delegate (or self-delegate) voting rights can participate in all decisions related to Aura Finance and its improvements. The AURA lockout period lasts 16 weeks.

Thus, the AURA crypto is used for internal governance, voting power for changes to the protocol and treasury management. In addition, AURA is directly related to the Balancer ecosystem and is necessary for Balancer snapshot and gauge voting.

If you want to lock AURA while receiving auraBAL rewards, you can do it on the Lock page. More detailed information about AURA’s distribution, allocation and vote locking can be found here.

Why Invest in Yield Farming with Aura?

Aura is a fairly popular yield protocol that offers the best farming solutions for Balancer. The protocol is a reliable source of income for both beginners and experienced investors, which offers the following benefits:

Pros

Decent income

Aura's liquidity pools have an average APY of 74.08%, allowing users to earn fairly high yield for providing their liquidity on the platform.

Additional rewards

By depositing assets to liquidity pools on the platform, users receive additional tokens that can be staked, traded, and used in other DeFi protocols. Thus, by investing with Aura, users can receive double rewards.

Multiple blockchains

While some yield farming protocols only use a few networks, Aura Finance supports Ethereum, Arbitrum, Gnosis, Optimism, Polygon, Base and Polygon zkEVM blockchains.

Contribution to the development of Aura and Balancer

By providing liquidity on Aura, investors also support Balancer's development and contribute to its security.

Community management

Aura is a completely community driven protocol, which means all actions regarding changes on the platform are taken by the holders of the native token.

Safety

The protocol pays special attention to its security and has undergone numerous audits during its existence. Moreover, Aura also has a bug bounty program to identify vulnerabilities on the platform.

Aura Finance: Investment Strategies

This investment strategy allows users to deposit their assets into the Aura B-80BAL-20WETH-AURABAL liquidity pool on Ethereum. Since it has a total value locked of over $10.5 million, this high liquidity option is quite a safe investment.

While depositing to this strategy, liquidity providers earn about 24.07% total APY. Moreover, this pool is also incentivised by the AURA and BAL tokens. Thus, by staking assets on Aura, users can earn additional rewards of around 23.66% APY.

Another popular strategy on Aura is the low-risk ETH-ALCX liquidity pool. This pool also has a fairly large TVL of about $8.4 million and is a reliable investment option on Ethereum.

Rewards for providing liquidity to this pool are about 12.46% total APY. Besides, as with the previous pool, this strategy also rewards its investors with AURA and BAL tokens. The ETH-ALCX pool allows users to earn an additional 11.91% APY.

On Notum, users can also invest in one of the most reliable Aura pools - RETH-WETH. Since it has a huge TVL of $97.3 million, this investment option is pretty safe.

And for those who want to get maximum rewards, the platform offers an INV-DOLA pool with a total APY of 136.53%. This strategy is more risky, so it is worth weighing the advantages or disadvantages before investing. Find out other popular Aura liquidity pools on Notum right here.

Aura: Risks and Disadvantages

Despite numerous unique features and fairly large rewards, Aura still has some disadvantages that are important to pay attention to before investing on the platform:

Cons

Risk of smart contracts

Even though Aura’s contributors have carefully reviewed its smart contracts and the platform has passed several audits, one hundred percent security still cannot be guaranteed. Thus, potential bugs or vulnerabilities in the smart contracts can lead to the loss of funds.

Dependency on Balancer

Since Aura directly integrates with Balancer.finance, any flaws and hacks can also result in losses on Aura.

Market volatility

Despite the fact that yield farming has high rewards and multiple advantages, it has risks associated with market volatility. Thus, if the value of a crypto asset drops, this may lead to the partial loss of funds and affect the rewards received.

Impermanent loss

The value of cryptocurrency deposited in pools may differ from that if the user stored the assets individually. Therefore, in some cases, investing crypto into pools may negatively impact farming rewards.

Platform's complexity

Yield farming itself is a rather difficult investment type as it involves many strategies and factors that need to be taken into account. Thus, interacting with the Aura protocol can be challenging.

Aura Finance also has its own page where it describes potential risks of interacting with the platform. More information can be found here.

Notum’s Verdict

Aura is a yield farming protocol that offers users a fairly large average APY, the opportunity to receive additional rewards and contribute to the Balancer ecosystem. Its TVL of more than $644 million, moderate risk level and support of multiple blockchains make the platform a worthy choice for investing in liquidity pools.

Aura is completely community-driven and has undergone numerous audits, indicating proper level of security. In addition, the running bug bounty program rewards users for finding vulnerabilities in platforms’ smart contracts.

The protocol offers users various investment strategies that differ in the level of risk and reward. This way, users can deposit their assets into Aura’s pool that matches their criteria and receive rewards for providing liquidity. Despite some complexity of using platforms, risks of smart contracts and impermanent loss, Aura is still a fairly good choice for investing in yield farming.

Disclaimer: Notum does not provide any investment, tax, legal, or accounting advice. This article is written for informational purposes only. Cryptocurrency is subject to market risk. Please do your own research and trade with caution.

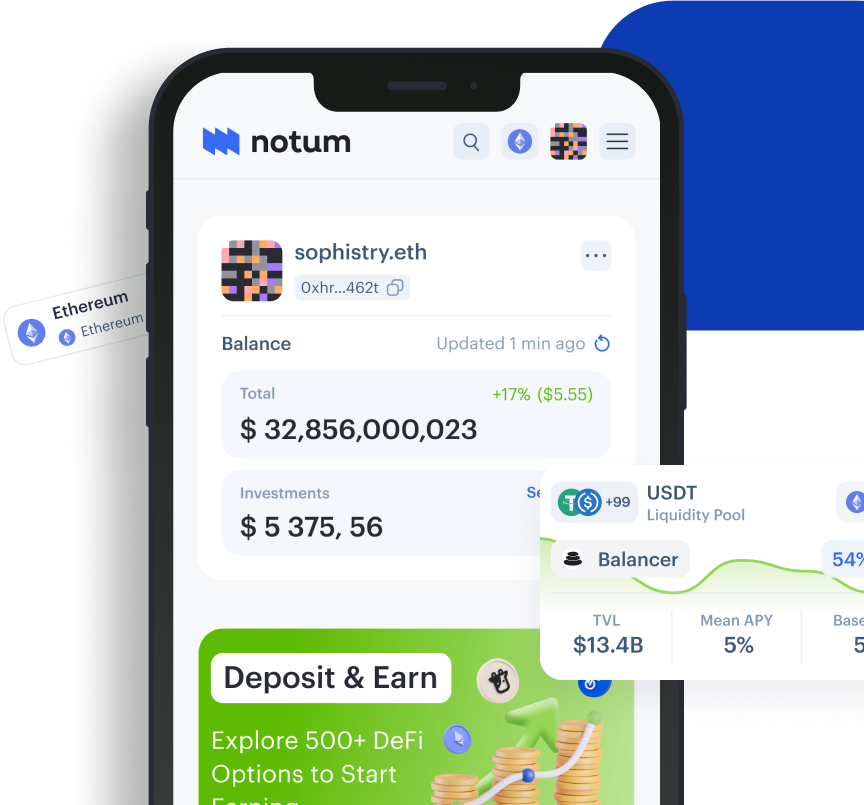

Try All Notum's Unique Features Without Log In

Cryptocurrency risks assessment, all-time gains insights and profit, and a loss calculator at your fingertips!

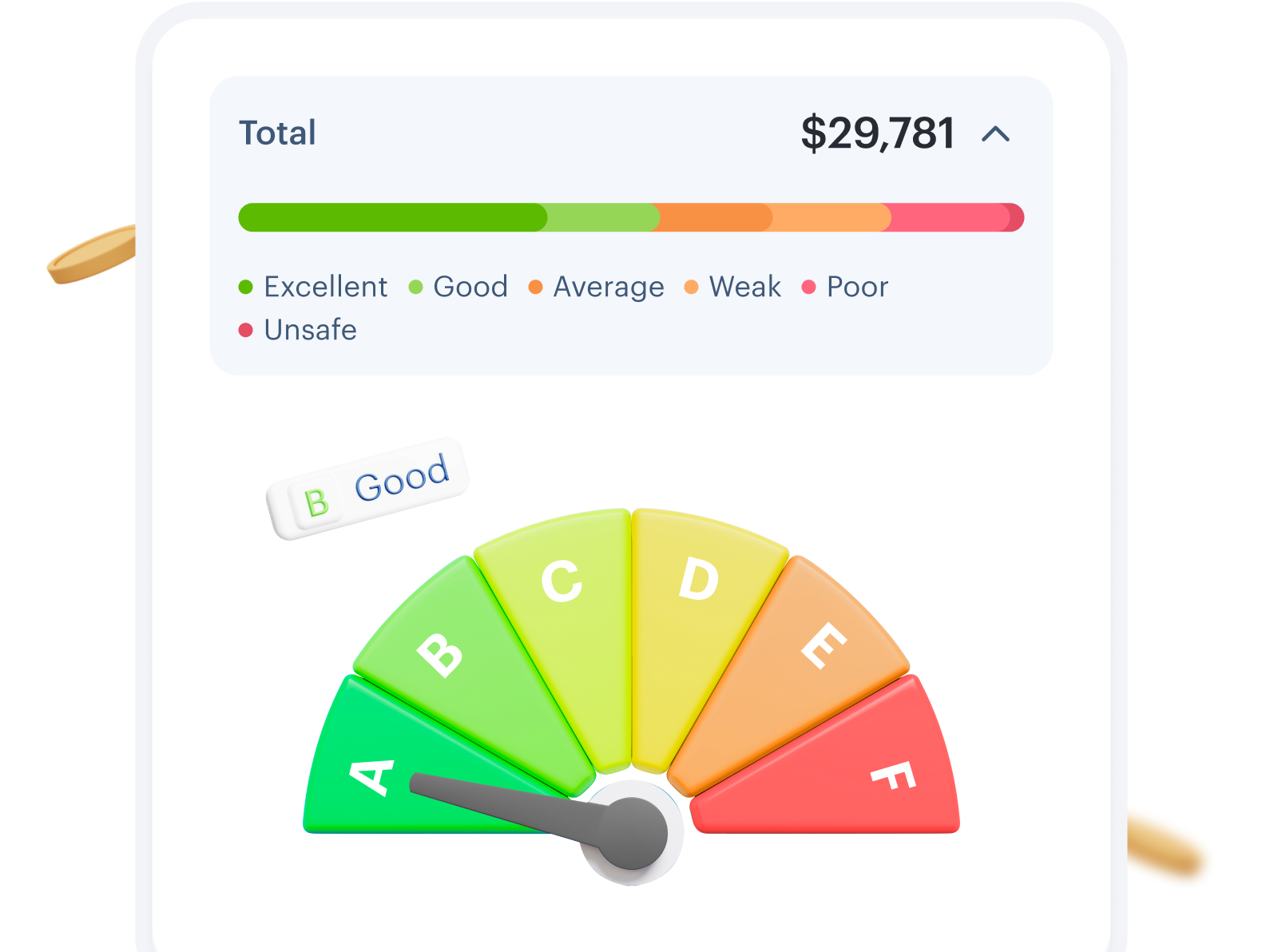

Wallet Risk Assessment

Get assessed crypto risks and helpful insights to control your investments.

Learn More

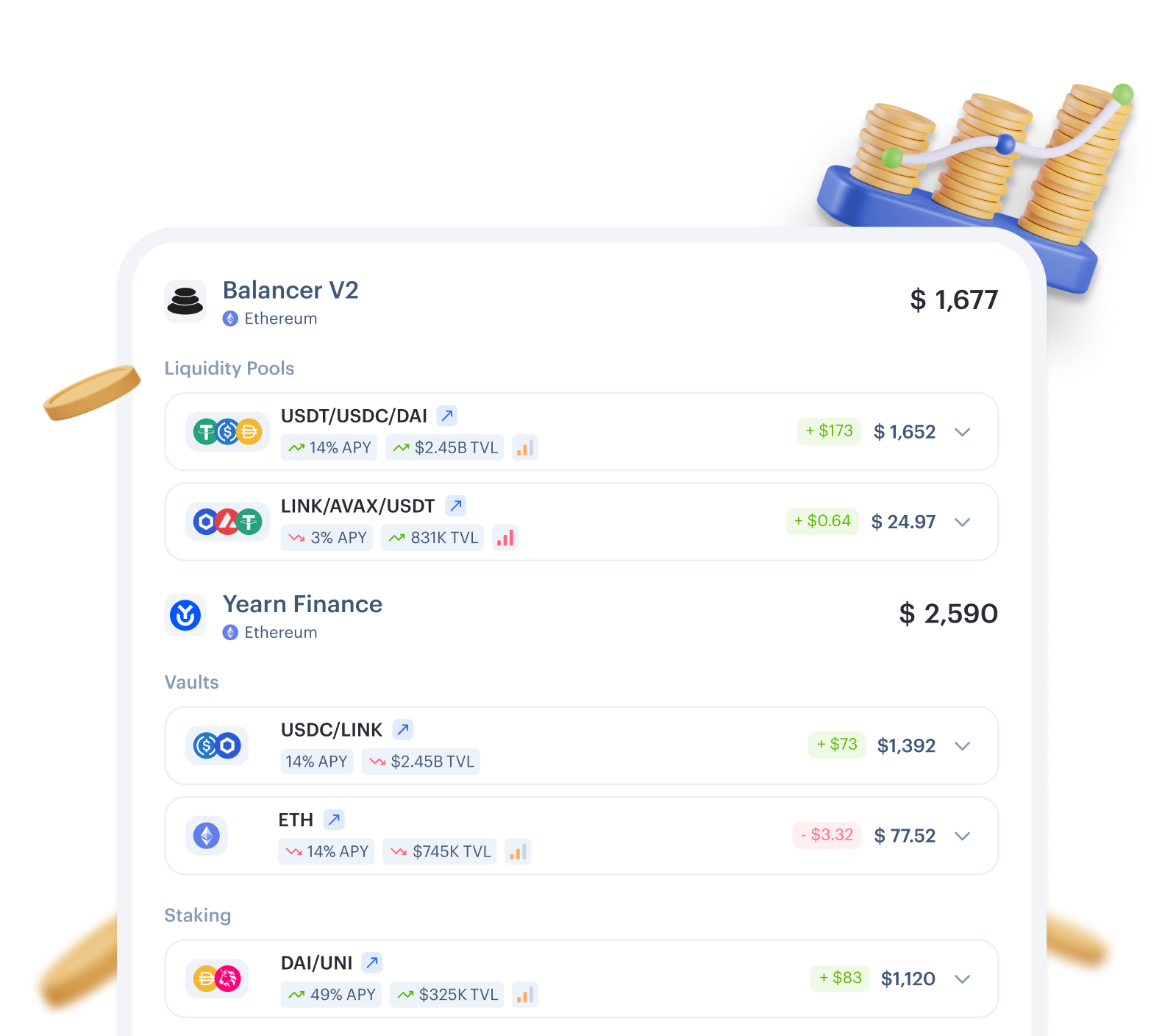

Profit and Loss Calculator

DeFi calculator to check on how profitable your current investments are.

Learn More

Boost Your Passive Income

Choose from a wide range of investments on Notum. Compare. Make a move.

Get started

FAQ

1.

What is Aura?

Aura Finance is a decentralized and community driven protocol that allows users to take part in yield farming and receive rewards by depositing their assets onto the platform.

2.

How to use Aura Finance?

After connecting wallet, users can select their preferred liquidity pool on one of seven networks and deposit cryptocurrency to receive rewards with average APY of 74.08%.

3.

How does Balancer Boost work?

When a pool can receive liquidity mining incentives through a gauge, investors in that pool must stake their BPT to receive their share of this incentive, i.e. the staking reward. To boost this value, liquidity providers should hold veBAL aswell.

4.

What are the core pools?

Core pools are basically pools that consist of at least 50% yield-bearing tokens that Balancer earns a fee on.

5.

What are the fees using Aura?

On Aura, fees are only taken only from BAL income (from LP staking). Besides this, no fees are taken from tokens from the auraBAL pool, nor from veBAL admin fees. The absolute amount of fees on Aura is 25%.

6.

Is Aura Finance safe?

Aura Finance has passed numerous audits from global security firms and has a bug bounty program, which makes its safety level quite high. However, please note that the protocol still has risks associated with smart contracts and impermanent loss.